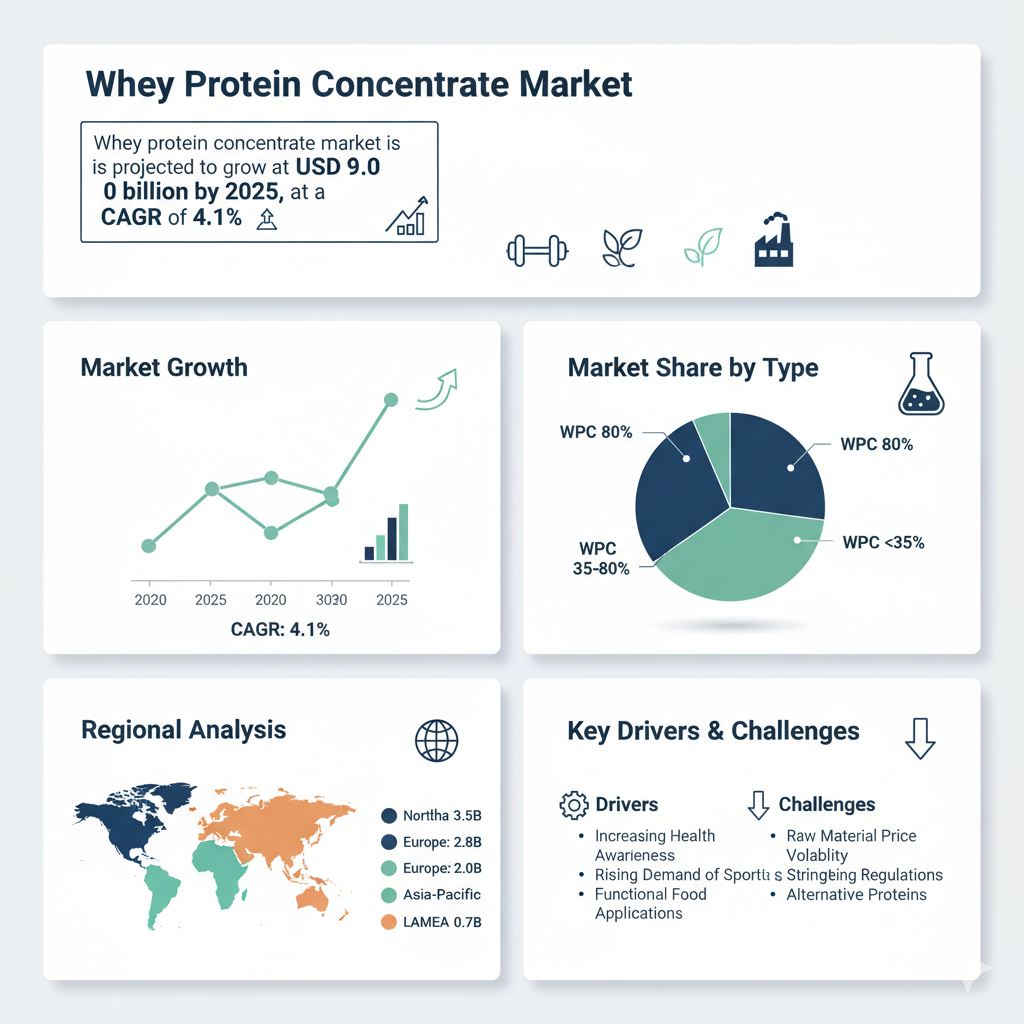

The global whey protein concentrate (WPC) market is poised for steady growth over the coming decade. The whey protein concentrate market is projected to grow from USD 6.0 billion in 2025 to USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1%.

Market Segmentation

The whey protein concentrate market is analyzed across multiple segments based on grade, application, form, and region.

In terms of grade, WPC 80, which represents a high-purity version of whey protein concentrate, has emerged as the dominant segment. It offers superior protein content and functionality, making it the preferred choice in sports nutrition and premium food products. The WPC 60-79 category, a medium-purity grade, serves a variety of applications in food and beverage manufacturing. The <60 grade represents the lower-purity category, commonly used in cost-sensitive formulations, animal feed, and other industrial uses.

By application, sports nutrition remains the largest and fastest-growing segment. Increasing consumer awareness about fitness, muscle development, and overall health has driven the demand for protein-rich products. The food and beverage segment also accounts for a significant share, as manufacturers incorporate WPC into functional foods, protein-fortified snacks, and beverages. In addition, the animal nutrition and other segments are expanding steadily, as the use of protein-enriched feed continues to grow across the livestock industry.

When segmented by form, WPC is primarily available in powder form, which dominates the market due to its convenience, longer shelf life, and ease of formulation. The liquid form is less common but is gaining attention in ready-to-drink nutritional beverages and other applications where liquid integration offers functional advantages.

Geographically, the market spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America currently leads the market, driven by strong sports nutrition demand, while Asia Pacific is emerging as a high-growth region due to increasing health awareness, rising disposable incomes, and the expansion of the fitness industry.

Recent Market Developments

Recent developments in the whey protein concentrate market reflect dynamic shifts in consumer preferences, technological innovation, and the evolving competitive landscape. The growing global focus on fitness, wellness, and clean eating has driven a surge in demand for high-quality protein ingredients. Manufacturers are responding by investing in advanced processing technologies that improve the purity, solubility, and digestibility of whey protein concentrates.

In addition to sports nutrition, WPC is finding broader applications across the food and beverage industry. Companies are increasingly using it in protein-fortified snacks, bakery items, dairy alternatives, and functional beverages. This diversification is helping to broaden the consumer base beyond traditional fitness enthusiasts. The dominance of powdered WPC continues, indicating that cost-efficiency and formulation flexibility remain key decision factors for manufacturers.

Regionally, the United States remains a significant driver of market expansion, supported by an established sports nutrition sector and a strong fitness culture. Meanwhile, markets in Asia Pacific are witnessing rapid growth due to urbanization, increasing protein consumption, and the rise of health-focused consumer segments. Sustainability and clean-label trends are also reshaping the industry, prompting key players to focus on environmentally responsible sourcing and transparent production methods.

Key Players and Competitive Analysis

The whey protein concentrate market is highly competitive, characterized by the presence of large dairy cooperatives, specialized protein suppliers, and multinational nutrition companies. Leading players include Fonterra Co-operative Group, Arla Foods Amba, Glanbia Nutritionals, Lactalis Group, FrieslandCampina, and Saputo Inc. These companies hold substantial market shares and are actively investing in expanding production capacity, enhancing product purity, and developing innovative formulations.

Fonterra and Arla Foods have been strengthening their positions through large-scale production facilities and continuous innovation in whey processing technology. Glanbia Nutritionals remains a leading supplier in the sports nutrition segment, leveraging its expertise in protein science and consumer branding. Other global dairy giants, including Lactalis and FrieslandCampina, are focusing on expanding their product portfolios and tapping into emerging regional markets.

Competition is intensifying as smaller regional producers and niche suppliers enter the market, offering customized WPC solutions for specific applications. While the major players dominate the high-purity WPC 80 segment, smaller firms often compete in cost-sensitive categories such as WPC 60-79 and <60, targeting local food manufacturers and the animal nutrition sector. Product differentiation based on purity, functionality, and flavor profile is a key factor in gaining a competitive edge.

Strategic collaborations and mergers are also shaping the competitive landscape. Partnerships between ingredient manufacturers and sports nutrition brands have become increasingly common, allowing for product innovation and faster market penetration. Companies are also investing in sustainability initiatives, such as waste reduction and improved energy efficiency in whey processing, to align with global environmental standards and consumer expectations.