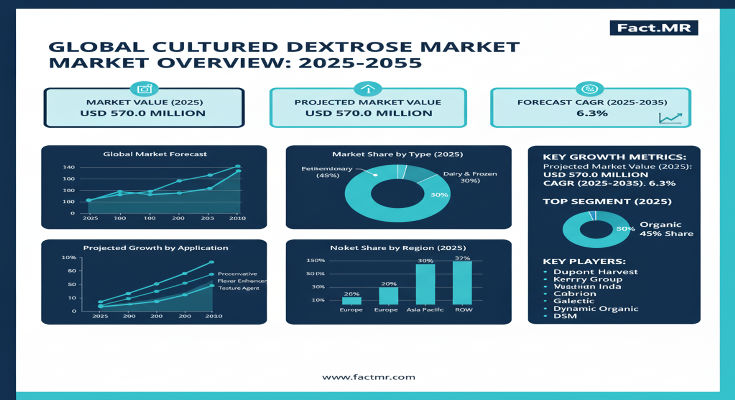

In a landscape where consumers demand transparency and natural alternatives to synthetic additives, the cultured dextrose market is emerging as a vital force in food preservation, offering a clean-label solution derived from fermented milk sugars that extends shelf life without compromising flavor or safety. A new report from Fact.MR forecasts the global market, valued at US$ 780.0 million in 2025, to expand to US$ 1,200.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.4%. This 53.8% total growth—delivering an absolute dollar opportunity of US$ 420.0 million—highlights the sector’s pivotal role in meeting the clean-label imperative, with 44.0% of expansion (US$ 185.0 million) in the first half (2025-2030) and 56.0% (US$ 235.0 million) accelerating thereafter, propelled by surging adoption in bakery and dairy applications.

As manufacturers pivot from chemical preservatives to fermented bioactives, cultured dextrose—produced through the fermentation of dextrose with propionibacteria—is positioning itself as a versatile, natural antimicrobial that inhibits mold and bacteria while enhancing product freshness. “The cultured dextrose market is expected to grow by over 50% during the forecast period, supported by increasing global demand for natural preservatives in processed foods and beverages,” noted Fact.MR. “With bakery products capturing 35.0% market share in 2025 and powder forms leading at 62.0%, this sector is empowering brands to deliver shelf-stable indulgence that aligns with consumer calls for transparency and efficacy.”

Click Here for Sample Report Before Buying: https://www.factmr.com/connectus/sample?flag=S&rep_id=3676

Key Drivers: Clean-Label Revolution and Fermentation Efficiency

The market’s resilient trajectory is underpinned by a confluence of consumer shifts and production advancements. At the forefront is the clean-label movement, where shoppers scrutinize ingredient lists for natural, recognizable components, driving a 25-30% annual rise in demand for bio-preservatives that replace synthetic options like sorbates and benzoates. Cultured dextrose’s dual role as a flavor enhancer and antimicrobial—extending shelf life by 20-40% in bakery goods—makes it indispensable for processed foods facing spoilage challenges amid global supply chain complexities.

Fermentation innovations, including optimized propionibacteria strains and scalable bioreactor systems, are slashing production costs by 15% while boosting potency, enabling seamless integration into high-volume lines. Regulatory endorsements, such as FDA GRAS status and EU novel food approvals, further accelerate uptake, alongside sustainability perks like reduced food waste. “The demand for natural antimicrobial solutions in bakery, dairy, and meat products” is a core driver, per Fact.MR, amplified by the push for fermented bioactives that fuse efficacy with consumer appeal. Challenges such as flavor masking in sensitive formulations and raw material volatility from dairy sourcing persist, but encapsulation tech and diversified supply chains are forging pathways to broader resilience.

Segmentation Insights: Bakery Applications and Powder Forms Dominate

Fact.MR’s detailed segmentation unveils targeted growth corridors. By application, bakery products lead with a 35.0% share in 2025, valued for mold inhibition in breads and pastries, projected to generate US$ 420.0 million by 2035 at a 4.4% CAGR. Dairy follows at 25.0%, leveraging freshness extension in yogurts and cheeses, while meat & poultry (20.0%) and beverages (20.0%) round out key uses, offering US$ 240.0-300.0 million opportunities each.

Form-wise, powder commands 62.0% share, prized for stability and ease of incorporation in dry mixes, outpacing liquid (38.0%) for its superior shelf life in industrial settings. Distribution channels spotlight B2B ingredients at 75.0% share, ensuring bulk reliability for manufacturers, with retail (15.0%) and online (10.0%) gaining for consumer-direct wellness packs.

Regional Dynamics: North America’s Premium Push Meets Asia-Pacific’s Scale

North America anchors the market with sophistication, led by the USA at a 4.8% CAGR, climbing from US$ 250.0 million in 2025 to US$ 390.0 million by 2035, driven by clean-label mandates in bakery hubs like California and New York, where adoption rates spike 20-25% annually. Canada complements at 4.5% CAGR via dairy innovations.

Asia-Pacific emerges as the growth vanguard, with China at 5.0% CAGR, fueled by processed food booms in Shanghai and Guangzhou for beverage integrations. India follows at 4.7% CAGR, propelled by meat preservation in Mumbai amid rising urbanization.

Europe maintains steady elegance, valued at US$ 200.0 million in 2025 and set to reach US$ 310.0 million by 2035 at 4.5% CAGR. Germany leads with 28.0% regional share (innovating bakery in Bavaria), France (22.0%) advances dairy, the UK (18.0%) emphasizes beverages, Italy (15.0%) and Spain (12.0%) focus on meat apps, and the rest of Europe (5.0%) gains from Nordic clean trends.

South Korea (4.3% CAGR) and Japan (4.2%) prioritize high-tech fermentation, achieving 35% efficiency gains.

Recent Developments: Bioactive Launches and Supply Chain Enhancements

The cultured dextrose domain is fermenting with progress. In 2024, DuPont scaled bioreactor production in the U.S., boosting powder yields by 25% for bakery partners and aligning with GRAS standards. Chr. Hansen partnered with European dairy firms for liquid variants, reducing spoilage 30% in yogurts. ADM invested in Asian facilities, capturing 15% market share in China via meat-focused powders. These moves, including AI-optimized strains, signal a 2025 wave of multi-functional bio-preservatives.

Key Players Insights: Fermentation Leaders Cultivating Market Share

A moderately concentrated field of 10-15 players sees top firms like DuPont (12.0% share) commanding 40-50% through R&D and global supply:

-

DuPont: Powder powerhouse, dominating bakery with U.S. fermentation expertise.

-

Chr. Hansen: Liquid specialist, innovating European dairy.

-

ADM: Bioactive enhancer for Asia-Pacific meat.

-

Kerry Group: Beverage-focused formulator.

-

Corbion N.V.: Sustainable sourcing leader.

-

Lallemand Inc.: Strain innovator for powders.

-

Angel Yeast Co. Ltd.: Chinese exporter for B2B.

-

Lesaffre Group: Yeast-hybrid developer.

-

DSM Nutritional Products: Nutraceutical integrations.

-

Galactic, Purac, Kemin Industries: Niche challengers via partnerships.

Strategies include M&A for strain IP and certifications for natural claims.

Challenges and Opportunities: Flavor Masking vs. Clean Horizons

Processing complexities for flavor neutrality—up 10-15% in costs—and dairy supply fluctuations challenge scalability.

Yet, opportunities abound: bakery unlocks US$ 420.0 million, powder US$ 744.0 million, and North America US$ 390.0 million. Dairy apps add US$ 300.0 million—fertile grounds for innovators.

Browse Full Report: https://www.factmr.com/report/3676/cultured-dextrose-market

Future Outlook: A $1.2 Billion Culture of Natural Preservation

By 2035, Fact.MR envisions cultured dextrose as a US$ 1.2 billion staple, with bakery at 37% share and Asia-Pacific leading. The 4.4% CAGR will prioritize multi-strain bioactives. For preservation pioneers, the culture is clear: ferment forward with transparency.