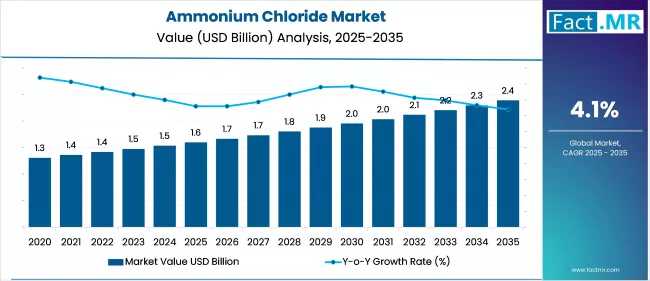

The global ammonium chloride market is set for steady growth over the next decade, expanding from USD 1.6 billion in 2025 to USD 2.4 billion by 2035 at a compound annual growth rate (CAGR) of 4.1%, according to Future Market Insights (FMI). Rising demand for nitrogen-rich fertilizers, particularly across Asia, combined with innovations in pharmaceutical and industrial applications, is driving this expansion.

A Decade of Agricultural and Industrial Growth

Ammonium chloride serves as a vital nitrogen source in fertilizers, enhancing soil fertility and boosting crop yields. With the global population projected to reach 9.8 billion by 2050, pressure on agricultural productivity is intensifying. Governments in India, China, and Nigeria are investing in fertilizer infrastructure and precision agriculture initiatives, which maximize ammonium chloride efficiency and optimize nutrient application.

Beyond fertilizers, ammonium chloride’s versatility spans pharmaceuticals, textiles, metalworking, and food processing. In pharmaceuticals, it is an active ingredient in expectorants and intravenous solutions, while in textiles and metalwork, it functions as a flux and pH regulator. Livestock feed applications are also expanding, supplementing essential nutrients to meet rising demand for meat and dairy products.

Regional Market Trends

-

North America: Demand remains robust in agriculture, metal treatment, and industrial applications. Sustainable farming practices and advanced production methods are shaping market trends.

-

Europe: Environmental and safety regulations drive clean production technologies. Germany, France, and the Netherlands are focusing on sustainable textile, pharmaceutical, and metalworking applications.

-

Asia-Pacific: China, India, and Japan dominate production, with strong agricultural demand fueling market expansion. Investments in infrastructure and manufacturing sustainability support growth. China also exports surplus ammonium chloride to Southeast Asia, Africa, and Latin America.

-

LAMEA: Agricultural development and industrial diversification create growth potential, though economic and infrastructure challenges moderate pace.

Market Challenges and Restraints

The ammonium chloride market faces competition from alternative fertilizers such as urea and ammonium sulfate. Price volatility of key raw materials — ammonia and hydrochloric acid — impacts production costs. Environmental concerns, strict EU regulations, and health risks in industrial handling require higher compliance costs, affecting overall profitability.

Country-Specific Insights

-

Germany: Industrial applications in metalworking, pharmaceuticals, and specialty chemicals drive demand. Strict adherence to REACH regulations promotes cleaner technologies and higher purity standards.

-

China: Leading global producer and consumer, primarily for fertilizers on alkaline soils. Production as a soda ash byproduct enhances cost efficiency. Environmental policies like the “Blue Sky” initiative encourage cleaner, sustainable production.

-

France: Focused on specialized fertilizer applications for crops like wheat, barley, and sugar beet. Sustainable manufacturing and green chemistry trends guide industrial usage.

Segment Analysis

-

By Grade: Industrial grade dominates due to high-purity requirements in metalworking and chemical manufacturing. Food-grade ammonium chloride is the fastest-growing segment, driven by pharmaceutical and food applications.

-

By Application: Fertilizers lead globally, followed by fast-growing metalworking applications. Pharmaceuticals, food additives, textiles, leather, and batteries are emerging segments.

Competitive Landscape

Major players include Zaclon LLC, BASF SE, Liuzhou Chemical, GFS Chemicals, The Chemical Company, Dallas Group, Central Glass, Tuticorin Alkali, Tinco, Hubei Yihua, and Jinshan Chemical. Market strategies focus on capacity expansion, strategic partnerships, cost-efficient production, and innovation in high-purity and sustainable solutions.

Recent Developments

-

March 2024: Actylis and Novo Nordisk Pharmatech A/S partnered to distribute pharmaceutical-grade Benzalkonium Chloride (BKC) across Europe.

-

January 2024: Southern Petrochemical Industries Corporation (SPIC) Ltd announced a ₹1,900 crore investment to expand production capacity and diversify operations.

Browse Full Report : https://www.factmr.com/report/947/ammonium-chloride-market

Outlook: Driving the Future of Ammonium Chloride

Over the next decade, the ammonium chloride market will be shaped by agricultural demands, industrial diversification, and sustainability trends. Emerging applications in precision agriculture, clean manufacturing, and high-purity pharmaceuticals will create new revenue streams. Companies adopting advanced production technologies, regulatory compliance, and innovation-driven strategies are poised to capture market leadership.

Key Market Metrics at a Glance

| Metric | Global Estimate |

|---|---|

| Market Value (2025) | USD 1.6 billion |

| Forecast Value (2035) | USD 2.4 billion |

| CAGR (2025–2035) | 4.1% |

| Leading Application | Fertilizers |

| Fastest-Growing Application | Metalworking |

| Dominant Grade | Industrial |

| Fastest-Growing Grade | Food Grade |