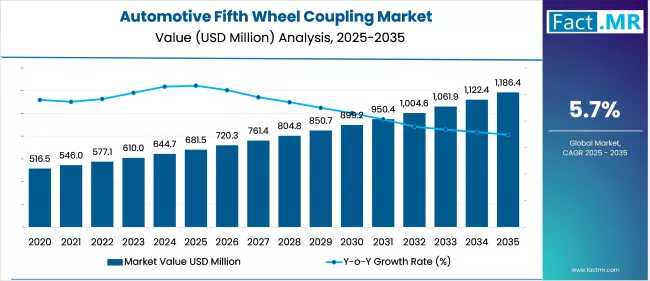

The global automotive fifth wheel coupling market is projected to grow from USD 681.5 million in 2025 to USD 1,186.4 million by 2035, registering a CAGR of 5.7% over the forecast period. Market growth is driven by the rising demand for heavy-duty logistics, expanding freight transport, fleet modernization, and the adoption of advanced coupling technologies in commercial vehicles.

Market Overview

Fifth wheel couplings are critical components in articulated trucks and trailers, enabling safe load transfer, efficient trailer detachment, and enhanced maneuverability under heavy load conditions. These systems are widely used in logistics, construction, mining, and long-haul freight industries.

The market is supported by several global trends, including:

-

Increasing semi-trailer use in commercial applications.

-

Fleet modernization initiatives in developed and emerging economies.

-

Integration of sensor-enabled and smart couplings for predictive maintenance and safety.

-

Regulatory push toward corrosion-resistant and durable materials for longer service life.

Market Drivers

-

Expansion of Freight and Logistics: Rising global road freight volumes, including cross-border transport in Asia, Europe, and North America, increase demand for robust fifth wheel couplings.

-

Vehicle Fleet Modernization: Aging fleets in North America, Europe, and Asia-Pacific are being upgraded to support higher loads and comply with stricter safety and emission standards.

-

Material Innovation: Use of forged steel, alloy-treated cast iron, and hybrid locking mechanisms ensures higher load thresholds and longer service life.

-

Modular Trailer Platforms: Adoption of modular designs requires versatile coupling systems compatible across multiple trailer types.

-

Digitization & Telematics: Sensor-equipped couplings monitor wear, misalignment, and locking failures, reducing downtime and enhancing fleet efficiency.

Market Restraints

-

High Component Costs: Advanced forged and alloy materials increase upfront costs, deterring budget-conscious fleet operators.

-

Certification Compliance: Adherence to SAE J2638, ISO 3842, and ECE R55 adds design, testing, and regulatory costs.

-

Supply Chain Volatility: Steel price fluctuations, limited availability of corrosion-resistant coatings, and precision-machined components may disrupt manufacturing timelines.

-

Interoperability Challenges: Variations in mounting standards and trailer configurations across geographies increase multi-platform adaptation costs.

Regional Insights

-

Asia-Pacific: Market leader due to high commercial vehicle production in China, India, and Japan, fueled by industrial output, logistics expansion, and cross-border freight.

-

North America: U.S. dominates with high trailer-to-truck ratios, fleet replacement cycles, and strict towing safety regulations. Canada supports growth via construction and industrial vehicle demand.

-

Europe: Germany, Poland, and the Netherlands drive growth with strong trailer manufacturing clusters, increasing freight traffic, and stringent emission/weight regulations.

-

Latin America & Southeast Asia: Emerging markets benefit from government-backed logistics corridors and industrial modernization, particularly in Brazil, Vietnam, and Indonesia.

Country-Wise Outlook

-

China: The market is driven by a large commercial vehicle base (31.28 million vehicles in 2024, including 3.8 million commercial vehicles) and adoption of zero-emission trucks. OEMs such as FAW, Dongfeng, and Sinotruk are upgrading fifth wheel designs with smart locking mechanisms and lightweight alloys to meet global standards.

-

Germany: Growth is supported by electrification of commercial fleets, advanced logistics infrastructure, and integration of sensor-enabled couplings. OEMs like Daimler Truck, MAN, and Mercedes-Benz are developing low-mount couplers for EVs to meet EU CO₂ reduction targets.

-

United States: High Class 8 truck orders, electrification, and fleet modernization drive fifth wheel demand. Key OEMs include Freightliner (Daimler), Tesla, Nikola, and Toyota/Hino, deploying electric and hybrid heavy-duty trucks requiring advanced couplings.

Segment Analysis

By Product:

-

Compensating Couplings: Largest segment due to superior load distribution and stability in heavy-duty trucking and long-haul applications.

-

Fully-Oscillating Couplings: Fastest-growing segment, offering enhanced articulation for construction, mining, and off-road operations.

-

Semi-Oscillating & Others: Cater to medium-duty applications or niche commercial vehicles.

By Actuation:

-

Pneumatic Actuators: Largest share, widely used in commercial fleets for reliability, ease of operation, and compatibility with air brake systems.

-

Hydraulic Actuators: Fastest-growing, offering precise force control for high-load and off-road applications.

-

Mechanical & Other Actuators: Support simpler or cost-sensitive applications.

By Tonnage:

-

2,144 Tons: Largest segment, ideal for medium-to-heavy trucks for regional and long-haul freight.

-

>75 Tons: Fastest-growing, driven by mining, infrastructure, and heavy industrial transport requiring high-capacity couplings.

-

Other tonnages (6–20, 21–44, 45–75 Tons): Cater to light and medium-duty commercial vehicles.

By Application:

-

Heavy-Duty: Dominates due to wide adoption in logistics, construction, mining, and long-haul freight.

-

Medium-Duty: Fastest-growing, driven by urban deliveries, intra-city transport, and e-commerce logistics.

-

Light-Duty: Niche applications, smaller trucks, and specialized urban transport.

Competitive Landscape

The market is highly competitive with global leaders and regional players investing in innovation, precision manufacturing, and digital integration. Key players include:

-

SAF‑Holland

-

JOST Werke

-

Fontaine

-

RSB Group

-

Tulga

-

Guangdong Fuwa

Trends and Innovations:

-

Sensor-enabled couplings with predictive maintenance capabilities (e.g., Fontaine SmartConnect).

-

Lightweight alloys and corrosion-resistant materials to reduce weight and meet fuel efficiency standards.

-

CNC machining and precision manufacturing for improved reliability and reduced downtime.

Recent Developments:

-

September 2024: Fontaine exhibited TechLock® system at Automechanika and IAA, enhancing safety and efficiency in long-haul and off-road applications.

-

November 2023: Fontaine launched SmartConnect, a digital coupling system providing secure lock verification and maintenance alerts.

Market Outlook (2025–2035)

The fifth wheel coupling market is expected to expand steadily (CAGR 5.7%), supported by:

-

Growth of logistics, mining, and construction sectors.

-

Electrification of commercial fleets requiring high-performance, sensor-enabled couplings.

-

Increasing adoption of compensating and fully-oscillating couplings for enhanced stability and flexibility.

-

Demand for high-tonnage solutions in infrastructure and heavy industries.

-

Material innovation and digital integration enhancing durability, safety, and operational efficiency.

As global freight and industrial activity expand, fifth wheel couplings will remain critical components for safe, efficient, and high-performance operation of articulated commercial vehicles, particularly in regions emphasizing fleet modernization, electrification, and urban-industrial transport.

Segmentation Summary

-

By Product: Compensating, Semi-Oscillating, Fully-Oscillating, Others

-

By Actuation: Hydraulic, Pneumatic, Mechanical, Others

-

By Tonnage: 6–20, 21–44, 45–75, >75 Tons

-

By Application: Light Duty, Medium Duty, Heavy Duty

-

By Region: North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Browse Full report : https://www.factmr.com/report/690/automotive-fifth-wheel-coupling-market