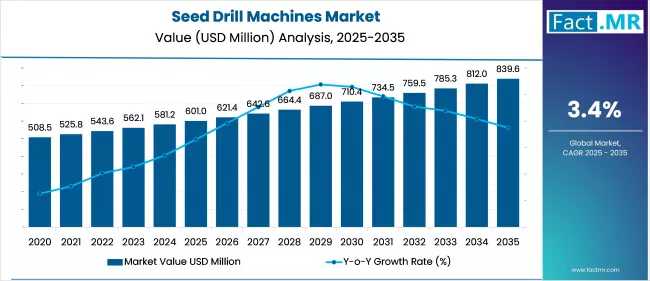

The global seed drill machines market is projected to grow from USD 601.5 million in 2025 to USD 839.6 million by 2035, registering a CAGR of 3.4% during the forecast period. The growth is driven by rising demand for agricultural productivity, the adoption of precision farming techniques, and the need for sustainable and efficient farming practices.

Market Overview

Seed drill machines are agricultural tools designed for precise seed placement at uniform depth and spacing, which enhances germination rates, improves crop yields, and optimizes resource usage. These machines are increasingly critical in modern agriculture, supporting practices such as no-till and minimum-till farming, which reduce soil erosion and maintain soil structure.

-

Industry Value (2025): USD 601 million

-

Projected Value (2035): USD 839.6 million

-

Forecast CAGR (2025–2035): 3.4%

The market is supported by government initiatives, rising labor shortages, and growing awareness of mechanized farming among small, medium, and large-scale farmers globally.

Market Drivers

-

Need for High-Yield Agriculture: Traditional sowing methods often lead to uneven seed distribution and lower productivity. Seed drills ensure consistent planting depth and spacing, directly improving yields.

-

Precision Agriculture Adoption: Advanced seed drills equipped with GPS, sensors, and automated controls allow data-driven sowing, optimizing seed usage and reducing operational costs.

-

Labor Shortages: Mechanization reduces reliance on labor-intensive manual sowing, particularly in large-scale farms, ensuring faster and more consistent planting.

-

Government Support & Subsidies: Programs such as India’s Sub-Mission on Agricultural Mechanization encourage mechanized farming by providing financial assistance and low-interest loans.

-

Sustainable Farming Practices: Seed drills support no-till and minimum-till techniques, maintaining soil fertility, structure, and moisture while promoting environmentally sustainable agriculture.

Market Restraints

-

High Initial Costs: Modern seed drills are expensive, which can limit adoption among smallholder farmers in low-income regions.

-

Lack of Awareness and Training: Many farmers are unfamiliar with operating advanced seed drills, particularly in rural areas with limited extension services.

-

Infrastructure Constraints: Poor road networks, limited access to dealers, and inadequate tractor availability can hinder market penetration.

-

Climatic and Soil Diversity: Seed drill performance varies across soil types, moisture conditions, and crop varieties, limiting universal applicability without proper adaptation.

Regional Insights

-

Asia-Pacific: Leading market share due to high arable land, government subsidies, and increasing adoption of mechanized farming in India, China, and Indonesia. Small to medium-scale farms dominate the region, creating strong demand for cost-effective mechanical and tine seed drills.

-

North America: Market growth is driven by highly mechanized agriculture, precision farming adoption, and labor shortages, particularly in the U.S. and Canada. Farmers widely use GPS-enabled pneumatic seed drills for large-scale operations.

-

Europe: Growth is fueled by environmentally conscious farming, EU regulations, and adoption of no-till techniques. Countries like Germany, France, and the U.K. demand high-precision pneumatic seed drills to optimize crop efficiency and sustainability.

-

Middle East & Southeast Asia: Adoption is gradual due to lower mechanization rates and limited infrastructure, though focus on food security and irrigation-based farming is expected to support future demand.

Country-Specific Outlook

-

United States:

-

Driven by precision agriculture, GPS-guided drills, and rising labor costs.

-

Farmers prefer automated and variable rate seeding systems to improve efficiency.

-

-

China:

-

Rapid adoption of smart farming, digital tools, and government initiatives in precision agriculture.

-

Focus on conservation agriculture, biotech, and GM crops enhances demand for advanced seed drills.

-

-

Japan:

-

Small-scale and fragmented farmland drives demand for smart, GPS-enabled, and electric seed drills.

-

National programs promote AI and IoT adoption to increase farm productivity and precision planting.

-

Product & Segment Analysis

By Product Type:

-

Mechanical Seed Drills: Leading segment (~34% market share), favored for simplicity, cost-effectiveness, and compatibility with small to medium tractors, especially in developing countries.

-

Pneumatic Seed Drills: Fastest-growing segment, offering high precision and uniformity, widely adopted in large-scale and technologically advanced farms.

-

Combination & Manual Seed Drills: Used for niche applications or low-scale farms.

By Mechanism:

-

Tine Seed Drill Machines: Leading segment and fastest-growing, valued for low cost, ease of maintenance, and adaptability to hard or uneven soils.

-

Disc Seed Drill Machines: Suitable for specific soil conditions; slightly higher cost but effective in soft and prepared soils.

By Working Width:

-

2–3 m: Dominant segment for small to medium farms, balancing efficiency and maneuverability.

-

3–4 m: Fastest-growing, favored in North America, Australia, and Western Europe for large-scale commercial operations.

-

Other widths (Below 2 m, 4–5 m, Above 5 m): Serve specialized farming operations and large mechanized farms.

Competitive Landscape

The market features a mix of global leaders and regional players, competing on cost, innovation, and local adaptability.

-

Key Players: KUBOTA Corporation, Mahindra and Mahindra, Deere & Company, Farmet A.S, AGCO Corporation, KUNH Machines, CLAAS KGaA GmbH, Bobcat Company, Agrowplow Pty. Ltd., Dale Drills, Landoll Corporation, Kasco Manufacturing Co.

-

Market Strategy: Leading companies focus on precision agriculture integration, smart drills, and sustainability, while local manufacturers provide cost-effective and regionally adapted solutions.

Recent Developments

-

April 2024: AGCO Corporation and Trimble formed PTx Trimble, focusing on precision agriculture solutions, with AGCO holding 85% stake.

-

February 2024: Mahindra & Mahindra partnered with Clean Seed Capital Group Ltd. for SMART Seeder Mini-MAX™, enhancing adoption of advanced sowing technology in emerging markets.

Market Outlook (2025–2035)

The seed drill machines market is expected to experience steady growth (CAGR 3.4%), driven by:

-

Increasing adoption of precision agriculture technologies.

-

Growing labor shortages and need for mechanization.

-

Rising focus on sustainable farming practices and soil conservation.

-

Government support through subsidies, low-interest loans, and mechanization programs.

-

Expansion of advanced technologies, including GPS-enabled pneumatic drills, automated seed metering, and data-driven sowing systems.

As mechanization and technology adoption expand globally, seed drill machines will remain a critical component of modern, efficient, and sustainable agriculture, particularly in regions emphasizing food security, labor optimization, and precision farming.

Browse Full Report : https://www.factmr.com/report/523/seed-drill-machines-market

Segmentation Summary

-

By Product: Mechanical, Pneumatic, Combination, Manual

-

By Mechanism: Disc, Tine

-

By Working Width: <2 m, 2–3 m, 3–4 m, 4–5 m, >5 m

-

By Region: North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa