The global membrane separation market is witnessing rapid expansion, driven by environmental urgency, regulatory pressure, and advances in material science. Valued at approximately US$ 43.0 billion in 2024, the market is projected to grow at a compound annual growth rate (CAGR) of about 10.4%, reaching an estimated US$ 115.64 billion by 2034. This growth underscores an accelerating adoption of technologies such as reverse osmosis, ultrafiltration, nanofiltration, and microfiltration across water treatment, industrial, pharmaceutical, food & beverage, and wastewater management sectors.

Key Drivers Fueling Market Growth

Several key forces are powering the membrane separation market:

-

Water scarcity and clean water demand: Expanding populations, urbanization, and climate change are creating water stress globally. Municipalities and industries are increasingly turning to membrane separation to provide safe drinking water, treat wastewater, and support desalination projects.

-

Stringent environmental regulation: Governments and regulatory bodies are tightening rules on water pollution, discharge limits, and reuse mandates. These regulations are pushing industries—including textiles, pharmaceuticals, chemicals, and food processing—to adopt membrane technologies that can meet high-purity separation standards.

-

Technological innovation & materials development: Advances in membrane materials (polymeric, ceramic, composite), improved membrane lifetime, enhanced fouling resistance, and energy-efficient designs are reducing operational costs and improving system performance. Integration of digital monitoring and smart control features (sensor-based diagnostics, remote monitoring) is also gaining traction.

-

Expansion in industrial & pharmaceutical applications: Beyond water treatment, membrane separation plays an increasing role in pharmaceuticals for filtration, sterile processing, and bioprocessing, in food & beverage for clarifying, concentrating, and purifying products, and in industrial gas separation (e.g. hydrogen purification, CO₂ separation).

Market Segmentation & Technology Trends

The membrane separation market is segmented by process type, material, application, and end-use:

-

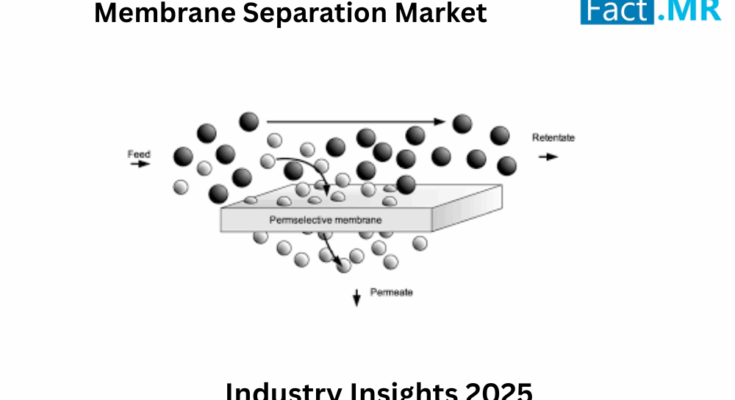

Process Types: Reverse osmosis (RO), nanofiltration (NF), ultrafiltration (UF), and microfiltration (MF) are the primary technologies. Reverse osmosis and nanofiltration are leading in applications demanding removal of fine salts, organic compounds, and dissolved solids. Microfiltration is widely used for particulate removal, sterile filtration, and pre-treatment, while ultrafiltration offers mid-range filtration and protein or macromolecule separation.

-

Material Types: Polymeric membranes dominate due to cost-effectiveness and wide applicability. However, ceramic and inorganic membrane materials are gaining interest for applications requiring high temperature, chemical resistance, or long lifetime. Composite membranes and hybrid structures are emerging in more demanding industrial or specialty use-cases.

-

Applications: Water & wastewater treatment continues to be the largest end-use segment. Other significant applications include industrial processing (chemical, petrochemical, oil & gas), food & beverage, pharmaceuticals, and gas separation. Solid separation is also gaining importance in specific industrial separations.

Regional Insights: North America & Asia-Pacific

North America

The North American market is growing at a CAGR slightly above the global average. The United States leads adoption, driven by strong regulatory frameworks for clean water and wastewater treatment, demand in pharmaceuticals for high-purity separation, and increasing investment in reuse and desalination infrastructure. Industrial users in sectors such as oil & gas, food processing, chemicals, and biotechnology are also significant contributors. Cost of operation, membrane lifetime, energy consumption, and regulatory compliance are key factors influencing purchase decisions.

Asia-Pacific

Asia-Pacific is among the fastest-growing and highest-potential regions. China, India, Southeast Asia, and Australia show strong demand for membrane separation systems, especially in municipal water treatment, industrial wastewater management, and desalination. Rapid industrialization and urban infrastructure growth, combined with increased environmental regulation and clean water awareness, are pushing adoption. The region also benefits from lower manufacturing and labor costs for membrane components, which encourages local manufacturing of membrane modules and materials.

Recent Developments & Innovation

Innovation in the membrane separation market is vibrant and multi-faceted:

-

Energy Efficiency Improvements: New membrane designs and modules are reducing energy demand, especially in RO systems, by optimizing flow patterns, reducing pressure drop, and improving module packing.

-

Enhanced Membrane Materials & Anti-Fouling Technologies: Research into novel coatings, surface treatments, and self-cleaning membrane technologies is helping extend membrane life and reduce maintenance.

-

Digital & Smart Monitoring Integration: Sensors, IoT devices, and real-time analytics are being incorporated to monitor membrane health, predict fouling, identify leaks or performance drop, and enable predictive maintenance.

-

Expanding Gas Separation Applications: Emerging demand for membranes in gas separation—such as hydrogen purification, biogas upgrading, and CO₂ capture—is fueling R&D and commercial interest in membrane materials that can function effectively under varied gas compositions and operating conditions.

-

Modular & Hybrid Systems: Systems combining multiple membrane technologies, or hybrid systems integrating membranes with traditional separation (e.g., adsorption, distillation) are being adopted to optimize cost, efficiency, and performance for complex separation tasks.

Key Players & Competitive Landscape

Several companies are shaping and leading this market. Among the major names are DuPont de Nemours Inc., Toray Industries Inc., Corning Inc., 3M Company, Hydranautics, GEA Group AG, Pall Corporation, SUEZ, Merck KGaA, Pentair plc, Asahi Kasei Corporation, Koch Membrane Systems, and Veolia Environment.

These players compete on technology innovation, membrane material science, module design, energy efficiency, after-sales service, geographic presence, and cost of operations. Some specialize in high-end or specialty membrane materials (ceramics, inorganic), others in large-scale polymeric systems. Patents, R&D, and partnerships with research institutions are common strategies used to maintain competitive advantage.

Challenges & Market Restraints

While the outlook is largely positive, some challenges must be addressed:

-

Fouling and maintenance costs: Membrane fouling remains one of the most significant operational issues, increasing cleaning cycles, downtime, and reducing membrane life.

-

Energy consumption: Especially for reverse osmosis and high-pressure systems, energy cost is a major component of total cost of ownership. Innovations in efficiency help, but regional electricity costs and infrastructure can limit adoption.

-

Capital expenditure & infrastructure: Installation costs, system integration, and upfront investment remain high, particularly in locations lacking existing infrastructure or where scale is small.

-

Material durability and performance under harsh conditions: Chemical, thermal, and mechanical stability are necessary, especially in industrial, gas separation, or extreme water quality conditions.

-

Regulatory & quality standards: Meeting varied regional standards for water treatment, pharmaceuticals, food processing, and environmental compliance can slow product development and scale-up.

Browse Full Report: https://www.factmr.com/report/membrane-separation-market

Forecast & Strategic Outlook

Over the 2024-2034 period, the membrane separation market is expected to nearly triple in size globally. Sectors most likely to drive value are water desalination and reuse, pharmaceutical & bioprocess separation, food & beverage purification, and industrial gas separation. Companies that succeed will be those that can combine high performance membrane materials with low energy consumption, strong modularity and scalability, integrated digital monitoring, and strong after-market support.

For investors and manufacturers, strategic priorities will include expanding manufacturing capacity in Asia-Pacific, investing in advanced materials (ceramic/inorganic, hybrid composites), pursuing anti-fouling and energy-saving R&D, and forming partnerships with municipal water authorities and industrial users to scale deployment.