The global test & measurement equipment market is set for significant growth. It is projected to expand from around USD 37.7 billion in 2025 to approximately USD 65.0 billion by 2035, indicating a strong compound annual growth rate (CAGR) of about 5.6% over the forecast period. This outlook underscores the rising demand for precision testing, calibration, measurement, and diagnostic instrumentation across electronics, industrial, telecom and automotive sectors.

Key Drivers & Market Catalysts:

A number of powerful market forces are driving the demand for test & measurement equipment. The proliferation of advanced electronics, IoT devices, and high-speed communication systems (like 5G / beyond) is pushing manufacturers to use more high-precision measurement instruments, signal analyzers, network testing equipment, and calibration services. Industries are also pushing for higher quality, stricter compliance, and automation, which increases reliance on accurate test and measurement solutions.

Moreover, growth in automotive electrification, advanced driver assistance systems (ADAS), autonomous vehicles, and electric powertrains is fueling demand for testing instrumentation (for high voltage, battery testing, power electronics, sensors). This vertical is becoming one of the major end-users.

Calibration & after-sales / maintenance services are also emerging as critical segments, with service providers offering calibration, repair and rental of test equipment to ensure measurement accuracy, reduce downtime, and maintain instrument reliability.

Click Here for Sample Report Before Buying: https://www.factmr.com/connectus/sample?flag=S&rep_id=8609

Product & Application Segmentation:

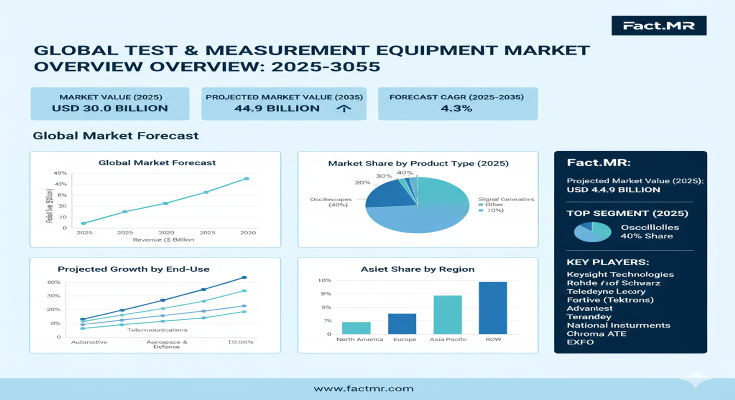

The market covers a wide array of product types: general purpose test instruments (oscilloscopes, signal generators, multimeters, network analyzers etc.), mechanical measurement equipment, environmental test setups, optical & measurement instrumentation, RF / wireless test equipment, and software / analytics that accompany measurement hardware.

End use spans across industries including telecommunications, consumer electronics, automotive & transportation, aerospace & defense, industrial automation, semiconductor manufacturing, healthcare / medical instrumentation, and research & development labs. Each vertical demands different measurement capabilities — from high frequency measurement to mechanical stress testing and environmental or reliability testing.

Regional Trends & Opportunity Hotspots:

Asia-Pacific emerges as one of the fastest growing regions. The region hosts major electronics manufacturing, semiconductor fabrication, telecom infrastructure expansion, and automotive assembly, all of which require test and measurement instrumentation. Investments in industrial automation and local calibration & test labs are further accelerating adoption.

North America remains strong, driven by advanced R&D, precision measurement requirements in aerospace, defense, semiconductor, and automotive testing, and established market for calibration and high-end instrumentation. Demand is boosted by high regulatory standards and strong innovation in measurement technologies.

Europe also remains a key market, with demand from precision manufacturing, automotive, telecom / 5G infrastructure, and calibration labs ensuring compliance with measurement standards. Strong regulatory frameworks and industrial automation drive adoption of test & measurement solutions.

Competitive Landscape & Strategic Initiatives:

The market is composed of established test equipment manufacturers, calibration service providers, instrumentation software firms, and emerging innovators focusing on modular or software-driven measurement systems. Many players are stepping up R&D to integrate AI / analytics, remote measurement capabilities, predictive maintenance, and connected instrumentation.

Companies are also forming partnerships and acquisitions to strengthen their product portfolios, expand calibration & service network, or localize manufacturing closer to emerging markets. This helps reduce lead times, costs, and improves after-sales support.

Challenges & Market Restraints:

Key challenges include the high cost of precision test instruments and calibration equipment, which can be a barrier for small / medium scale users. As measurement accuracy and performance requirements increase (high frequency, high speed, small tolerances), equipment complexity and cost rise.

Also, calibration and maintenance are critical: measurement instruments drift over time and must be periodically calibrated, so lack of calibration infrastructure in emerging regions can slow adoption. Additionally, evolving standards and regulatory requirements necessitate frequent instrument upgrades.

Forecast & Strategic Recommendations for Buyers:

With the market forecast growing from USD 37.7 billion in 2025 to USD 65.0 billion by 2035 at a CAGR of 5.6%, the test & measurement equipment market presents substantial long-term opportunities. Stakeholders – instrument manufacturers, calibration service providers, or integrators – should consider investing in modular, software-enabled and AI-driven measurement instrumentation to tap into multiple verticals.

Calibration service providers should expand capacity in high-growth emerging markets by establishing local accreditation labs and rental fleets. Instrument makers should adapt product portfolios for automotive high voltage / EV testing, telecom / 5G measurement, IoT / sensor testing, and industrial automation testing.

Browse Full Report: https://www.factmr.com/report/test-and-measurement-equipment-market

Editorial Perspective & Call to Action:

Test and measurement equipment is the invisible backbone of innovation, production quality, and compliance across industries. As devices and systems become more complex and precision demands increase, reliable measurement instrumentation becomes non-negotiable. The growth from USD 37.7 billion to USD 65.0 billion by 2035 underscores how central this market is becoming for electronics, telecom, automotive, aerospace, and research sectors.

For decision makers, purchasing the full research report gives access to detailed segmentation (by product type, service type, vertical, region), competitive analysis, emerging trends, calibration forecasts, and strategic insights. It becomes a valuable tool for forecasting demand, planning product launches, setting up calibration networks, or investing in emerging markets.