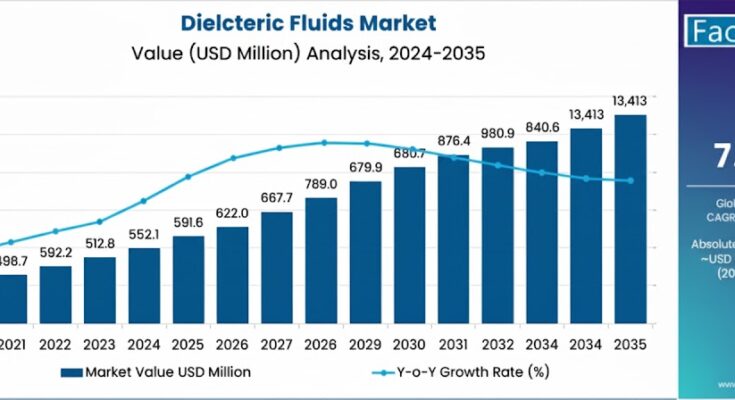

The global dielectric fluids market is projected to surge from USD 6,508 million in 2025 to USD 13,413 million by 2035, reflecting a robust CAGR of 7.5%, according to a recent Fact.MR report. This growth is being driven by increasing investments in research and development, the global shift toward energy-efficient technologies, and the rising adoption of eco-friendly, high-performance dielectric fluids across power generation, transmission, and industrial sectors.

Dielectric fluids, including dielectric oils, coolants, and hydraulic fluids, play a critical role in the efficient operation of high-voltage electrical components. These fluids provide insulation, reduce transmission losses, and ensure effective thermal management, making them essential for transformers, capacitors, switchgear, and electrical discharge machines (EDMs).

Market Growth Drivers

-

Global Clean Energy Initiatives – The worldwide push for renewable energy is increasing demand for advanced dielectric fluids that support energy-efficient transformers and electrical equipment. Governments and industries are investing in low-carbon transformers and bio-based fluids to minimize environmental impact.

-

Expansion of EDM Applications – Electrical discharge machines are widely used in aerospace, defense, and precision manufacturing. EDM processes rely heavily on dielectric fluids for heat dissipation and spark control, driving specialized product demand in high-precision sectors.

-

Renewable Energy and Smart Grid Adoption – Growing use of wind, solar, and off-shore transformers requires fluids with superior thermal stability and environmental compliance. Smart grid technologies further enhance the need for high-performance dielectric oils that ensure reliability and safety.

-

Sustainability and Biodegradable Fluids – Manufacturers are developing biodegradable dielectric fluids that meet stringent environmental standards, aligning with global sustainability goals and increasing regulatory pressure for eco-friendly solutions.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2024A) | USD 6,039 million |

| Market Size (2025E) | USD 6,508 million |

| Forecasted Market Size (2035F) | USD 13,413 million |

| CAGR (2025–2035) | 7.5% |

| Key Regional Share (2025) | East Asia – 29.8% |

| Leading Country Growth | China – 8.4% CAGR |

| Major Players | Cargill, 3M, PROLEC GE, Shell, DuPont, Repsol, Shrieve Chemical, M&I Materials, NYCO, Soltex |

Short, Medium, and Long-Term Outlook

-

Short-Term (2025–2028) – Eco-friendly dielectric fluids will see steady growth as industries adopt biodegradable and low-carbon alternatives for transformers and data center cooling systems. Regulatory pressures will accelerate innovation and adoption.

-

Medium-Term (2028–2032) – The expansion of renewable energy projects and smart grid technologies will drive demand for dielectric fluids with advanced thermal stability, dielectric strength, and environmental compatibility. Both major players and startups will invest in innovative formulations.

-

Long-Term (2032–2035) – Next-generation dielectric fluids, including bio-based and synthetic variants, will gain traction across energy storage, transmission, and industrial applications. Emerging economies, particularly in Asia-Pacific, will contribute significantly to global market revenue.

Country-Wise Insights

-

United States – Estimated at USD 1,606 million in 2025, the U.S. market is projected to expand at 7.0% CAGR through 2035. Growth is fueled by grid modernization, renewable energy integration, and increasing data center infrastructure. Regulatory standards for environmental compliance further support adoption.

-

China – Poised to reach USD 1,979 million by 2035 at 8.4% CAGR, China benefits from rapid industrial growth, urbanization, and energy infrastructure modernization. Rising EV adoption and renewable energy expansion further drive demand for high-performance dielectric fluids.

Category-Wise Insights

-

By Type – Water-based, hydrocarbon oil-based, and gas-based dielectric fluids are widely used. Hydrocarbon oil-based fluids dominate due to their versatility, while water-based and eco-friendly formulations are experiencing rapid growth.

-

By Application – Key applications include windmill transformers, traction transformers, EDMs, capacitors, off-shore transformers, and distribution transformers. EDMs, in particular, are expected to show significant growth due to increased aerospace and defense manufacturing activities.

-

By End Use – Power generation, transmission, distribution, and electrical equipment manufacturing are the primary end-use sectors. Growth is driven by industrial modernization and the global shift toward sustainable energy.

Competitive Landscape

The dielectric fluids market is highly competitive, with key players investing in R&D, sustainable innovations, and strategic collaborations.

-

M&I Materials Ltd. – Introduced biodegradable dielectric fluids for transformer applications in April 2024.

-

The Chemours Company – Launched Opteon 2P50 hydrofluoroolefin dielectric fluid for data center cooling in March 2023.

-

Cargill Incorporated, 3M, Shell, DuPont, Repsol, Shrieve Chemical, NYCO, Soltex – Focused on product innovation, customized solutions, and compliance with evolving environmental regulations.

Market Outlook

The dielectric fluids market is projected to sustain strong growth due to:

-

Rapid adoption of renewable energy technologies and smart grid infrastructure.

-

Increasing demand for EDM fluids in precision industries.

-

Regulatory emphasis on environmental compliance and biodegradable solutions.

-

Technological advancements enhancing thermal management and dielectric strength.

Browse Full Report : https://www.factmr.com/report/721/dielectric-fluids-market

About Fact.MR

Fact.MR is a leading provider of market research and competitive intelligence, delivering actionable insights across industries. Their data-driven approach empowers businesses to capture growth opportunities, optimize strategies, and achieve sustainable global success.