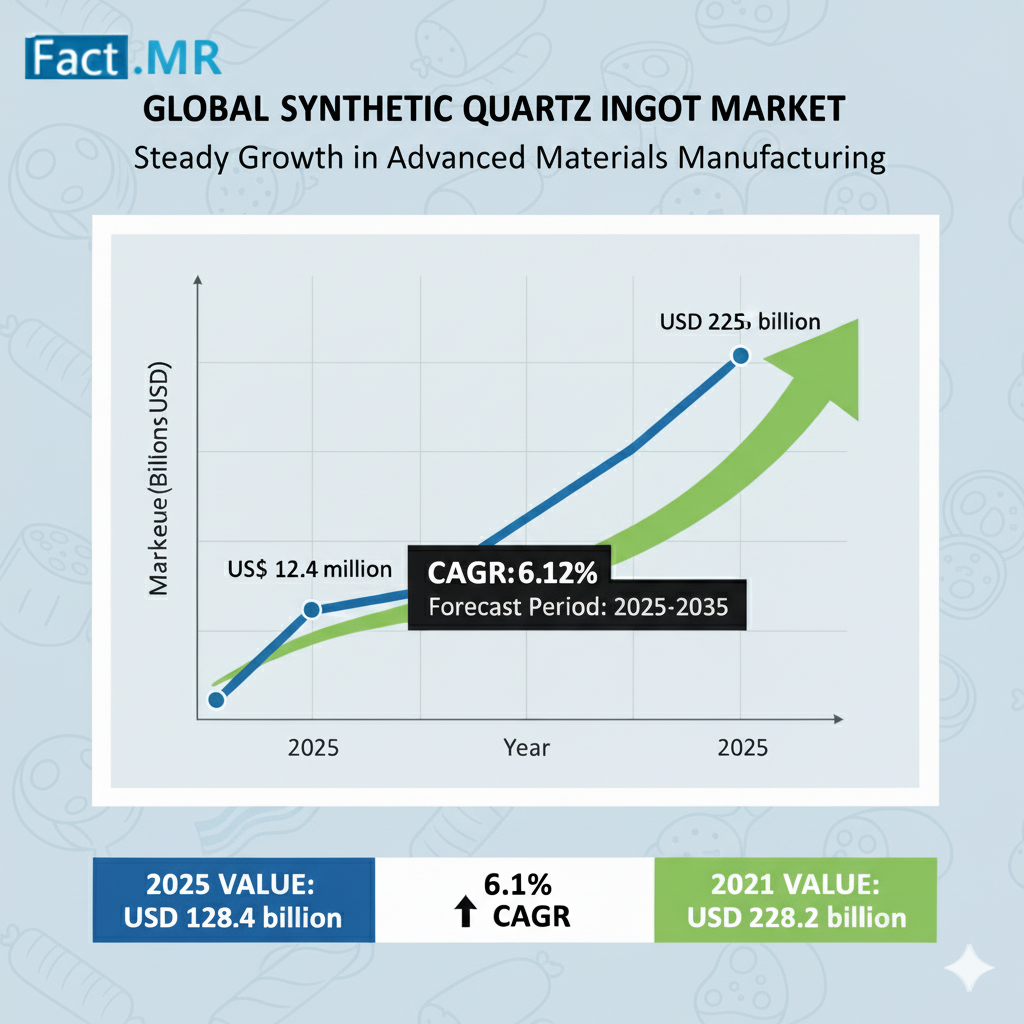

The global synthetic quartz ingot market was valued at US$ 124.4 million in 2025 and expand at a CAGR of 6.1% to end up at US$ 225.6 million by 2035.This trajectory underscores the industry’s vital role in powering the semiconductor, telecommunications, and renewable energy sectors industries at the heart of global digitalization and clean energy transition.

Synthetic quartz ingots, engineered for exceptional purity, uniformity, and precision, have emerged as indispensable materials in the production of semiconductors, optical components, and high-efficiency solar cells. Their superiority over natural quartz in controlling impurities and achieving atomic-level accuracy has made them essential to next-generation manufacturing technologies such as 5G infrastructure, quantum computing, and high-performance electronics.

Rising Demand from Semiconductor and Electronics Sectors:

The synthetic quartz ingot market’s growth is tightly bound to the semiconductor industry’s expansion, driven by the global push for advanced computing, AI integration, and IoT ecosystems. The segment accounts for 45.7% of global demand, representing a market value of US$ 56.8 million in 2025.

As chip architectures become increasingly complex, semiconductor manufacturers require ultra-pure quartz materials that ensure minimal contamination during wafer fabrication. These materials enable higher yields, improved reliability, and the production of smaller, more powerful devices.

According to Fact.MR analysts, technological shifts in semiconductor production and the ongoing establishment of domestic chip fabrication plants in the U.S., China, and Japan are further propelling demand for synthetic quartz ingots.

– United States, the market is expected to expand at a 6.5% CAGR, bolstered by the CHIPS Act and increased investments in semiconductor self-sufficiency.

– China, aiming for technological independence, is forecasted to record the highest CAGR at 6.9%, driven by massive infrastructure development in electronics and quantum technologies.

– Japan and East Asia collectively remain strongholds for manufacturing excellence, registering a regional growth rate of 6.6% CAGR between 2025 and 2035.

Medium-Sized Ingots Lead Market Momentum:

Among product types, the 200–500 mm synthetic quartz ingot segment continues to dominate, generating an estimated US$ 60.8 million in 2025 and creating an absolute dollar opportunity of US$ 46.4 million by 2035.

These ingots strike the perfect balance between processing efficiency and precision, making them ideal for semiconductor wafer fabrication and high-end electronics production. The demand from 5G infrastructure development and optoelectronics manufacturing has reinforced their importance, with many manufacturers optimizing production to serve this rapidly growing segment.

Solar Energy Revolution Boosting Market Expansion:

The global transition to renewable energy has opened new avenues for synthetic quartz ingot applications. High-purity quartz components are critical in the production of advanced solar cells capable of achieving greater energy conversion efficiencies.

As government incentives accelerate solar adoption worldwide, leading manufacturers are scaling production capacity to meet the booming demand for precision-engineered materials. This intersection of clean energy technology and high-purity materials science has positioned synthetic quartz ingot manufacturers as essential contributors to global sustainability initiatives.

Industry Dynamics: Balancing Innovation, Cost, and Sustainability:

While opportunities abound, market players face increasing competitive pressures as regional manufacturers challenge established leaders through innovation and price competitiveness. Companies must balance cost optimization, product performance, and sustainability to secure their market positions.

Fact.MR’s data indicates that green manufacturing and energy-efficient production processes are becoming decisive factors in procurement decisions, with customers increasingly prioritizing environmentally responsible suppliers.

Leading companies such as Asahi Glass Co., Ltd.; Heraeus Holding; Shin-Etsu Chemical Co., Ltd.; Momentive; Nihon Dempa Kogyo Co., Ltd.; and QSIL AG are responding by integrating automation, waste reduction systems, and eco-friendly manufacturing lines into their operations.

– In March 2024, Shin-Etsu Chemical Co., Ltd. expanded its synthetic quartz production facility in Japan, increasing capacity by 30% to meet growing semiconductor industry demand.

– In November 2023, Momentive unveiled a specialized line of synthetic quartz ingots tailored for quantum computing applications, the result of collaboration with leading research institutions and quantum technology firms.

These strategic initiatives underscore how market leaders are not only scaling production but also pioneering innovation to capture emerging high-value applications.

Future Outlook: Emerging Technologies and Regional Opportunities:

Over the next decade, the synthetic quartz ingot industry will evolve in three distinct phases:

– Short Term (2024–2027): Heightened competition and focus on automation, with strategic alliances between manufacturers and semiconductor producers.

– Medium Term (2027–2030): Product customization and R&D-driven differentiation, with companies investing in sustainable and recyclable material production.

– Long Term (2030–2035): Market transformation through integration into quantum computing, aerospace, and advanced photonics, supported by innovations in crystal growth and large-format ingot fabrication.

North America, East Asia, and Western Europe will remain critical hubs for innovation and consumption, while emerging economies in South Asia and the Middle East are expected to strengthen their roles as manufacturing bases and supply chain partners.

Industry Leaders’ Call to Action:

The synthetic quartz ingot market’s acceleration signals a pivotal moment for manufacturers and technology companies. As industries like semiconductors, solar energy, and quantum computing demand ever-higher material performance, collaboration across the value chain will be essential.

Executives across the materials science and electronics sectors are encouraged to invest in advanced R&D, sustainable production systems, and regional capacity expansion to stay ahead of the curve.

“Synthetic quartz ingot manufacturing is no longer a niche materials segment—it’s becoming a cornerstone of global technological progress,” said a Fact.MR senior analyst. “Manufacturers who align innovation with sustainability will define the next decade of market leadership.”

Browse Full Report-https://www.factmr.com/report/synthetic-quartz-ingot-market