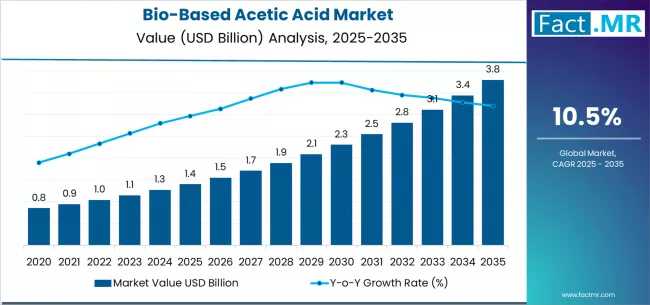

The global bio-based acetic acid market is projected to grow from USD 1.4 billion in 2025 to USD 3.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 10.5%. This surge represents a total market increase of USD 2.4 billion over the next decade, driven by increasing demand for sustainable chemical alternatives and renewable solutions. Between 2025 and 2030, the market is expected to reach USD 2.3 billion, contributing around 37.5% of total growth, while the period from 2030 to 2035 will add another USD 1.5 billion.

Key Growth Drivers

Sustainability is the primary factor propelling market growth. Companies and governments worldwide are prioritizing eco-friendly production processes, reducing reliance on fossil fuels, and meeting carbon reduction targets. Bio-based acetic acid, primarily produced through biomass fermentation, offers a renewable alternative with applications across food, beverage, and industrial sectors.

Technological advancements are also supporting expansion. Innovations in waste-to-chemical conversion, fermentation optimization, and synthetic biology are improving efficiency, reducing costs, and making large-scale production more feasible. This allows manufacturers to meet growing demand while maintaining environmentally responsible practices.

Industrial and Application Demand

The food and beverage sector is the largest consumer, accounting for 42% of the market, driven by bio-based acetic acid’s use in food preservation, flavoring, and processing. Industrial applications, including chemical manufacturing and pharmaceuticals, represent approximately 64% of total consumption in 2025. Biomass fermentation dominates production with around 61% market share, underscoring the increasing reliance on renewable production methods.

Regional Insights

North America is expected to lead growth, with the United States achieving a CAGR of 11.2% due to its strong biotechnology and pharmaceutical sectors. Mexico is forecasted at 10.7% CAGR, leveraging abundant agricultural residues and growing biorefinery infrastructure.

In Europe, Germany leads with 10.3% CAGR, supported by innovation in biotech and chemical manufacturing, followed by France at 10.1% and the United Kingdom at 10.0%. Asian markets, including South Korea and Japan, are projected to grow steadily at 9.8% and 9.6%, respectively, reflecting rising industrial demand for renewable chemicals.

Competitive Landscape

Leading players include LanzaTech, Wacker Chemie, Godavari Biorefineries, Afyren, Zea2, Novozymes, Carbon Recycling International, BP Bioacids, BioChemtex, and Sekab. LanzaTech holds an estimated 13% market share, notable for its waste-to-chemical fermentation technology. Companies are competing on process innovation, microbial engineering, and feedstock flexibility to capture a growing share of the market.

Challenges and Restraints

Despite promising growth, challenges remain. Bio-based acetic acid costs more than petrochemical alternatives, and scaling fermentation processes presents technical difficulties. Additionally, consistent supply of renewable feedstocks, such as agricultural residues, and developing biorefinery infrastructure in certain regions can limit near-term expansion.

Strategic Implications

The market presents opportunities for chemical manufacturers, biotech firms, investors, and policymakers. Strategic investment in technology, process efficiency, and sustainable infrastructure, combined with supportive regulatory policies, will enable stakeholders to capture a growing share of this market. Companies that prioritize innovation and sustainability are best positioned to benefit from this rapidly expanding sector.

Browse Full Report : https://www.factmr.com/report/1189/bio-based-acetic-acid-market

Conclusion

The bio-based acetic acid market is on track for robust growth, expanding from USD 1.4 billion in 2025 to USD 3.8 billion by 2035. Driven by sustainability trends, technological innovation, and rising industrial and consumer demand, bio-based acetic acid is set to play a pivotal role in the transition to renewable and circular chemical solutions. Companies and investors aligned with this market will find significant opportunities for growth in the coming decade.