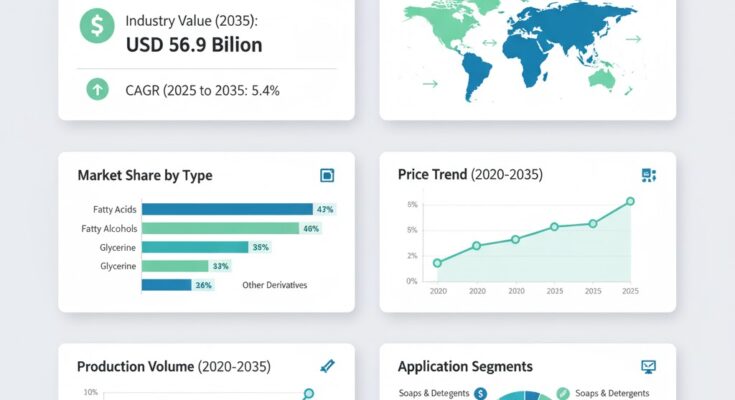

The global oleochemicals market is witnessing robust growth as industries accelerate the shift toward sustainable, bio-based alternatives to petrochemical-derived products. According to a recent report by Fact.MR, the market is poised to reach USD 33.6 billion in 2025 and is projected to grow at a CAGR of 5.4% from 2025 to 2035, achieving a valuation of approximately USD 56.9 billion by 2035.

As industries increasingly embrace eco-friendly chemical solutions, oleochemicals derived primarily from natural fats and oils are emerging as vital building blocks for personal care, pharmaceuticals, food additives, and industrial manufacturing sectors.

Strategic Market Drivers

- Rising Demand for Sustainable and Bio-based Ingredients

The global movement toward sustainability and carbon neutrality has significantly fueled demand for oleochemicals as renewable substitutes for traditional petrochemicals.

Manufacturers across cosmetics, detergents, and lubricants sectors are leveraging fatty acids, fatty alcohols, and glycerol to create biodegradable and non-toxic products. The growing consumer preference for “green chemistry” formulations is reshaping global supply chains, promoting circular economy models, and spurring investments in bio-refinery technologies.

- Expanding Applications Across Industrial and Consumer Sectors

Oleochemicals have become indispensable in numerous applications—from surfactants and lubricants to pharmaceutical excipients and food emulsifiers.

In the personal care industry, fatty alcohols and esters derived from oleochemicals are widely used in skin care, hair care, and cosmetic formulations.

Meanwhile, industrial applications such as bioplastics, paints, coatings, and metalworking fluids are driving consistent consumption growth as manufacturers transition to environmentally responsible raw materials.

- Government Support and Regulatory Push for Green Alternatives

Supportive policies and sustainability mandates across the U.S., European Union, and Asia-Pacific are reinforcing market momentum.

Governments are offering incentives for renewable raw material use and imposing stricter emission norms on petrochemical-based products. This regulatory environment has spurred investments in oleochemical production infrastructure and advanced catalytic conversion technologies, particularly in Indonesia, Malaysia, and India.

Regional Growth Highlights

Asia Pacific: The Global Production Powerhouse

Asia Pacific remains the largest producer and consumer of oleochemicals, driven by abundant feedstock availability (palm and coconut oil), cost advantages, and rising domestic demand.

Countries like Malaysia, Indonesia, China, and India lead the region’s dominance, with strong support from government initiatives promoting renewable and circular economies. The expansion of palm-based derivative facilities continues to reinforce the region’s export potential.

Europe: Regulation-led Growth and Innovation

Europe’s oleochemicals market is thriving under stringent environmental regulations and rising consumer awareness about sustainable products.

Germany, France, and the Netherlands are at the forefront of innovation, emphasizing green chemistry, bio-lubricants, and eco-friendly surfactants. European manufacturers are integrating advanced biotechnological processes to enhance efficiency and reduce the carbon footprint of oleochemical production.

North America: Technological Advancement and Bio-based Investments

The U.S. market is witnessing growing adoption of oleochemicals in personal care, pharmaceuticals, and biodiesel production.

Major players are investing in next-generation bio-refineries and partnering with agricultural producers to secure sustainable raw material supplies. The shift toward plant-derived polymers and specialty esters is expected to further accelerate regional growth.

Emerging Economies: Industrialization and Feedstock Advantage

Latin America, the Middle East, and Africa are gradually establishing themselves as emerging markets for oleochemicals, supported by rising industrial manufacturing, urbanization, and agriculture-based economies. Increasing focus on local processing and value addition to vegetable oils is expected to stimulate market participation in these regions.

Market Segmentation Insights

By Product Type:

- Fatty Acids: Widely used in soaps, detergents, and food products.

- Fatty Alcohols: Increasing demand in surfactants and personal care products.

- Glycerol: Utilized across pharmaceuticals, food, and cosmetics industries.

- Methyl Esters: Expanding usage in biodiesel and lubricants.

By Application:

- Personal Care & Cosmetics

- Food & Beverages

- Pharmaceuticals

- Industrial Manufacturing

- Soaps & Detergents

- Biodiesel Production

Challenges and Market Considerations

Despite strong growth prospects, the oleochemicals industry faces notable challenges:

- Feedstock Supply Risks: Fluctuating palm and coconut oil prices impact production economics.

- Deforestation and Sustainability Concerns: Environmental scrutiny around palm oil cultivation may affect raw material sourcing.

- Competition from Petrochemical Counterparts: Although oleochemicals are eco-friendly, cost competitiveness remains a challenge.

- Technological Barriers: Advanced catalytic processes and purification technologies require significant capital investment.

Competitive Landscape

The global oleochemicals market is characterized by strong competition and innovation, with major players focusing on sustainable sourcing, bio-based product development, and strategic collaborations to enhance global reach.

Key Companies Profiled:

- Emery Oleochemicals

- BASF SE

- Wilmar International

- DuPont

- Solvay

- Musim Mas Group

- Croda International

- IOI Group

- Cargill Inc.

- Evonik Industries

- P&G Chemicals

- Kao Corporation

- Clariant

- Oxiteno

- Oleon

- Apical Group

- ADM (Archer Daniels Midland)

- Vantage Specialty Chemicals

- IOI Oleochemicals

These players are investing heavily in green chemistry R&D, carbon-neutral production methods, and biodegradable oleochemical derivatives to meet evolving global standards.

Recent Developments

- June 2023 – Wilmar International announced capacity expansion in its Malaysian oleochemical facility to strengthen exports across Europe and the U.S.

- May 2023 – Croda International launched bio-based surfactants under its “ECO Range,” reducing carbon emissions by up to 60%.

- March 2022 – BASF introduced its new series of sustainable fatty alcohols derived from certified palm oil for use in detergents and cosmetics.

Future Outlook: The Bio-based Transformation Ahead

The coming decade will redefine the oleochemicals industry, with sustainability, biotechnology, and digital process optimization at its core.

Manufacturers are expected to integrate AI-based process control, carbon capture technologies, and waste-to-value initiatives to enhance yield and reduce environmental impact.

With global industries transitioning toward renewable chemical solutions, the oleochemicals market stands at the forefront of the bioeconomy revolution—poised for consistent and sustainable growth through 2035.