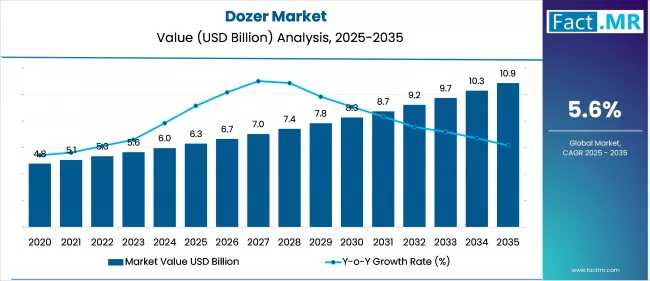

The global dozer market is projected to grow from USD 6.3 billion in 2025 to USD 10.9 billion by 2035, reflecting a CAGR of 5.6% during the forecast period. This growth is primarily driven by a surge in global infrastructure investments, increased urbanization, and a boom in energy and transportation projects, particularly in emerging economies.

Market Overview

Dozers—commonly known as bulldozers—are indispensable in earthmoving, grading, land clearing, and excavation tasks. Their high power, durability, and efficiency make them ideal for large-scale infrastructure, mining, and urban development projects. Recent technological innovations, including GPS integration, telematics, autonomous operation, and electric/hybrid powertrains, have further strengthened their position as essential equipment in construction and industrial operations.

-

Market Size (2025E): USD 6.3 billion

-

Market Size (2035F): USD 10.9 billion

-

CAGR (2025–2035): 5.6%

Market Drivers

-

Infrastructure Investment Surge: Global spending on transportation, energy, and urban development is fueling demand for heavy machinery. In the U.S., the Bipartisan Infrastructure Law (BIL/IIJA) allocates USD 1.2 trillion to roads, bridges, and energy projects, requiring high-capacity dozers for large-scale construction.

-

Mining Sector Expansion: Rising commodity prices and new mining developments, particularly in Africa, Australia, and Latin America, are driving the adoption of heavy-duty dozers.

-

Technological Advancements: Integration of autonomous operation, GPS, telematics, and SmartGrade systems improves operational efficiency, safety, and fleet management. Autonomous and electric models, like battery-powered PR 776 dozers, support sustainability in mining and construction projects.

-

Sustainability & Green Construction: The shift toward low-emission, hybrid, and electric machinery aligns with global environmental regulations and corporate sustainability initiatives.

-

Foreign Investment in Emerging Markets: Countries like India are attracting substantial FDI in infrastructure, housing, and urban development projects, boosting demand for modern construction equipment.

Market Restraints

-

High Initial Costs: Sophisticated dozers, especially those with telematics, automation, and hybrid/electric technology, are expensive (USD 30,000–900,000), limiting adoption among SMEs.

-

Economic & Project Volatility: Economic slowdowns or delays in infrastructure projects can reduce demand for new machinery.

-

Competitive Alternatives: Other equipment, such as compact loaders or multi-functional excavators, compete with dozers for similar tasks.

-

Raw Material Price Fluctuations: Steel and other component costs, combined with financing challenges, can impact pricing and accessibility.

Regional Insights

-

Asia-Pacific: Leads globally, driven by infrastructure development, urbanization, and mining expansion in China, India, Australia, and Southeast Asia. India’s Mining and Construction Equipment (MCE) sector is projected to reach USD 45 billion by 2030, growing at 19% CAGR.

-

Europe: Transformation toward eco-friendly and low-emission machinery is accelerating dozer adoption, supported by urban redevelopment, renewable energy projects, and civil engineering initiatives in Germany, France, and the U.K.

-

North America: The market remains lucrative due to infrastructure upgrades, mining and energy sector demand, and the adoption of hybrid and electric dozers. Advanced technologies such as SmartGrade and E-Drive improve efficiency and operator safety.

Country-Specific Outlook

-

United States: CAGR 5.1% (2025–2035). Investments in infrastructure revitalization, energy projects, and low-emission equipment adoption are driving market growth. Notable advancements include John Deere’s 850 X-Tier Dozer with E-Drive technology.

-

China: CAGR 5.7%. Growth is fueled by urbanization, mining, and green construction initiatives. Innovations such as the world’s first autonomous unmanned bulldozer by Shantui and Huazhong University are redefining construction automation.

-

Japan: CAGR 4.9%. Space-constrained urban environments drive demand for compact, efficient, and technologically advanced dozers, complemented by domestic and overseas infrastructure investments.

Segmental Analysis

By Product Type:

-

Crawler Dozers: Lead the market due to heavy-duty performance in mining, construction, and infrastructure projects.

-

Mini Dozers: Fastest-growing segment, ideal for compact urban projects, landscaping, and utility maintenance.

-

Wheeled Dozers: Serve niche applications requiring mobility and transport flexibility.

By Operating Weight:

-

20,000–60,000 lb: Dominates due to versatility for medium to large-scale projects.

-

Under 20,000 lb: Fastest-growing, suitable for urban construction and constrained environments.

By Flywheel Power:

-

126–250 HP: Leading segment, balancing power, efficiency, and operational cost for large-scale construction.

-

>250 HP: Fastest-growing, driven by mining, mega infrastructure, and heavy excavation requirements.

By End-Use Vertical:

-

Construction: Largest segment, supported by infrastructure, urban redevelopment, and smart city projects.

-

Mining: Fastest-growing segment, driven by mineral extraction for energy and electronics industries.

By Wattage:

-

2,251–4,500 W: Dominates, used in medium-duty electric excavators and auxiliary tools.

-

>6,000 W: Fastest-growing, reflecting trends in electrification, high-powered machinery, and sustainability initiatives.

Competitive Landscape

The global dozer market is highly competitive with multinational and regional players emphasizing technology, sustainability, and cost efficiency:

-

Caterpillar Inc.: Leader in hybrid and SmartGrade-equipped dozers, with global manufacturing and service networks.

-

Komatsu, Liebherr, Deere & Company, Zoomlion, CNH Industrial, Guangxi Liugong Machinery Co., Bell Equipment Co., Shandong Shantui Construction Machinery: Key players focusing on automation, telematics, and electric/hybrid models.

Recent Developments:

-

April 2025 – Liebherr-Canada: Launched Generation 8 PR 776 dozers at Taseko’s Gibraltar mine, featuring fuel efficiency improvements and advanced operator assistance.

-

April 2025 – Leica Geosystems & Shantui: Introduced 3D machine control kits for DH20M dozers, enhancing precision, productivity, and operational efficiency.

Market Outlook (2025–2035)

The dozer market is positioned for steady growth over the next decade, underpinned by global infrastructure investment, technological innovation, and sustainability trends. Crawler dozers will continue to dominate heavy-duty applications, while mini and electrically powered machines will gain traction in urban and environmentally sensitive projects. Mining and construction sectors will remain primary end-users, with emerging markets in Asia-Pacific leading overall demand.

Browse Full report : https://www.factmr.com/report/385/dozer-market

Segmentation Summary:

-

Product Type: Crawler, Wheeled, Mini

-

Operating Weight: Under 20,000 lb, 20,000–60,000 lb, 60,001–150,000 lb, Over 150,000 lb

-

Flywheel Power: 75–125 HP, 126–250 HP, >250 HP

-

End-Use Vertical: Construction, Mining, Forestry & Agriculture, Others

-

Wattage: 1,000–1,250 W, 1,251–1,500 W, 1,501–1,750 W, 1,751–2,000 W, 2,001–2,250 W, 2,251–4,500 W, 4,501–6,000 W, Above 6,000 W

-

Region: North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Fact.MR’s dozer market report provides a detailed analysis of market size, trends, technological advancements, regional dynamics, and competitive strategies, enabling stakeholders to make informed investment and strategic decisions in the expanding heavy machinery landscape.