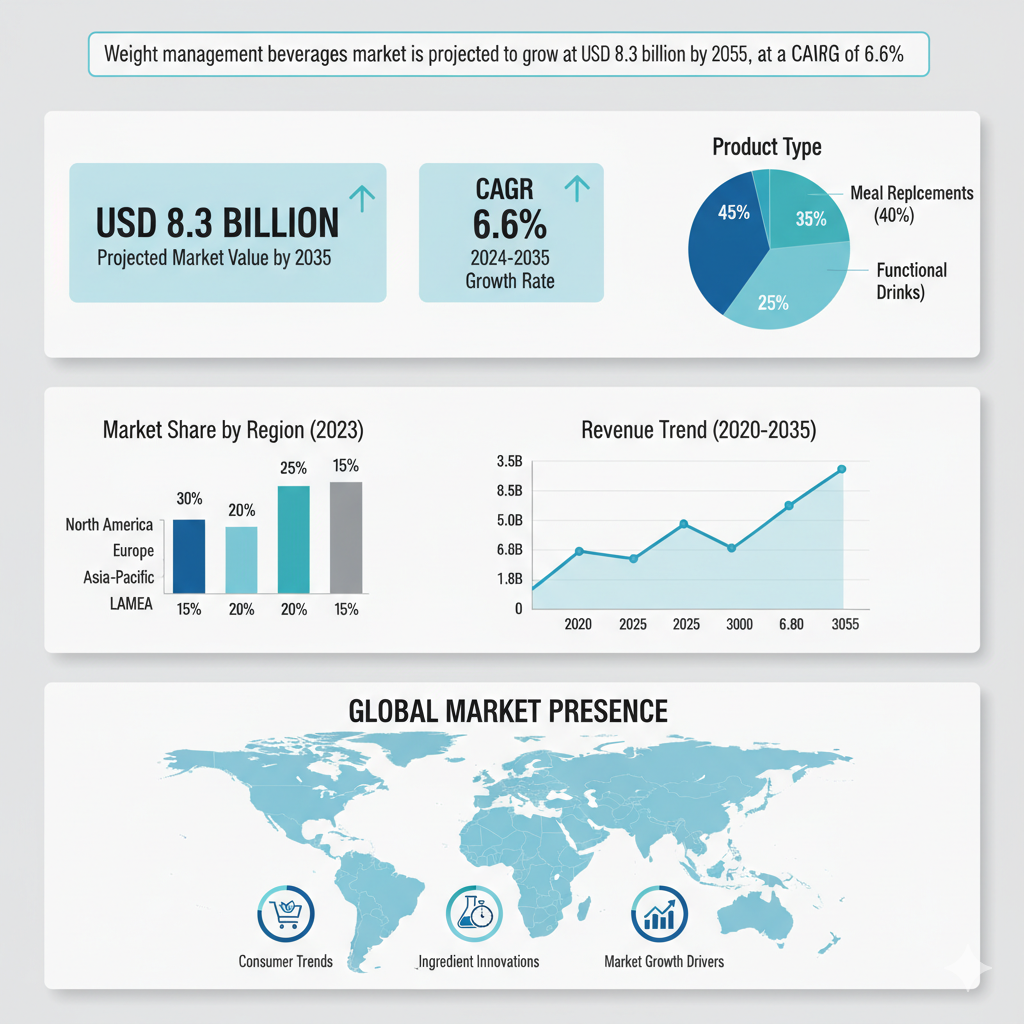

The global weight management beverages market is poised for robust expansion over the next decade. The market is projected to grow from USD 4.4 billion in 2025 to USD 8.3 billion by 2035, registering a CAGR of 6.6%. This growth reflects the increasing consumer focus on health, convenience, and nutrition-driven lifestyles. As the prevalence of obesity and lifestyle-related diseases continues to rise globally, demand for beverages that support weight control and provide balanced nutrition is expected to intensify.

Market Segmentation

The weight management beverages market is broadly segmented by type, claim, distribution channel, and region.

By Type, the market includes protein-based ready-to-drink (RTD) beverages, meal-replacement shakes, and functional teas or other drinks. Among these, protein-based RTD beverages lead the segment due to their convenience, nutritional value, and rising consumer preference for high-protein diets.

By Claim, weight management beverages are categorized into low-calorie, keto or low-carb, and high-protein formulations. The low-calorie segment currently dominates the market as calorie-conscious consumers seek beverages that support weight loss without compromising on taste. However, the keto and high-protein categories are gaining momentum, especially among fitness enthusiasts and consumers following specialized diets.

By Channel, the market is divided into retail, direct-to-consumer (D2C), and clinically prescribed products. Retail continues to be the primary sales channel, but the D2C model is rapidly expanding due to the growing influence of digital marketing, personalized nutrition plans, and subscription-based health products. Clinically prescribed beverages are also gaining importance, particularly among consumers seeking medically guided weight management solutions.

By Region, North America and Europe currently hold the largest market shares, driven by high consumer awareness and mature health and fitness industries. Meanwhile, Asia Pacific, Latin America, and the Middle East are emerging as high-growth regions due to increasing urbanization, rising disposable incomes, and greater focus on wellness among younger populations.

Recent Developments and Market Trends

Several key developments are shaping the trajectory of the weight management beverages market.

The most significant driver is the global rise in health and wellness consciousness. Consumers are becoming increasingly aware of the importance of maintaining a healthy weight and adopting balanced diets. This shift is boosting demand for beverages that combine nutritional benefits with convenience.

Another trend influencing the market is the rising popularity of protein-based and functional beverages. Protein has become a preferred ingredient in weight management products, as it helps build lean muscle mass, supports satiety, and aids in metabolism regulation. Functional ingredients such as green tea extracts, probiotics, and plant-based proteins are also gaining traction, as consumers seek added health benefits beyond weight loss.

Clean-label and natural formulations are becoming a key differentiator. Consumers increasingly prefer beverages made from natural ingredients, low in artificial additives and sugars. Brands are responding by reformulating products with natural sweeteners like stevia, monk fruit, and erythritol, as well as by emphasizing plant-based and allergen-free ingredients.

The distribution landscape is also evolving. While traditional retail continues to dominate, direct-to-consumer sales are growing rapidly through e-commerce platforms and brand websites. This shift enables companies to offer personalized nutrition, build stronger customer relationships, and leverage subscription models for recurring revenue.

Regionally, developing markets such as India, China, and Brazil are emerging as lucrative opportunities due to rising health awareness, expanding middle-class populations, and growing access to online fitness and nutrition content. These markets offer immense potential for both global and local players to expand their footprint.

At the same time, competition is becoming more intense, prompting companies to invest in innovation, flavor enhancement, and functional differentiation. Ingredient cost fluctuations and regulatory scrutiny of health claims are among the main challenges facing manufacturers.

Key Players and Competitive Analysis

The competitive landscape of the weight management beverages market features a mix of established global corporations and emerging niche brands. Major players include Nestlé S.A., Herbalife Nutrition Ltd., Abbott Laboratories, Glanbia plc, SlimFast, Atkins, Huel, and Premier Protein. These companies are continually innovating to capture market share through improved formulations, marketing strategies, and diversified product portfolios.

Nestlé continues to leverage its strong nutrition science expertise and global distribution networks to expand its portfolio of weight management beverages. Herbalife has strengthened its market position with meal-replacement shakes that are distributed through its extensive network of independent distributors, particularly in emerging markets. Abbott Laboratories focuses on clinically oriented nutritional solutions, appealing to both healthcare professionals and consumers seeking evidence-based products. Glanbia, with its ownership of SlimFast and other nutrition brands, has a strong presence in the sports and weight management beverage segments. Meanwhile, brands like Huel, Atkins, and Premier Protein are disrupting the market through innovation, appealing packaging, and targeted marketing toward health-conscious millennials and busy professionals.

Competition in this space revolves around several strategic dimensions. Companies are competing on formulation quality, product claims, taste, and convenience. The ability to balance efficacy with flavor and consumer appeal is a critical success factor. Moreover, firms are differentiating through digital engagement, influencer marketing, and personalized nutrition programs. As consumers become more discerning about label transparency and ingredient sourcing, brands with credible scientific backing and ethical positioning are likely to gain a competitive edge.