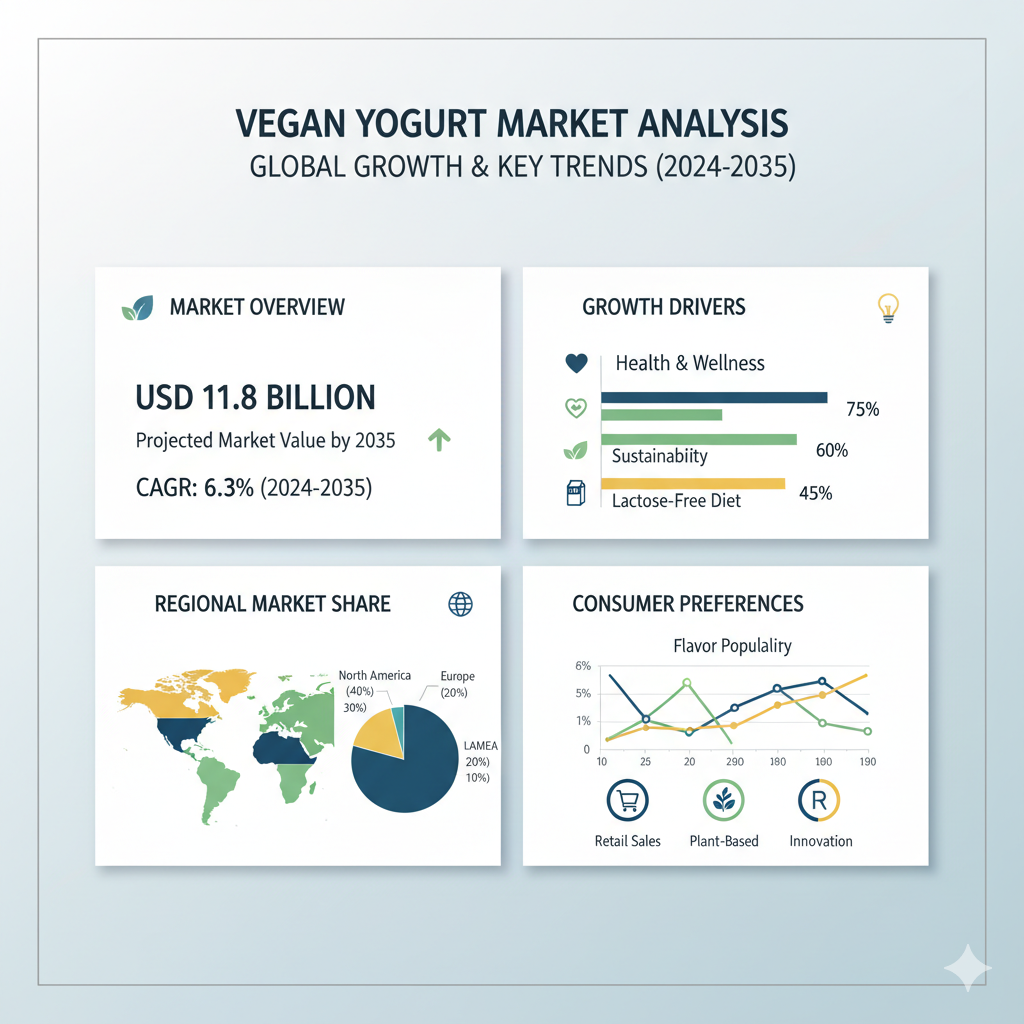

The vegan yogurt market stands at the threshold of a decade-long expansion trajectory that promises to reshape dairy alternative technology and plant-based nutrition solutions. The market’s journey from USD 6.6 billion in 2025 to USD 11.8 billion by 2035 represents substantial growth, and it will rise at a CAGR of 6.3 %.

Segmental Breakdown: Base, Positioning, Claims & Region

Understanding the segmentation of the market is key to appreciating its momentum and where opportunity lies. The market is segmented by base, positioning, claim, and region, each contributing to shaping its growth dynamics.

In terms of base, almond and soy remain dominant, commanding the majority share due to their familiarity and broad consumer acceptance. Oat and coconut bases are rapidly gaining ground in the premium segment, appreciated for their taste and sustainability attributes. Other bases such as pea and rice, while niche, are emerging as innovative alternatives offering unique nutritional benefits and catering to allergy-sensitive consumers.

Regarding positioning, refrigerated vegan yogurts continue to lead the market. This segment aligns closely with traditional yogurt purchasing behavior, where freshness and taste perception drive consumer decisions. Shelf-stable variants, however, are gaining momentum as convenient options with longer shelf life, appealing to on-the-go consumers and expanding into regions with limited cold-chain infrastructure.

When viewed through the lens of claims, probiotic and functional yogurts occupy a strong position. Consumers increasingly seek products that provide added health benefits, particularly those supporting gut health and immunity. Organic offerings also continue to grow, driven by demand for clean-label and sustainably sourced ingredients. Conventional plant-based yogurts remain relevant, serving as more affordable options accessible to a wider audience.

Regionally, North America and Europe maintain leadership due to mature plant-based markets and advanced retail infrastructure. Asia Pacific, Latin America, and the Middle East & Africa are rapidly emerging growth territories, propelled by rising health consciousness, dietary diversification, and increasing availability of plant-based products. The United States, in particular, is projected to post impressive growth over the forecast period, underpinned by the country’s innovation in plant-based dairy and consumer openness to sustainable food choices.

Recent Developments and Market Trends

Several factors are shaping the direction of the vegan yogurt market. Functional ingredients have become a key area of focus as brands introduce fortified yogurts with probiotics, added protein, and vitamins. What was once a niche trend has evolved into a mainstream expectation, as health-driven consumers look for multifunctional products.

Innovation in taste and texture is another transformative trend. Historically, one of the major barriers to vegan yogurt adoption was its inability to match the sensory profile of dairy yogurt. Today, improved fermentation technology, fat stabilization systems, and novel ingredient formulations are delivering creamier textures and more balanced flavors. Enhanced taste profiles and functional ingredients are now seen as essential rather than premium differentiators.

Sustainability is also influencing consumer purchasing decisions. Beyond being dairy-free, consumers expect plant-based products to align with ethical and environmental values. Brands are responding through recyclable packaging, carbon-neutral manufacturing, and transparent sourcing. These sustainability commitments not only support brand image but also strengthen consumer loyalty.

Retail distribution remains a crucial factor in driving adoption. Refrigerated plant-based sections continue to expand in supermarkets, with dedicated space for vegan yogurt and dairy alternatives. Shelf-stable formats are becoming popular in developing regions, where logistical constraints have historically limited access to perishable products. This diversification in product placement ensures broader market reach and greater accessibility.

The market’s growth trajectory is also divided into two clear phases. The first half of the decade, from 2025 to 2030, is expected to be driven by premium and health-focused innovations. The latter half, from 2030 to 2035, will likely see broader mass-market penetration as production scales up and prices become more competitive

Key Players and Competitive Landscape

The vegan yogurt market features an increasingly competitive and dynamic landscape, with approximately two to three dozen active players globally. The top five brands account for a significant share of the overall revenue, but the competition remains intense across regional and niche markets.

Established multinational companies like Danone, through its Alpro and Silk brands, are leveraging extensive distribution networks and brand recognition to strengthen their dominance. Oatly, originally known for oat-based beverages, has successfully expanded into yogurt alternatives, capturing consumers seeking taste innovation and sustainable branding. The Coconut Collaborative and other smaller producers continue to build strong footholds in the premium category by emphasizing quality ingredients, natural formulations, and ethical sourcing.

Meanwhile, emerging players are entering the market with creative formulations based on alternative bases such as pea and rice. These brands often focus on unique functional claims, like probiotic support or high-protein content, to differentiate themselves in a crowded marketplace. Regional manufacturers benefit from proximity to local raw materials and adaptable supply chains, though they face challenges in scaling production and expanding globally.

Competition is intensifying as more dairy companies invest in plant-based diversification, often acquiring or partnering with existing vegan brands to accelerate entry. Success increasingly depends on innovation in taste, nutritional profile, and cost optimization, along with effective branding that communicates wellness and sustainability.