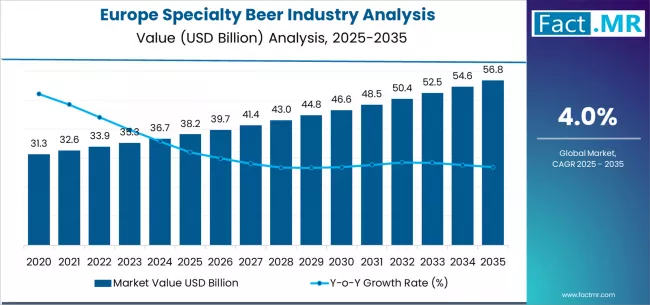

According to the latest research by Fact.MR, the Europe specialty beer market is set to experience robust expansion over the next decade. The market, valued at USD 38.2 billion in 2025, is projected to grow to approximately USD 56.8 billion by 2035, recording an absolute increase of USD 18.6 billion. This represents total growth of 48.7%, with demand forecast to expand at a CAGR of 4.0% between 2025 and 2035.

As Europe’s beer culture continues to evolve, consumer preferences are shifting from mainstream lagers to more diverse, premium, and flavor-rich specialty brews. The trend is being fueled by craft breweries, sustainability-driven brewing practices, and growing consumer interest in authentic and locally produced beverages.

Strategic Market Drivers

- Craft Brewing Revolution and Premiumization

Europe’s craft brewing renaissance is at the heart of the specialty beer boom. Consumers increasingly favor limited-edition, small-batch, and artisanal beers that offer unique taste profiles and provenance.

Breweries across Belgium, Germany, the U.K., and Scandinavia are investing heavily in innovation—experimenting with barrel aging, mixed fermentation, and locally sourced ingredients. The premiumization trend is also boosting higher price points, with consumers showing willingness to pay more for quality, authenticity, and craftsmanship.

- Changing Consumer Demographics and Lifestyle Shifts

Millennials and Gen Z consumers are driving the demand for new and experiential beverages. The rise of low-alcohol, non-alcoholic, and health-conscious specialty beers reflects a broader lifestyle shift toward moderation and mindful drinking.

Additionally, the growing popularity of beer tourism—through brewery tours, festivals, and tasting experiences—continues to expand the visibility and reach of niche beer categories.

- Sustainable and Localized Production

Sustainability has emerged as a defining pillar of Europe’s specialty beer industry. Breweries are increasingly embracing eco-friendly brewing methods, water efficiency, circular packaging, and renewable energy.

Local sourcing of hops, malts, and yeasts supports regional economies while reducing carbon footprints—aligning with EU sustainability goals and strengthening brand identity among eco-conscious consumers.

- Digital Transformation and Direct-to-Consumer Channels

E-commerce platforms, subscription beer boxes, and online brewery stores are transforming beer retail. Digital engagement, coupled with data-driven personalization, is enabling breweries to connect directly with consumers, expand brand loyalty, and gain insights into evolving taste trends.

Browse Full Report: https://www.factmr.com/report/europe-specialty-beer-industry-analysis

Regional Insights

Western Europe: Traditional Stronghold Meets Modern Innovation

Western Europe remains the largest market for specialty beers, driven by established brewing cultures in Germany, Belgium, the Netherlands, and the U.K.. The region’s focus on quality, tradition, and innovation has led to the emergence of hybrid styles such as Belgian IPAs, sour ales, and barrel-aged stouts.

Northern Europe: Sustainability and Craft Diversity

Countries like Denmark, Sweden, and Norway are at the forefront of sustainable brewing practices, with a strong emphasis on organic certification and carbon-neutral operations. Craft breweries here are renowned for their experimentation with wild yeasts, Nordic herbs, and seasonal ingredients.

Southern and Eastern Europe: Emerging Hubs for Niche Growth

Markets in Italy, Spain, and Poland are witnessing rising interest in craft beer culture, supported by growing disposable incomes, tourism, and urbanization. Local brewers are combining traditional recipes with modern brewing technology, creating a vibrant and fast-evolving beer landscape.

Market Segmentation Insights

By Product Type:

- Ale: Continues to dominate, favored for its bold and varied flavor profile.

- Lager: Premium and flavored lagers gaining traction among younger consumers.

- Wheat & Sour Beers: Rapidly emerging category driven by health-conscious and adventurous drinkers.

- Stout & Porter: Popular in northern Europe for their complex and roasted flavor notes.

By Distribution Channel:

- On-Trade (Bars, Pubs, Restaurants): Core growth driver, with experiential consumption playing a key role.

- Off-Trade (Retail, E-commerce): Expanding due to home consumption trends and online accessibility.

Challenges and Market Considerations

Despite optimistic growth, the Europe specialty beer market faces several headwinds:

- Supply Chain and Ingredient Costs: Volatile barley and hop prices can pressure profit margins.

- Regulatory Restrictions: Alcohol taxation and advertising regulations vary significantly across EU nations.

- Market Saturation in Mature Regions: Intense competition in Western Europe drives the need for constant innovation.

Competitive Landscape

The market is moderately consolidated, with leading brewers and craft innovators focusing on product diversification, branding, and sustainability.

Key Players in the Europe Specialty Beer Market include:

- Heineken N.V.

- Carlsberg Group

- Anheuser-Busch InBev SA/NV (AB InBev)

- BrewDog plc

- Duvel Moortgat Brewery NV

- Chimay Brewery (Bières de Chimay S.A.)

- Stone & Wood Brewing Co.

- Founders Brewing Co.

- Sierra Nevada Brewing Co.

These companies are leveraging smart brewing technologies, collaborations with local breweries, and expansion into low-alcohol and functional beverage segments to strengthen their regional footprint.

Future Outlook: Toward a Premium and Sustainable Brewing Future

The next decade will redefine Europe’s beer identity. Specialty beer producers will focus on eco-friendly brewing, flavor innovation, and digital consumer engagement to sustain long-term growth. As premiumization and conscious consumption gain momentum, the Europe specialty beer industry is poised to become a cornerstone of the continent’s evolving beverage economy—balancing heritage, innovation, and sustainability in every pour.