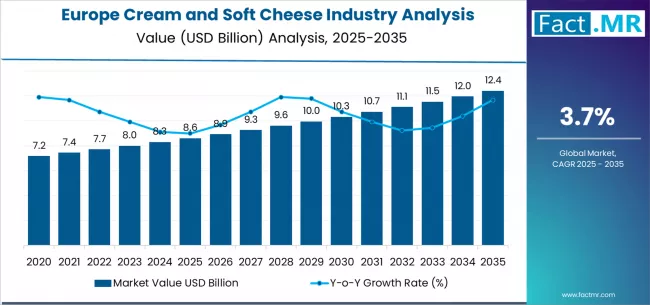

The European cream and soft cheese industry is entering a dynamic growth phase, propelled by evolving consumer preferences, product innovation, and expanding applications across foodservice and retail sectors. According to a recent report by Fact.MR, the demand for cream and soft cheese in Europe is projected to grow from USD 8.6 billion in 2025 to approximately USD 12.4 billion by 2035, recording an absolute increase of USD 3.8 billion over the forecast period. This translates into a total growth of 44.2%, with demand forecast to expand at a CAGR of 3.7% between 2025 and 2035.

As consumers increasingly prioritize taste, convenience, and nutrition, cream and soft cheese varieties such as mascarpone, ricotta, brie, and cream cheese have become essential components in modern European diets — influencing both household consumption and professional culinary practices.

Strategic Market Drivers

- Premiumization and Product Innovation:

The growing preference for premium and artisanal dairy products is redefining the European cheese market. Manufacturers are investing in novel formulations that incorporate organic ingredients, functional additives (like probiotics), and sustainable sourcing practices.

Innovation in flavor profiles — from herb-infused to low-fat variants — is expanding consumer choices and driving value-added sales, particularly in Western Europe. - Expansion of the Foodservice and Bakery Sectors:

Europe’s booming café, patisserie, and restaurant culture continues to amplify cream and soft cheese consumption. These products are key ingredients in desserts, pastries, sauces, and savory spreads.

Countries such as France, Italy, and Germany are leading this demand surge, supported by strong growth in premium bakery chains and quick-service restaurants. The rise of European-style cafés globally is also boosting export potential. - Growing Health and Nutritional Awareness:

Consumers are increasingly seeking products rich in protein and calcium while reducing sugar and artificial additives. This has led to a resurgence in naturally cultured and low-sodium cheese varieties. The trend toward “clean-label” dairy offerings aligns with Europe’s broader focus on health-conscious eating and sustainability-driven consumption. - Sustainability and Circular Dairy Production:

European dairy producers are embracing carbon-neutral manufacturing, recyclable packaging, and circular farming models. As environmental regulations tighten across the EU, dairy cooperatives and major players are investing in renewable energy, waste reduction, and regenerative agriculture to maintain competitiveness and trust among eco-aware consumers.

Browse Full Report: https://www.factmr.com/report/europe-cream-and-soft-cheese-industry-analysis

Regional Growth Highlights

Western Europe – The Dairy Innovation Hub:

France, Germany, and Italy remain the dominant markets, fueled by centuries-old cheese-making traditions, robust domestic consumption, and strong retail penetration. France’s leadership in premium soft cheese, such as camembert and brie, underscores its position as a global taste trendsetter.

Northern Europe – The Sustainable Growth Frontier:

Scandinavian countries are pioneering sustainable dairy production. Denmark and the Netherlands have emerged as innovation centers, focusing on reduced-carbon dairy chains and plant-blend cheese alternatives.

Eastern and Southern Europe – Rising Consumption and Export Momentum:

Countries like Poland, Greece, and Spain are witnessing growing local production and rising per-capita cheese consumption. Expanding middle-class populations and increased participation in EU export trade agreements are supporting regional market acceleration.

Market Segmentation Insights

By Product Type:

- Cream Cheese: Widely used in bakery, spreads, and ready-to-eat applications.

- Soft Cheese (Brie, Camembert, Ricotta, Mascarpone): Dominates gourmet and premium segments, supported by artisanal production.

By Distribution Channel:

- Retail (Supermarkets, Hypermarkets, and Specialty Stores) – Accounts for the largest share, boosted by private label offerings.

- Foodservice (Restaurants, Cafés, and Bakeries) – Fastest-growing segment due to culinary innovation and menu diversification.

By Country:

- France, Germany, Italy, U.K., Netherlands, Denmark, Spain, and Poland represent the top regional markets driving revenue growth.

Challenges and Market Considerations

Despite robust expansion, the European cream and soft cheese industry faces several headwinds:

- Fluctuating Milk Prices – Impacting production margins and pricing strategies.

- Stringent EU Regulations – Food safety and labeling standards require continuous compliance investments.

- Competition from Plant-Based Alternatives – Vegan cheese substitutes are capturing health-conscious segments.

- Supply Chain Volatility – Energy costs and logistics disruptions continue to challenge small-scale producers.

Competitive Landscape

The European cream and soft cheese market is highly competitive, characterized by strong brand portfolios, regional diversification, and continuous product innovation.

Key players include:

- Philadelphia (Mondelez International)

- Lactalis Group

- Arla Foods amba

- Royal FrieslandCampina N.V.

- Danone S.A.

- Kerry Group plc

- Bel Group S.A.

- Savencia Fromage & Dairy

- Müller Group GmbH

- Galbani (Lactalis Group)

These companies are focusing on expanding sustainable production lines, introducing low-fat and plant-blend variants, and leveraging digital marketing to enhance brand loyalty and visibility.

Future Outlook: Toward Taste, Health, and Sustainability

Over the next decade, Europe’s cream and soft cheese industry will continue evolving at the intersection of culinary innovation, health awareness, and environmental responsibility.

Manufacturers that embrace traceable sourcing, functional nutrition, and circular dairy systems will be best positioned to lead the market transformation.

With the region’s deep-rooted dairy heritage and expanding export potential, Europe is set to remain the global epicenter of premium and sustainable cream and soft cheese innovation through 2035.