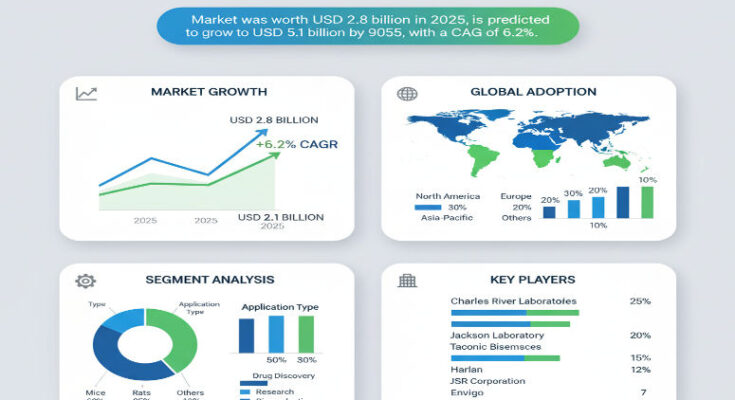

The global animal model market is witnessing strong momentum as biomedical research, drug discovery efforts, and regulatory requirements continue to expand. Market estimates suggest that in recent years the market size has been around USD 2.10 billion in 2022, and is projected to exceed USD 4.01 billion by 2030, indicating a projected compound annual growth rate (CAGR) of around 8.4% over the the 2023–2030 period. This robust growth underscores the critical importance of animal models—especially genetically engineered or disease-specific models—in preclinical testing, toxicology studies, translational research and therapeutic validation.

Market Drivers & Research Imperatives

Several interlocking factors are fueling this market’s expansion. First, the pharmaceutical and biotechnology industries are investing heavily in preclinical R&D pipelines, particularly for novel therapies in oncology, immunology, infectious diseases, neurological disorders and rare diseases. Animal models remain indispensable for validating safety and efficacy prior to first-in-human trials. Second, advances in gene editing technologies (e.g. CRISPR, transgenic techniques) have made it easier to develop sophisticated, humanized, or disease-specific animal models—enhancing the physiological relevance of preclinical studies. Third, regulatory frameworks in many regions require preclinical data from animal studies for investigational new drug approvals, creating a structural demand for validated animal model systems. Fourth, academic institutes, contract research organizations (CROs), and research hospitals are expanding their capabilities, driving demand for both standard and specialized animal models.

Segmentation: Animal Type, Application & End-User

The market is segmented by animal type, application, and end user. Rodent models (especially mice) dominate due to their genetic adjustability, short lifespans, and suitability for genetic modification. Mice are often used for genetically engineered, disease, or humanized models, which remain the premier choice for many types of research. Other animals such as rats, guinea pigs, rabbits, hamsters, non-rodents or larger animal models are used depending on the need (e.g. toxicology, translational physiology or bigger organism size).

In terms of applications, animal models are used for drug discovery and development (preclinical testing, toxicology, efficacy), basic / mechanistic research, and other uses (e.g. safety, regulatory validation, disease modeling). The drug discovery / development application typically commands the largest share because of its central role in early-stage R&D pipelines.

Regarding end users, major segments include pharmaceutical & biotechnology companies, academic research institutions, and contract research organizations (CROs). Pharma / biotech firms often drive upstream demand for specialized or customized animal models; academic / research institutes use models for mechanistic or fundamental research; CROs often supply models or run studies for external clients.

Regional Insights & Market Trends

Geographically, North America remains a leading region due to advanced R&D infrastructure, established preclinical research ecosystem, funding for academic and industry research, and stringent regulatory requirements that mandate animal data. This region accounts for a large portion of demand. Europe also has strong demand with mature research infrastructure, high prevalence of CROs and regulatory expectations.

At the same time, Asia-Pacific is emerging as a high-growth region, driven by rising investment in biomedical research, expansion of CROs, government support for biotech industry and growing preclinical capabilities. Emerging economies are building capacity for breeding, genetic engineering, and outsourced research. Latin America, Middle East & Africa also hold potential as research infrastructure matures.

Competitive Landscape & Key Players

The competitive landscape is populated by specialized providers of animal models, breeding / genetic engineering labs, CROs and research model suppliers. Key names in the market include companies that breed, supply or engineer animal models, humanized or genetically modified models, or run preclinical studies. These participants often compete on model quality, genetic accuracy, availability of humanized disease models, regulatory compliance, turnaround time, and geographic presence.

To maintain competitive edge, many companies are investing in advanced model development (e.g. humanized immune models, transgenic disease models, knock-out/knock-in animals), expanding breeding capacities, forging partnerships with research institutions, and offering full preclinical study services inclusive of animal model provision plus data generation.

Challenges & Market Restraints

Despite strong growth prospects, several challenges exist. Ethical concerns and animal-welfare regulations impose restrictions that can limit model availability or increase compliance costs. Regulatory approvals and certification for new or genetically modified models require rigorous validation. Also, alternative methods (organoids, in vitro systems, organ-on-chip, computational / in silico modeling) are evolving, which can reduce reliance on animal models over time. Furthermore, high cost of specialized or humanized animals, long breeding cycles, and logistical costs pose constraints.

Forecast & Strategic Outlook

Looking forward to 2030 and beyond, the market is projected to nearly double in value from the 2022 baseline, supported by continuous growth in preclinical R&D, increasing adoption of advanced genetic models, and global expansion of preclinical capabilities. For businesses active in this space, strategic priorities include expanding breeding and model engineering capacity, investing in humanized or disease-specific models, forming partnerships with CROs, and expanding presence into high-growth regions such as Asia-Pacific.

Companies that invest in regulatory compliance, high-fidelity model generation, and provide bundled services (model + study execution) are likely to capture greater market share.

Browse Full Report: https://www.factmr.com/report/1590/animal-model-market

Editorial Perspective

The animal model market is a foundational component of biomedical research, bridging early discovery and clinical translation. As therapies become more targeted and precision medicine advances, the demand for humanized, genetically modified, or disease-specific animal models will only intensify. While alternative methods are emerging, animal models remain critically relevant to preclinical validation. Companies that deliver high quality, reproducible models and integrate with preclinical services will likely lead in this expanding market.