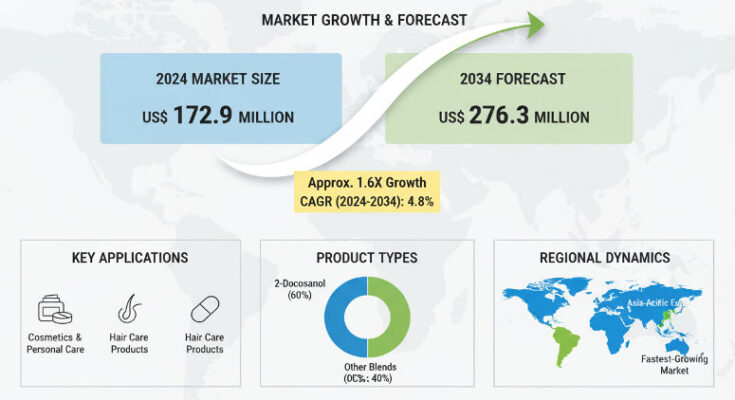

With formulation precision becoming ever more critical in cosmetics, pharmaceuticals, and nutritional supplements, behenyl alcohol stands out as a versatile ingredient. Known also as docosanol, this 22-carbon fatty alcohol delivers thickening, emollient, stabilizing, and emulsifying functions, helping manufacturers improve texture, stability, and skin feel. Recent market estimates place the behenyl alcohol market at about US$ 172.9 million in 2024, with forecasts suggesting growth to approximately US$ 276.3 million by 2034, at a CAGR of around 4.8%. This trajectory reflects steady demand and rising premiumization rather than explosive disruption—but it is nevertheless compelling.

Key Growth Drivers

Several forces are driving Behenyl Alcohol Market Growth:

-

Natural and Clean-Label Demand: Consumers increasingly prefer naturally derived and gentle ingredients. Behenyl alcohol, when sourced from plant-based oils or via bio-friendly synthesis, meets rising expectations for sustainability and skin compatibility.

-

Cosmetics & Personal Care Priority: Skincare, hair care, and personal hygiene brands are leveraging behenyl alcohol in formulations to improve creaminess, reduce tackiness, stabilize emulsions, and enhance moisturizing properties. Anti-wrinkle, anti-aging, and sensitive skin lines are particular hotspots.

-

Pharmaceutical & Nutraceutical Applications: Beyond cosmetics, formative use in pharmaceutical formulations and nutritional supplements (as an excipient, texture enhancer, or stabilizer) is expanding. Its antiviral properties in certain formulations add further appeal.

-

Innovation in Formulation & Emollience: New product developments—hypoallergenic creams, luxurious body butters, conditioners—place heavy emphasis on sensory feel. Behenyl alcohol helps deliver improved slip, non-greasy touch, and consistency, which strengthens brand differentiation.

Segment Insights & Market Share Dynamics

Breaking down by function:

-

Emollients and emulsifiers are the two leading application segments. Emollient uses (in skincare, hair care) are expected to generate over US$ 80 million of value by 2034; emulsifier uses similarly projected near US$ 80–81 million. These segments collectively dominate the market.

-

By end-use, cosmetics and personal care remain largest, with pharmaceuticals and nutritional supplements following. The proportion going into pharmaceuticals is growing, thanks to increased research into skin care therapeutics and antiviral topical products.

-

Purity and grade matter: higher-purity grades command premium rates, especially for applications in high-end cosmetics and pharmaceutical formulations.

Regional Insights: United States & Europe

United States:

The U.S. is a significant market in 2024, accounting for roughly US$ 22.6 million of global value. Growth is projected at about 5.7% CAGR through 2034, with a forecasted value of approximately US$ 39.2 million by then. The U.S. demand is driven by cosmetic innovation, stricter regulation on ingredient safety, and growing consumer awareness of clean-beauty trends. Leading brands are investing in products that use behenyl alcohol to improve feel, reduce irritancy, and enhance texture.

Europe:

In Europe, growth is steady though somewhat more moderated by regulatory oversight and high expectations for environmental and safety performance. Countries such as Germany, France, UK, Italy and the Nordics show strong demand for both performance and “ethical” attributes. European consumers often expect not just product efficacy but also clean sourcing, sustainability, and minimal environmental footprint. Regulatory compliance and ingredient transparency are significant competitive differentiators among regional manufacturers.

Challenges & Restraints

The market is not without its headwinds:

-

Alternative Ingredients & Substitutes: Some well-known fatty alcohols (such as stearyl alcohol) or synthetic/emollient substitutes may compete on cost or functional equivalence, pressuring behenyl alcohol’s premium positioning.

-

Cost of High-Purity Grades: Meeting stringent contamination thresholds, purity, and regulatory compliance drives up production cost. Brands targeting pharmaceuticals or sensitive skin lines are especially sensitive to cost-vs-benefit trade-offs.

-

Raw-Material Supply & Sustainability: Plant-derived sources, bio-based feedstocks, and supply chain stability are increasingly important. Any volatility (in feedstock availability or regulations) can ripple through costs.

-

Performance Perceptions: While behenyl alcohol performs well in certain textural and sensory roles, in some harsh environments (very high or low temperature, frequent washing) its performance vs alternative stabilizers or fatty alcohols may be questioned.

Outlook & Forecast

Projections show market size doubling over the coming decade from 2024 to 2034 in many estimates. A value of about US$ 276.3 million by 2034 is seen in leading forecasts. Key opportunities lie in:

-

Premium cosmetics & personal care: As consumer expectations evolve, premium textures and natural claims will favor ingredients like behenyl alcohol.

-

Natural and plant-based sourcing: Suppliers who can ensure traceability, sustainability, and low environmental impact will have strong competitive edge.

-

Growth in pharmaceutical, prescription skincare, and high-end sun care: Applications where both safety and texture are critical will drive incremental value.

-

Regional expansion: Asia-Pacific and Latin America hold strong upside, due to growing middle classes, expanding cosmetics industries, and increasing regulatory convergence with safety standards.

Browse Full Report: https://www.factmr.com/report/behenyl-alcohol-market

Strategic Imperatives for Players

From an editorial perspective, companies in this market should aim to:

-

Innovate on purity & grade: Developing ultra-high purity behenyl alcohol with certifiable low contaminant profiles can open up higher-value pharmaceutical and premium cosmetics segments.

-

Optimize supply chains for sustainability: Sourcing renewable raw materials and ensuring sustainable manufacturing will increasingly be table stakes rather than luxuries.

-

Differentiate via sensory experience: Brands that leverage behenyl alcohol to create exceptional texture, feel, spreadability in products will stand out—sensory appeal remains a strong purchase driver.

-

Regulatory & certification focus: Certifications (organic, vegan, clean beauty, cruelty-free), allergen safety, and transparent manufacturing will be decisive in markets such as the U.S. and Europe.