The global automotive cabin air filter market is projected to grow from USD 5.2 billion in 2025 to USD 9.5 billion by 2035, representing a CAGR of 6.2%, according to Fact.MR. This growth is fueled by heightened awareness of in-vehicle air quality, stricter emission regulations, and rising demand for advanced filtration technologies in electric and hybrid vehicles.

Market Overview

-

Market Size (2025E): USD 5.2 billion

-

Market Size (2035F): USD 9.5 billion

-

Forecast CAGR (2025–2035): 6.2%

-

Key Filter Technologies: HEPA, Activated Carbon, Synthetic, Cellulose

-

Dominant Channels: OEMs, IAM (Independent Aftermarket)

-

Leading Vehicle Segments: Compact Passenger Cars, Off-road Vehicles, Premium and Luxury Passenger Cars

Increasing urban pollution levels and growing health concerns are driving the adoption of cabin air filters worldwide. Passengers are now demanding cleaner in-vehicle air environments, making cabin filters an essential component in modern vehicles.

Market Drivers

-

Health & Air Quality Awareness: Rising consumer consciousness about particulate matter, allergens, and urban pollutants is increasing cabin air filter adoption.

-

Regulatory Pressure: Governments across Europe, North America, and Asia are mandating stricter interior air quality standards and emission regulations.

-

Electric & Hybrid Vehicle Adoption: EVs and hybrids emphasize passenger comfort and clean cabin environments, increasing demand for advanced HEPA and activated carbon filters.

-

Shared Mobility & Ride-Hailing Growth: Fleet operators prioritize air quality maintenance, increasing the frequency of filter replacements and aftermarket sales.

Market Restraints

-

Limited awareness in emerging markets leading to low replacement frequency.

-

Price sensitivity affecting adoption of premium HEPA or activated carbon filters.

-

Supply chain disruptions and raw material cost fluctuations impacting production.

-

Lack of standardization allowing low-quality or counterfeit products to enter the market.

-

EVs with long-lasting filtration systems may reduce aftermarket replacement cycles.

Regional Trends

-

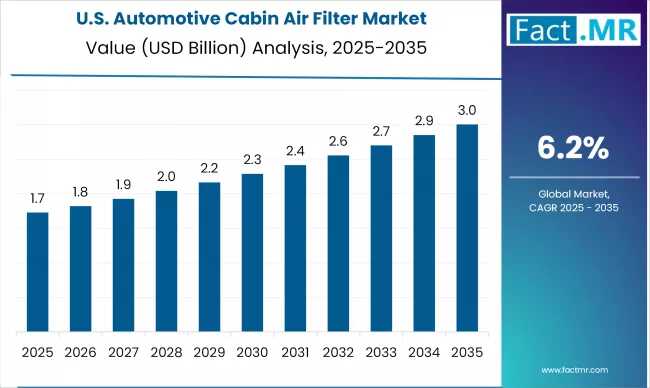

North America: CAGR 5.6%; high consumer awareness, stringent EPA regulations, and adoption of multi-layer filters in mid-to-premium vehicles drive growth.

-

Europe: Regulatory compliance (Euro 6), environmental consciousness, and EV adoption in Germany, France, and the UK support strong market growth.

-

Asia-Pacific: CAGR 7.0% in China; rapid urbanization, air pollution, rising middle-class population, and EV adoption fuel demand. Japan sees high adoption of HEPA and multi-layer activated carbon filters with innovations in nanofiber media and air quality monitoring systems. South Korea follows closely.

-

Latin America & Middle East/Africa: Emerging demand in urban centers with poor air quality; increasing disposable income and health awareness are gradually expanding the market.

Country-Specific Insights

-

USA: OEMs increasingly integrate multi-layer HEPA and activated carbon filters in premium vehicles. Aftermarket replacement cycles are supported by fleet operators and heightened public concern over allergens and urban pollutants.

-

China: Strong growth driven by urban air pollution, regulatory pressure, EV penetration, and ride-hailing fleet adoption. OEMs offer multi-stage carbon filtration systems, while aftermarket platforms provide premium replacement options.

-

Japan: Adoption accelerated by public health focus, stringent environmental regulations, and innovation in nanofiber-based filtration systems. EV adoption shifts attention to cabin air quality, increasing demand for frequent replacement.

Segmental Analysis

By Vehicle Type:

-

Compact Passenger Cars: Dominant segment due to high production volumes, urban prevalence, and frequent maintenance cycles.

-

Off-road Vehicles: Fastest-growing segment driven by exposure to dust, harsh conditions, and infrastructure development in emerging markets.

-

Premium & Luxury Vehicles: Increasing use of HEPA and activated carbon filters for superior passenger comfort.

By Sales Channel:

-

OEMs: Lead the market due to integrated filters meeting strict compliance and warranty-backed reliability.

-

IAM: Fastest-growing channel fueled by aging fleets, DIY maintenance, and e-commerce retailing, particularly in developing regions.

By Filter Medium:

-

Cellulose Filters: Largest revenue share; cost-effective and widely used for conventional vehicles.

-

Synthetic Filters: Fastest-growing segment due to durability, superior filtration efficiency, and suitability for modern vehicles and high-performance applications.

Competitive Landscape

The market is highly competitive with key players focusing on technological innovation, product durability, and performance optimization. Leading companies include:

-

UFI Filters Spa: Extensive OEM partnerships and proprietary filter media.

-

Robert Bosch GmbH: Integrated vehicle systems and aftermarket solutions.

-

Denso Corporation: High-efficiency filtration for passenger and commercial vehicles.

-

Donaldson Company Inc., Mahle Group, SOGEFI SpA, Freudenberg & Co. KG: Investment in multi-layer and sustainable filtration technologies.

-

K&N Engineering Inc.: High-performance reusable aftermarket filters.

-

Mann + Hummel, Champion Laboratories, Cummins, Hengst SE, Mann + Hummel GmbH: Diverse product portfolios targeting multiple vehicle segments.

Recent Innovations

-

MANN+HUMMEL (2024): Launched FreciousPlus FP 38 004, a nanofiber-enhanced cabin filter for BMW 5 & 7 Series, capturing up to 90% of PM1 and 80% of ultrafine particles (<0.1 μm).

-

MANN+HUMMEL (2023): Expanded multi-stage HEPA filters achieving ≥99.95% particle removal, compliant with DIN EN 1822/ISO 29463 standards, designed for EVs and premium vehicles.

Browse Full Report : https://www.factmr.com/report/266/automotive-cabin-air-filter-market

Market Outlook

The Automotive Cabin Air Filter Market is expected to achieve USD 9.5 billion by 2035, driven by urbanization, pollution awareness, regulatory pressure, and rising adoption of EVs and hybrids. Compact cars dominate demand, off-road vehicles offer high growth potential, and OEM channels remain the backbone of market sales. Advances in HEPA, activated carbon, and synthetic filter technologies will shape competitive dynamics, while e-commerce and IAM channels are expected to gain prominence in emerging regions.