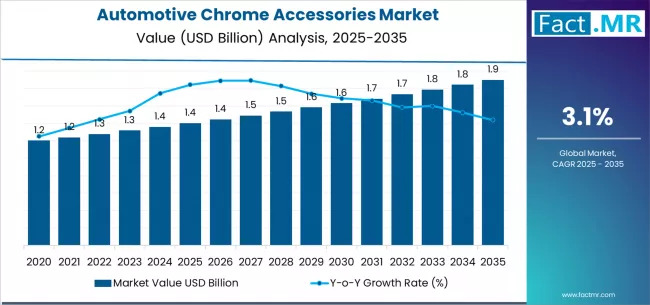

he global automotive chrome accessories market is poised for steady growth, expanding from USD 1.4 billion in 2025 to approximately USD 1.9 billion by 2035, representing a total increase of USD 0.5 billion and a CAGR of 3.1%, according to Fact.MR, a leading market research and competitive intelligence provider. This growth is being fueled by rising consumer demand for vehicle customization, increasing adoption of styling enhancements, and a strong focus on aesthetics across global automotive and aftermarket sectors.

Market Overview

-

Market Value (2025): USD 1.4 billion

-

Forecast Value (2035): USD 1.9 billion

-

Forecast CAGR (2025–2035): 3.1%

-

Leading Product Segment: Body trim & moldings (46.0% market share)

-

Key Regions: North America, Europe, Asia Pacific

-

Prominent Players: Lund/AVS, Putco, Carrichs, TFP, Cowles Products, EGR Group, Dee Zee, Trim Illusions, Mopar Accessories, 3M Automotive

The market is experiencing a steady transformation as chrome accessories shift from niche styling elements to essential components in vehicle enhancement and customization. Body trim & moldings dominate the market, offering both aesthetic appeal and cost-effective solutions for diverse automotive applications.

Market Dynamics

Drivers:

-

Rising Demand for Customization: Consumers and automakers are increasingly investing in chrome accessories for styling, performance enhancement, and differentiation.

-

Adoption in Vehicle Enhancement Systems: Integration of chrome accessories in body panels, grilles, mirrors, and door/fuel caps enhances both visual appeal and perceived value.

-

Focus on Aesthetics & Quality Compliance: Modern automotive standards and regulatory frameworks encourage the use of high-quality chrome accessories for consistent styling outcomes.

-

Aftermarket Opportunities: The aftermarket segment accounts for 74% of demand, providing cost-effective customization solutions while meeting performance standards.

Challenges:

-

Complex integration processes in manufacturing and assembly.

-

Potential variations in performance during implementation.

-

Supply chain consistency for specialized chrome components.

Historical and Forecast Market Trends

-

2020–2025: Steady growth driven by rising awareness of styling technologies and acceptance of customization solutions in complex automotive applications.

-

2025–2030: Market projected to expand from USD 1.4 billion to USD 1.6 billion, contributing 40% of the total forecast growth. Growth fueled by rising production capabilities, aftermarket penetration, and increasing demand for vehicle styling solutions.

-

2030–2035: Market expected to grow from USD 1.6 billion to USD 1.9 billion, accounting for 60% of total growth, supported by advanced styling technologies, specialized OEM systems, and premium vehicle applications.

Segmental Analysis

By Product:

-

Body Trim & Moldings: 46% market share; primary growth driver offering cost-effective styling solutions. Revenue pool: USD 0.6–0.9 billion.

-

Grilles/Mirrors and Door/Handle/Fuel Caps: Specialized applications with incremental growth opportunities.

By Vehicle Type:

-

Light Trucks & SUVs: Premium applications requiring performance-sensitive styling; revenue potential USD 0.7–1.0 billion.

-

Passenger Cars & LCV/HCV: Consistent demand driven by styling and customization requirements.

By Channel:

-

Aftermarket: Dominates with 74% share, balancing performance and economics. Opportunity: USD 1.0–1.4 billion.

-

OEM Accessories: Targeting high-quality, specialized applications; opportunity: USD 0.4–0.5 billion.

Key Market Opportunities

-

Body Trim & Moldings Dominance: Central to styling workflows, driving demand for advanced formulations with superior performance.

-

Aftermarket Market Leadership: Economic customization solutions expand reach across diverse automotive applications.

-

American Market Acceleration: USA (CAGR 3.4%) and Mexico (3.0%) lead regional growth due to infrastructure expansion and local production networks. Opportunity: USD 0.4–0.6 billion.

-

Light Trucks & SUVs Premium Segment: High-performance applications for specialized vehicle types.

-

Advanced OEM & Digital Systems: Automated styling management and performance monitoring enhance system reliability. Opportunity: USD 0.4–0.5 billion.

-

Supply Chain Optimization & Reliability: Strategic distribution and inventory management differentiate manufacturers. Opportunity: USD 0.3–0.4 billion.

-

Emerging Applications: Beyond body trim, chrome accessories in grilles, mirrors, and door handles expand market potential. Opportunity: USD 0.2–0.3 billion.

Regional Insights

-

USA: CAGR 3.4%; expanding automotive infrastructure, styling capabilities, and domestic demand for premium chrome accessories.

-

Mexico: CAGR 3.0%; favorable policies, manufacturing clusters, and automotive growth create opportunities.

-

Germany: CAGR 2.6%; advanced manufacturing, precision styling, and regulatory compliance strengthen market position.

-

South Korea: CAGR 2.5%; growing automotive infrastructure and technology adoption support steady growth.

-

France: CAGR 2.5%; established manufacturing frameworks and performance guidelines sustain demand.

-

UK: CAGR 2.4%; evidence-based automotive protocols and advanced manufacturing frameworks drive steady adoption.

-

Japan: CAGR 2.2%; precision manufacturing infrastructure and structured styling systems support consistent market growth.

Europe Market Split (2025–2035):

-

Germany: 31.8% → 32.6%

-

UK: 19.7% → 20.4%

-

France: 16.9% → 17.3%

-

Italy: 13.2% → 13.7%

-

Spain: 10.8% → 11.3%

-

BENELUX: 5.1% → 5.4%

-

Rest of Europe: 2.5% → 2.3%

Competitive Landscape

Key market participants include Lund/AVS, Putco, Carrichs, TFP, Cowles Products, EGR Group, Dee Zee, Trim Illusions, Mopar Accessories, and 3M Automotive. Companies are investing in:

-

Advanced styling technologies.

-

Performance monitoring and control systems.

-

Supply chain optimization and technical support.

-

Strategic partnerships and aftermarket expansion.

Lund/AVS leads the market with consistent high-quality offerings, while Putco, Carrichs, and TFP focus on specialized systems and customized vehicle applications. Dee Zee and Trim Illusions excel in aftermarket and niche automotive markets.

Browse Full Report : https://www.factmr.com/report/141/automotive-chrome-accessories-market

Outlook

The Automotive Chrome Accessories Market is evolving steadily, driven by growing vehicle customization trends, advanced styling technologies, and expanding aftermarket adoption. By 2035, the market is expected to reach USD 1.9 billion, supported by premium applications in body trim, light trucks, and SUVs, as well as regional growth in the USA, Mexico, and Europe.