The Dipropylene Glycol N-Propyl Ether (DPnP) market is on a steady growth path as industries accelerate their transition toward environmentally responsible and high-performance solvents. According to a recent study by Fact.MR, the market is estimated at USD 1.08 billion in 2025 and projected to reach USD 1.65 billion by 2035, expanding at a CAGR of 4.3%.

The report, “Dipropylene Glycol N-Propyl Ether Market Size, Share, and Forecast 2025–2035,” highlights increasing adoption across paints & coatings, industrial cleaners, printing inks, and electronics manufacturing, supported by global sustainability goals and VOC emission standards.

Sustainable Solvents Transforming Industrial Formulations

With mounting pressure to phase out hazardous petrochemical solvents, Dipropylene Glycol N-Propyl Ether is emerging as a critical enabler of green chemistry. Its low volatility, excellent coupling power, and odor neutrality make it ideal for waterborne and eco-label cleaning formulations.

From 2025 to 2030, the market is projected to add nearly USD 240 million in value, driven by low-VOC paint consumption and industrial cleaning expansions. Between 2030 and 2035, revenue is expected to increase by another USD 330 million, reflecting the rise of smart coatings, circular solvent recovery, and bio-based manufacturing.

“Dipropylene Glycol N-Propyl Ether represents the new balance between performance and sustainability,” said a Fact.MR chemical analyst. “As industries pursue cleaner formulations, this glycol ether’s demand trajectory remains firmly upward.”

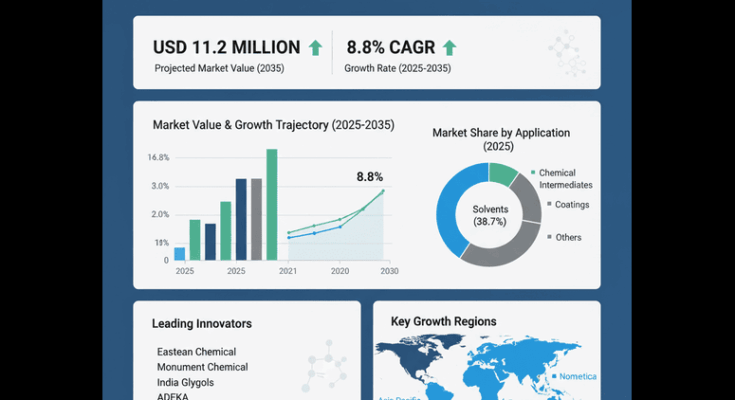

Market Overview at a Glance

| Metric | Global Estimate |

|---|---|

| Market Value (2025) | USD 1.08 billion |

| Forecast Value (2035) | USD 1.65 billion |

| CAGR | 4.3% |

| Leading Application | Paints & Coatings (35% share) |

| Fastest-Growing Segment | Industrial Cleaners (5.1% CAGR) |

Segmental Analysis: Paints, Cleaners, and Electronics Driving Demand

By Grade:

Industrial-grade DPnP remains the most consumed variant, capturing over 60% of the market. Meanwhile, high-purity and electronic-grade formulations are expanding due to semiconductor and precision cleaning applications.

By Application:

-

Paints & Coatings account for one-third of demand, propelled by growth in construction and automotive refinishing.

-

Cleaning & Degreasing Agents are witnessing accelerated adoption in industrial maintenance and metal processing.

-

Printing and Adhesive Applications benefit from e-commerce packaging expansion and label production.

By End Use:

Construction and automotive sectors dominate with a combined 45% market share, while electronics and consumer goods continue to see double-digit growth through 2035.

Regional Insights: Asia Pacific Retains Leadership

Asia Pacific leads global consumption, commanding over 45% market share in 2025, driven by China, India, and South Korea’s robust coatings and manufacturing ecosystems.

North America and Europe remain pivotal due to stringent VOC and REACH regulations, prompting large-scale substitution toward glycol ether solvents. These regions together represent 40% of global volume, with major innovation hubs focusing on low-emission formulations.

Emerging markets in Latin America and the Middle East & Africa are also gaining traction, as industrialization fuels solvent-based cleaner demand.

Market Drivers and Emerging Trends

-

Green Chemistry Movement: Environmental regulations drive replacement of traditional solvents.

-

Industrial Cleaning Growth: Rising metal fabrication and maintenance sectors sustain demand.

-

Construction Rebound: Global infrastructure investments boost coating applications.

-

Electronics Manufacturing Expansion: Precision cleaning fuels high-purity solvent use.

-

Circular Solvent Recovery: Recycling and emission reduction innovations enhance market sustainability.

“The future of solvent chemistry lies in cleaner molecular design and efficient recycling,” added the Fact.MR analyst. “DPnP is well-positioned to play a central role in that transformation.”

Competitive Landscape

Leading companies in the market include:

Dow Chemical Company, LyondellBasell Industries, BASF SE, Eastman Chemical Company, Shell Chemicals, and KH Neochem Co., Ltd.

Together, these players represent more than 60% of global share, focusing on green product portfolios, capacity expansion in Asia, and advanced formulation technologies.

Outlook: Cleaner Chemistry for a Sustainable Future

By 2035, over 70% of Dipropylene Glycol N-Propyl Ether applications will be aligned with eco-friendly and low-VOC standards. The growing integration of bio-based feedstocks, digital supply chain tracking, and R&D for solvent optimization will continue reshaping the competitive landscape.

As global industries move toward net-zero manufacturing, DPnP’s dual role as a high-performance and sustainable solvent will cement its importance across coatings, cleaning, and industrial processing markets.

Browse Full report : https://www.factmr.com/report/dipropylene-glycol-n-propyl-ether-market

About Fact.MR

Fact.MR is a trusted market intelligence and advisory firm providing actionable insights across 30+ industries and 1,200 markets. The firm supports global businesses in aligning strategic growth with sustainability and innovation-driven objectives.