The global n-propyl bromide (nPB) market is poised for steady growth over the next decade, projected to expand from USD 560.0 million in 2025 to USD 720.0 million by 2035, reflecting a CAGR of 2.5%, according to recent market analysis. This growth is fueled by rising demand for industrial cleaning solutions, precision solvent applications, and adoption in electronics and industrial manufacturing systems worldwide.

N-Propyl bromide is increasingly recognized as a high-performance solvent for metal cleaning, adhesives, coatings, and specialized industrial processes. Its superior cleaning efficiency, environmental compliance potential, and regulatory alignment make it an essential tool for modern manufacturing and chemical operations.

Market Drivers and Opportunities

The nPB market growth is underpinned by multiple factors:

-

Industrial Cleaning Dominance – Metal cleaning applications account for 38% of market demand, serving as the primary driver for nPB adoption. Industrial operators increasingly rely on nPB for cleaning complex metal components, improving manufacturing outcomes, and ensuring quality compliance across automotive, aerospace, and heavy machinery sectors.

-

Industrial Manufacturing Applications – Representing 51% of the market, industrial manufacturing is the leading end-user segment. The demand is supported by complex cleaning processes and specialized solvent requirements in multi-stage industrial systems. Manufacturers are prioritizing high-efficiency, reliable, and consistent cleaning protocols where nPB delivers measurable operational advantages.

-

Adhesives and Electronics – Adhesives account for 32% market share, reflecting high-value applications requiring specialized performance. Electronics manufacturing contributes 28% of demand, driven by precision cleaning for semiconductor and high-tech production processes.

-

Environmental and Regulatory Alignment – Increasing focus on sustainability, regulatory compliance, and cleaning optimization has accelerated the adoption of nPB in both developed and emerging markets. Manufacturers are adopting ultra-efficient nPB formulations that balance performance with environmental responsibility.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 560.0 million |

| Market Size (2035F) | USD 720.0 million |

| CAGR (2025–2035) | 2.5% |

| Leading Application | Metal Cleaning (38%) |

| Leading End User | Industrial Manufacturing (51%) |

Regional Insights

-

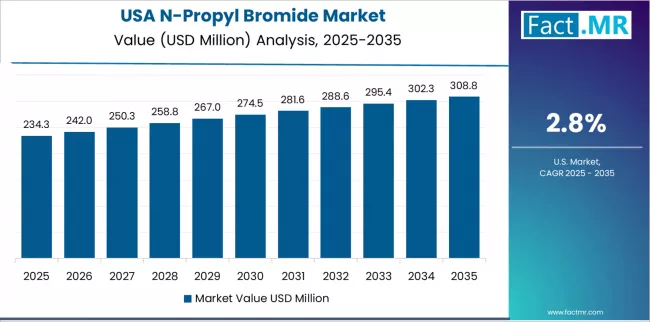

United States – The U.S. market leads growth at a 2.8% CAGR, driven by industrial infrastructure expansion, increased cleaning capabilities, and domestic demand for high-efficiency nPB systems. Strategic investments in advanced cleaning facilities and regulatory compliance expertise are supporting industrial adoption.

-

Mexico – Expanding at 2.6% CAGR, Mexico benefits from growing industrial clusters and production capabilities, particularly in metal cleaning and adhesives applications. Domestic production and distribution networks are enabling access to high-performance cleaning systems.

-

Germany and Europe – Germany maintains market leadership in Europe at a 2.3% CAGR, supported by advanced industrial infrastructure, precision cleaning protocols, and established chemical manufacturing networks. France (2.2%), UK (2.1%), Italy (12.6% share), and Spain (9.8% share) are expanding alongside modernization of industrial facilities and adoption of high-efficiency cleaning technologies.

-

Asia-Pacific & Japan – South Korea (2.2% CAGR) and Japan (2.0% CAGR) exhibit steady growth due to established industrial systems, precision cleaning infrastructure, and consistent adherence to performance and regulatory standards.

Drivers, Restraints, and Trends

The nPB market is evolving as industrial operators prioritize high-efficiency solvent systems, cleaning optimization, and regulatory compliance.

Key growth drivers include:

-

Rising demand for specialized industrial cleaning systems across metal processing, electronics, adhesives, and coatings.

-

Integration of digital monitoring and automated cleaning systems, improving process efficiency and reliability.

-

Expansion of chemical manufacturing capacity for high-purity, performance-optimized nPB formulations.

Challenges include:

-

Complex regulatory requirements for chemical handling and environmental compliance.

-

Potential environmental concerns during production and use of nPB.

-

Supply chain consistency for specialized chemical equipment and raw materials.

Competitive Landscape

The nPB market is competitive, with key players emphasizing technology advancement, quality control, and technical support. Leading companies include:

-

Albemarle Corporation – Market leader with 11% share, providing high-efficiency industrial cleaning systems.

-

LANXESS AG – Specialized nPB solutions with industrial application focus.

-

Chemtura and Oceanchem – Advanced cleaning technologies and customized industrial solutions.

-

Tosoh, Honeywell, Tianjin Changlu, Shandong Brother Sci-Tech – Offering performance-driven, regulatory-compliant nPB systems for global markets.

Recent expansions include strategic partnerships, enhanced supply chains, and adoption of digital monitoring for optimized solvent system performance across industrial hubs.

Browse Full Report : https://www.factmr.com/report/589/n-propyl-bromide-market

Future Outlook

The n-propyl bromide market is expected to continue steady growth through 2035, driven by:

-

Increasing adoption of ultra-high-efficiency cleaning technologies.

-

Expansion in industrial manufacturing and electronics sectors requiring precision cleaning.

-

Geographic growth in North America, Europe, and emerging Asia-Pacific markets.