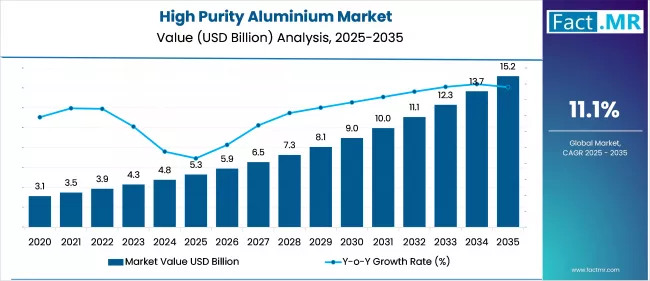

The global high purity aluminium (HPA) market is projected to surge from USD 5.3 billion in 2025 to USD 15.2 billion by 2035, registering a CAGR of 11.1%, according to recent market research. The rapid growth is primarily driven by the increasing use of high-purity alumina in electric vehicle (EV) batteries, semiconductors, and advanced electronic components, where superior thermal stability, conductivity, and corrosion resistance are critical.

High-purity aluminium, including grades 4N, 5N, and 6N, is refined to 99.99% purity and above, making it an indispensable material for applications requiring exceptional performance and reliability. Its applications span LED lighting, lithium-ion batteries, aerospace, automotive, and semiconductor production.

Market Drivers and Opportunities

The market growth of HPA is supported by multiple factors:

-

Electric Vehicle and Energy Storage Applications – Lithium-ion battery performance is significantly enhanced by HPA-coated separators and thin alumina coatings, improving durability and high-discharge capacity. As EV adoption accelerates globally, demand for HPA as a key battery component is expected to rise sharply.

-

LED and Lighting Industry – HPA is essential in the production of LED chips and lighting solutions for residential and commercial use. ENERGY STAR-qualified LED products, which consume approximately 75% less energy than traditional lighting, drive demand for high-purity alumina in energy-efficient lighting systems.

-

Semiconductors and Electronics – The semiconductor sector dominates HPA consumption due to its role in wafer production, thin films, capacitor foils, and flat panel displays. Increasing device miniaturization, higher precision requirements, and rapid electronic adoption are fueling demand for 5N and 6N grades.

-

Advanced Manufacturing and Aerospace – HPA’s high thermal stability and hardness make it a preferred material for sapphire substrates in aerospace, optoelectronics, and defense industries. Japan, in particular, is witnessing growth through initiatives targeting low-carbon aluminium and high-performance aerospace materials.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 5.3 billion |

| Market Size (2035F) | USD 15.2 billion |

| CAGR (2025–2035) | 11.1% |

| Leading Grade | 4N (99.99% purity) |

| Leading End Use | Semiconductors |

| Leading Form | Ingots |

Regional Insights

-

North America – The U.S., Canada, and Mexico dominate the market, driven by semiconductor growth, EV adoption, and LED innovations. Investments in domestic HPA production aim to enhance mineral supply chains and reduce imports.

-

Asia-Pacific – APAC leads in revenue share due to China, Japan, South Korea, and India’s strong manufacturing base. China, in particular, is a global leader in battery production and LED manufacturing, reinforced by government policies promoting green energy, clean technology, and industrial self-sufficiency.

-

Europe – Germany, France, and the UK are witnessing rising demand from semiconductor and LED sectors, driven by regulatory frameworks favoring energy-efficient technologies. Sustainability initiatives and carbon reduction goals are further supporting HPA adoption.

-

Latin America – Brazil is emerging as a market with growing infrastructure and renewable energy initiatives, alongside increasing adoption of EVs and LEDs.

Challenges and Restraints

While the HPA market is poised for strong growth, several challenges persist:

-

High Production Costs – HPA production is energy-intensive, requiring sophisticated equipment. CAPEX and OPEX for a standard plant (4,000 tons/year) can reach USD 297.6 million and USD 44.6 million, respectively.

-

Raw Material Availability – Bauxite scarcity and fluctuating energy prices can impact manufacturing costs.

-

Environmental Concerns – The Bayer process produces red mud, an industrial waste requiring expensive handling and storage. Global smelters generate roughly 1.4–1.5 tons of red mud per ton of aluminium.

Category-wise Insights

-

By Grade – The 4N segment leads due to its balance of purity and cost, while 5N is projected to grow fastest for ultra-high-purity applications in semiconductors and aerospace.

-

By End Use – Semiconductors dominate HPA consumption, followed by electronics, aerospace, and automotive applications.

-

By Form – Ingots hold the largest share for ease of transport and processing, while wires and coils are the fastest-growing due to EV and electronics applications.

Competitive Landscape

The high-purity aluminium market is highly competitive, with global and regional players innovating through R&D, partnerships, and capacity expansions. Key players include:

-

Orbite Technologies Inc. – Advanced refining techniques and strong global footprint.

-

Altech Chemicals Ltd. – Integrated production and application versatility.

-

Almatis, Inc. – Specialty alumina and electronic applications.

-

Nippon Light Metal Holdings Co., Ltd. – Focus on low-carbon aluminium and aerospace applications.

-

Hindalco Industries Limited – Acquired AluChem Companies Inc. in 2025 to expand US specialty alumina production.

-

Alpha HPA – Full-scale production of HPA at Gladstone, Queensland, creating the world’s largest single-site refinery (2024–2025).

Browse Full Report : https://www.factmr.com/report/625/high-purity-aluminium-market

Future Outlook

The global HPA market is expected to continue robust growth through 2035, driven by:

-

Rapid EV adoption and energy storage solutions.

-

Expansion of semiconductor and electronics manufacturing.

-

Increasing LED and energy-efficient lighting implementation.

-

Technological advancements and government-led sustainability initiatives.