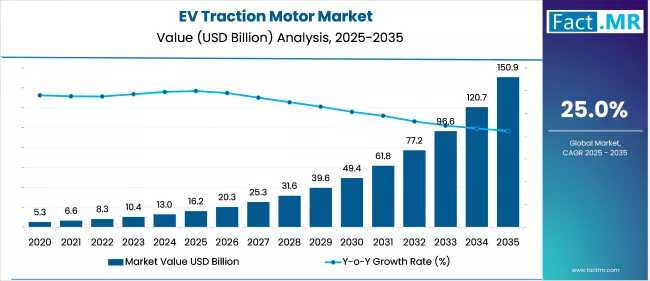

The global electric vehicle (EV) traction motor market is set to witness unprecedented growth, expanding from USD 16.2 billion in 2025 to USD 150.9 billion by 2035, registering a robust CAGR of 25% during the forecast period, according to Fact.MR. This growth is being propelled by accelerating EV adoption, advancements in high-efficiency traction motors, and significant investments in electric mobility infrastructure.

Market Overview

Traction motors are the heart of electric mobility, converting electrical energy from batteries into mechanical energy to drive vehicles efficiently. They are central to performance, range, and overall energy management, with innovations including permanent magnet synchronous motors (PMSMs), asynchronous motors, axial flux designs, and integrated motor-drive systems. Their high power density, compact size, and ability to deliver instant torque have made them indispensable across EV segments.

-

Market Size (2025E): USD 16.2 billion

-

Market Size (2035F): USD 150.9 billion

-

CAGR (2025–2035): 25%

Market Drivers

-

Rapid Growth in EV Sales: In 2023, global EV sales reached 14 million units, representing 18% of all vehicle sales—up from 14% in 2022. Rising consumer preference for environmentally sustainable vehicles continues to drive traction motor demand.

-

High Efficiency & Performance: Traction motors provide instant torque, improved driving range, and lower energy consumption compared to internal combustion engines. Multiple motors per vehicle enable torque vectoring for better handling and stability.

-

Technological Innovations: Emerging technologies, such as axial flux motors, which are smaller and have higher power density, reduce dependence on rare-earth elements. PMSMs and switched reluctance motors (SRMs) are also seeing wider adoption in premium EVs.

-

Government Policies & Incentives: Regulatory frameworks worldwide, including ZEV mandates, tax incentives, and emissions targets, have created favorable conditions for EV adoption, indirectly boosting traction motor demand.

-

Investment in Electric Mobility: OEMs are expanding EV production lines, investing in R&D to develop motors with higher efficiency, lower weight, and reduced reliance on scarce raw materials.

Market Restraints

-

High Production Costs: Advanced traction motors require rare-earth materials and sophisticated manufacturing techniques, leading to elevated costs.

-

Supply Chain Vulnerabilities: Dependence on limited suppliers for magnets and other critical components exposes manufacturers to price volatility and geopolitical risks.

-

Charging Infrastructure Limitations: Insufficient charging networks in developing regions slow EV adoption, limiting traction motor sales.

-

Battery Technology Constraints: Current battery energy density restricts maximum motor output and vehicle range.

-

Technical & Operational Challenges: Thermal management, motor efficiency, durability, and the need for skilled workforce create ongoing industry hurdles.

Regional Insights

-

Asia-Pacific: Dominates global EV traction motor demand due to massive EV adoption in China, Japan, and South Korea. Favorable government policies, subsidies, and the rapid expansion of production facilities for automakers like BYD, NIO, and SAIC have fueled market growth. China alone sold over 8 million EVs in 2023, accounting for ~60% of global sales.

-

North America: U.S. and Canada are high-growth regions driven by Tesla, Ford, GM, and supplier ecosystems (ABB, Bosch, Continental). Investments under the Bipartisan Infrastructure Law and ZEV mandates further boost traction motor adoption. CAGR projected at 24.1% (2025–2035).

-

Europe: Germany, with BMW, Mercedes-Benz, and Volkswagen, is spearheading technological innovations in high-performance PMSMs, magnet-free motors, and charging infrastructure expansion. CAGR projected at 24.7%.

-

Latin America & Middle East/Africa: Emerging markets are gradually adopting EVs, providing growth potential for cost-effective traction motors, particularly in fleet and commercial applications.

Country-Specific Outlook

-

United States: Market value expected to grow from USD 16.2 billion (global share) with U.S.-specific traction motor market at USD 24.1% CAGR, reaching USD 1XX billion by 2035. Drivers include EV adoption, advanced motor technology, and government incentives.

-

China: Global leader in EV sales and production; traction motor demand expected to surge with CAGR 25.3%, driven by New Energy Vehicle mandates, subsidies, and carbon neutrality goals by 2060.

-

Germany: Technological expertise and automaker investment lead to growth in PMSM and magnet-free motors, supported by charging infrastructure and innovation in high-performance propulsion.

Segmental Analysis

By Motor Type:

-

Permanent Magnet Synchronous Motors (PMSMs): Lead the market due to high efficiency, strong torque, and compact size; widely used in premium EVs and urban/long-range vehicles.

-

Asynchronous Motors: Fastest-growing segment; cost-effective, robust, and rare-earth free, increasingly used in budget EVs, commercial fleets, and emerging markets.

By Voltage Rating:

-

High Voltage (>400V): Dominant, supports long-range EVs, rapid acceleration, and fast-charging; key in premium EV segments.

-

Low Voltage (48V): Fastest-growing, used in mild hybrids and entry-level electrification, providing fuel savings and emission reduction without full EV adoption.

By Vehicle Type:

-

Electric Vehicles (EVs): Lead market share, rely entirely on traction motors.

-

Mild Hybrid Vehicles: Fastest-growing segment due to cost-effective electrification and regenerative braking; adoption is rising in Asia and Europe.

-

Plug-in Hybrid & Full Hybrid Vehicles: Moderate growth, particularly in regions with regulatory support for electrification.

Competitive Landscape

The global EV traction motor market is highly competitive with both global and regional players. Key manufacturers include:

-

ABB Limited: Offers AMXE series motors and integrated inverter packages for buses, rail, and industrial EVs.

-

Robert Bosch GmbH: Specializes in PMSMs, axial flux motors, and integrated motor-drive systems.

-

Valeo SA: Provides high-efficiency traction motors for passenger and commercial EVs.

-

Zytek Group Limited, YASA Motors Ltd, SKF AB, Parker-Hannifin Corp, Magnetic System Technology: Innovators in high-performance EV propulsion systems.

Recent Developments:

-

Nidec Motor & Ashok Leyland (Oct 2024): Partnership to electrify commercial vehicles in India with Nidec E-Drive motor-controller systems.

-

ABB (May 2024): Launched AMXE250 motor and HES580 inverter for electric buses, improving efficiency, reliability, and sustainability in public transport.

Market Outlook (2025–2035)

The EV traction motor market is on a transformative growth path. Rising EV adoption, continuous R&D, and regulatory incentives will drive demand for high-efficiency, compact, and environmentally sustainable motors. Innovations in PMSMs, asynchronous motors, axial flux designs, and magnet-free technologies will allow automakers to address efficiency, cost, and sustainability simultaneously. Emerging markets in Asia-Pacific, Europe, and North America will remain key growth drivers, while the expansion of mild hybrids and plug-in hybrids will supplement traction motor sales in cost-sensitive regions.

Browse Full Report : https://www.factmr.com/report/336/ev-traction-motor-market

Segmentation Summary:

-

Motor Type: Permanent Magnet Synchronous, Asynchronous

-

Voltage Rating: High Voltage, Low Voltage

-

Vehicle Type: Electric Vehicles, Plug-in Hybrid, Mild Hybrid, Full Hybrid

-

Region: North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Fact.MR’s EV traction motor market report provides a detailed analysis of market size, growth trends, technological developments, regional dynamics, and competitive strategies, enabling stakeholders to make informed investment and strategic decisions in the rapidly expanding electric mobility sector.