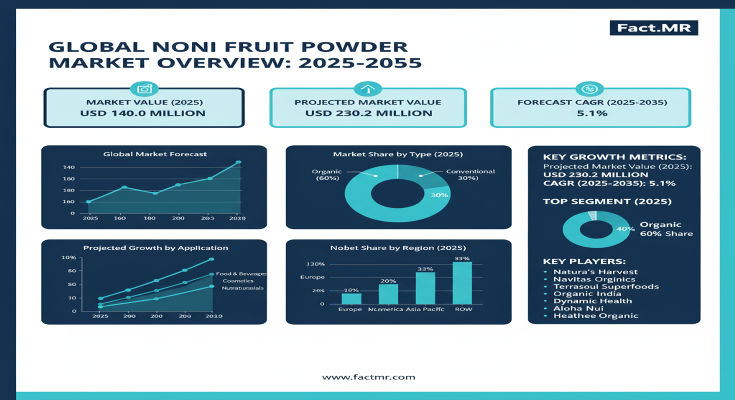

In a world increasingly turning to nature’s bounty for holistic health, the noni fruit powder market is blossoming as a key player in the superfood revolution, delivering potent antioxidants and immune-supporting compounds from the revered Polynesian fruit. According to a comprehensive new report from Fact.MR, the global market, valued at US$ 140.0 million in 2025, is projected to surge to US$ 230.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.1%. This 64.3% total growth—representing an absolute dollar opportunity of US$ 90.0 million—underscores the sector’s vibrant potential, with 46.7% of expansion (US$ 42.0 million) in the first half (2025-2030) and 53.3% (US$ 48.0 million) accelerating thereafter, propelled by escalating demand for plant-based wellness ingredients amid global health awareness.

As consumers embrace noni’s traditional medicinal legacy—rooted in Polynesian healing practices—for modern applications like immune modulation and anti-aging, noni fruit powder is evolving from a niche tropical extract to a staple in functional beverages, supplements, and cosmetics. “The noni fruit powder market is expected to grow by nearly 1.6 times during the forecast period, supported by increasing global interest in traditional medicinal plants and tropical superfruits, With nutraceuticals capturing 44.0% market share in 2025 and spray-dried forms leading at 61.0%, this sector is a golden opportunity for brands blending ancient wisdom with cutting-edge science to meet the clean-label cravings of today’s health-savvy consumers.

Click Here for Sample Report Before Buying: https://www.factmr.com/connectus/sample?flag=S&rep_id=3523

Key Drivers: Superfruit Wellness Boom and Processing Innovations

The market’s steady ascent is propelled by a fusion of cultural revival and technological progress. At the heart is the surging global fascination with tropical superfruits, where noni’s rich profile of xeronine, proxeronine, and antioxidants positions it as a natural powerhouse for immune support, inflammation reduction, and holistic vitality—benefits backed by growing clinical interest in its anti-cancer and anti-diabetic potential. The wellness industry’s expansion, valued at over $4.5 trillion globally, amplifies this, with consumers prioritizing plant-based ingredients that offer multifaceted health perks without synthetic additives.

Innovations in extraction and drying technologies are another catalyst, enabling spray-dried powders that retain 90-95% bioactivity while extending shelf life to 24 months, making noni accessible for mass-market formulations. Regulatory tailwinds, including FDA nods for GRAS status and EU organic certifications, further ease market entry, while e-commerce and direct-to-consumer channels democratize distribution. “Increasing demand for natural wellness ingredients providing immune support and antioxidant benefits” is a primary driver, per Fact.MR, alongside the emphasis on innovative superfruit components that fuse traditional Polynesian uses with modern science. Challenges like seasonal raw material availability and complex processing for quality preservation persist, but sustainable cultivation in regions like Tahiti and investments in green sourcing are turning these into opportunities for premium differentiation.

Segmentation Insights: Nutraceuticals and Spray-Dried Forms Lead

Fact.MR’s granular segmentation spotlights high-growth streams. By application, nutraceuticals hold a commanding 44.0% share in 2025, driven by functional supplements targeting immunity and vitality, projected to generate US$ 101.3 million by 2035 at a 5.1% CAGR. Beverages follow at 30.0%, leveraging noni’s solubility for ready-to-drink health elixirs, while cosmetics (26.0%) surge for anti-aging serums and masks, offering a US$ 59.9 million opportunity.

Form-wise, spray-dried powder dominates with 61.0% share, valued for cost-effectiveness and scalability in blending, outpacing freeze-dried (39.0%) for its superior nutrient retention in high-volume production. Distribution channels emphasize B2B ingredients at 68.0% share, ensuring bulk reliability for manufacturers, while retail (20.0%) and online (12.0%) gain traction for consumer-direct wellness packs.

Regional Dynamics: USA’s Premium Surge Meets Europe’s Steady Climb

North America leads with sophistication, anchored by the USA at a robust 5.8% CAGR, projected to climb from US$ 35.0 million in 2025 to US$ 60.0 million by 2035, fueled by wellness retail expansions in California and New York, where noni-infused supplements see 25-30% annual uptake. Mexico complements at 5.4% CAGR, tapping tropical sourcing synergies.

Europe projects balanced growth, valued at US$ 42.0 million in 2025 and set to reach US$ 68.0 million by 2035 at a 4.9% CAGR. Germany tops with 27.8% regional share (innovating nutraceuticals in Frankfurt), France (24.2% share) advances beverage formulations, the UK (19.8%) emphasizes cosmetics, Italy (13.5%) and Spain (9.5%) focus on Mediterranean wellness fusions, and the rest of Europe (5.2%) gains from Nordic clean-label trends.

Asia-Pacific unlocks explosive potential, with Japan at 4.1% CAGR for precision processing in Tokyo and Osaka, and South Korea at 4.3% leveraging K-beauty integrations. Latin America, Middle East & Africa, and other regions offer untapped blue oceans via emerging superfood imports.

Recent Developments: Formulation Partnerships and Quality Enhancements

The noni powder landscape is ripening with collaboration. In 2024, Tahitian Noni International expanded spray-dried production in Tahiti, achieving 95% bioactivity retention for U.S. nutraceutical partners and boosting exports 20%. Herbalife launched noni-blended immune shots in Europe, aligning with organic standards and capturing 15% shelf share in Germany. Nature’s Way invested in freeze-dried tech in Asia, reducing oxidation by 25% for beverage stability. These initiatives, including blockchain for traceability, signal a 2025 wave of hybrid superfruit powders and AI-optimized drying.

Key Players Insights: Superfruit Specialists Blending Tradition and Tech

A moderately concentrated field of 10-15 players sees leaders like Tahitian Noni (9.0% share) commanding 30-40% through sourcing expertise and innovation:

- Tahitian Noni International: Market frontrunner, dominating nutraceuticals with Polynesian authenticity.

- Herbalife Nutrition Ltd.: Beverage specialist, expanding global retail.

- Nature’s Way Products LLC: Spray-dried innovator for cosmetics.

- Noni BioTech Inc.: Freeze-dried expert for Asia-Pacific.

- Morinda Inc.: Sustainable sourcing leader.

- NutraGreen Biotechnology Co. Ltd.: Chinese exporter for B2B.

- AIDP Inc.: U.S. formulator for supplements.

- Sabinsa Corporation: Bioactive enhancer.

- Xi’an Natural Field Bio-Technique Co. Ltd.: Affordable blends.

- Givaudan Naturex: Premium hybrid developer.

Strategies include M&A for cultivation IP and certifications for organic claims.

Challenges and Opportunities: Supply Constraints vs. Superfruit Synergies

Limited seasonal supply and processing complexities—upping costs 10-15%—challenge scalability, alongside competition from acai and goji.

Yet, opportunities abound: nutraceuticals unlock US$ 101.3 million, spray-dried US$ 140.4 million, and USA US$ 60.0 million. Beverage integrations add US$ 69.1 million—ripe for bold brands.

Browse Full Report: https://www.factmr.com/report/3523/noni-fruit-powder-market

Future Outlook: A $230.2 Million Harvest of Holistic Health

By 2035, Fact.MR envisions noni fruit powder as a US$ 230.2 million staple, with nutraceuticals at 46% share and Asia-Pacific leading. The 5.1% CAGR will prioritize bio-preserved, multi-functional variants. For superfruit strategists, the fruit is clear: powder forward with purity.