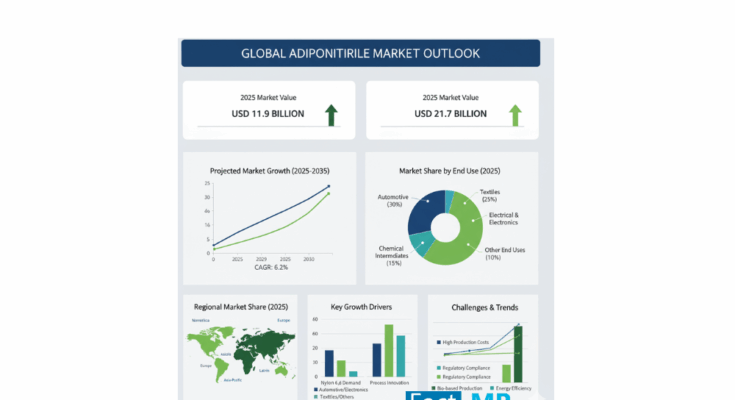

The global adiponitrile market is poised for robust growth, with forecasts indicating a rise from USD 11.9 billion in 2025 to USD 21.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2%. The market expansion is primarily fueled by the growing demand for nylon 6,6, a key derivative of adiponitrile, which is widely used in the automotive, electronics, textile, and consumer goods industries due to its strength, heat resistance, and durability.

Adiponitrile Market Growth Drivers

Technological advancements in adiponitrile production are driving market growth by improving yields and reducing costs. Catalytic process innovations and energy-efficient manufacturing techniques enable companies to scale production while maintaining profitability. Such advancements are critical for meeting the increasing demand for high-performance materials in electric vehicles (EVs), aerospace components, and industrial applications.

The electronics industry has emerged as a major consumer of adiponitrile-derived nylon 6,6. The polymer is used extensively in connectors, switch housings, and insulating components due to its electrical insulation properties and thermal resistance. Companies such as BASF have expanded production capacity in Asia to meet rising demand for electronics, smartphones, appliances, and EVs. As devices become smaller and more sophisticated, the role of adiponitrile in high-performance electronics is set to strengthen.

In the automotive sector, the shift towards lightweight, high-strength materials is accelerating, particularly in electric and hybrid vehicles. Nylon 6,6 derived from adiponitrile is increasingly used for engine components, battery housings, and interior assemblies, helping manufacturers achieve energy efficiency and enhanced durability.

The textile industry is another key driver, with nylon 6,6 fibers in high-performance fabrics and industrial applications. Growth in the global fashion and industrial textiles sectors, particularly in emerging regions, is expected to significantly boost adiponitrile demand over the next decade.

Adiponitrile Market Regional Market Trends

-

North America leads the market due to its established chemical industry, large-scale manufacturing, and adoption of nylon 6,6 in automotive and industrial applications. Investments in sustainable manufacturing and digitalization of chemical processes are enhancing production efficiency while minimizing environmental impact.

-

Europe maintains significant demand for high-performance polymers, driven by regulatory incentives for eco-friendly materials. Countries such as Germany, France, and Italy are promoting the adoption of adiponitrile-based solutions in automotive and industrial applications.

-

Asia Pacific is expected to record the fastest growth, with China, Japan, South Korea, and India expanding adiponitrile production due to rapid industrialization, urbanization, and infrastructure development. In China, vertical integration and government support for bio-based adiponitrile are boosting domestic supply and reducing dependence on imports.

-

Latin America is witnessing growing demand, particularly in Brazil and Mexico, driven by automotive manufacturing and textile production. The transition to EVs and high-performance nylon components is expected to further accelerate growth.

-

Middle East & Africa (MEA) are emerging as high-growth regions, fueled by investments in oil & gas infrastructure, power generation, and sustainable energy projects. MEA’s focus on carbon capture, emissions reduction, and sustainable industrial development is creating new market opportunities.

Adiponitrile Market Challenges and Market Restraints

Despite strong demand, the adiponitrile market faces several challenges:

-

High Production Costs: Complex catalytic processes and energy-intensive manufacturing increase costs, particularly in regions with stringent environmental regulations.

-

Regulatory Compliance: Companies must invest in systems and procedures to meet EU REACH, EPA, and OSHA standards, raising operational expenses.

-

Price Volatility: Raw material and energy price fluctuations create uncertainty, particularly in emerging economies where competitive pricing pressures exist.

-

Technology Barriers: Proprietary production methods, including butadiene-based synthesis, limit market entry and slow capacity expansion. Safety and licensing considerations further restrict new entrants.

Adiponitrile Market Country-Wise Insights

-

United States: The market is supported by investments in sustainable adiponitrile production, renewable feedstocks, and digitalization of chemical processes. Collaborations between industry leaders and national research institutions are developing specialty nylon 6,6 variants for aerospace, defense, and medical applications, enhancing high-margin opportunities. The Gulf Coast’s chemical infrastructure and integrated parks facilitate cost-effective production and global exports.

-

China: Rapid industrialization and a focus on energy-efficient, green manufacturing are boosting adiponitrile demand. Production zones like the Yangtze River Delta offer integrated operations, reducing unit costs by up to 15%. The “Dual Carbon” program is encouraging companies to adopt low-emission technologies, creating a more sustainable and competitive market.

-

Japan: Japan emphasizes high-quality, sustainable production. Advanced catalytic processes, device miniaturization, and eco-friendly product development are driving demand for nylon 6,6 in automotive, electronics, and industrial applications. Strict regulatory frameworks further stimulate innovation in low-impact manufacturing technologies.

Adiponitrile Market Segment Insights

-

By Application: Nylon 6,6 synthesis is the primary driver of adiponitrile demand. The electrolyte solutions segment is expanding rapidly due to its use in lithium-ion batteries for electric vehicles and advanced energy storage systems.

-

By End Use: Automotive leads demand, followed by textiles, electrical & electronics, and chemical intermediates. Increased adoption of high-performance plastics in critical components is strengthening market growth.

-

By Region: North America holds a strong position, while Asia Pacific is the fastest-growing market, driven by industrialization, automotive production, and infrastructure projects.

Adiponitrile Market Competitive Landscape

The market is dominated by major players such as Ascend Performance Materials, INVISTA, Thermo Fisher Scientific, Asahi Kasei Corp, Merck, Acros Orhanixs BVBA, Alfa Aesar, Spectrum Chemical, and Vizag Chemical International. Companies compete through proprietary technologies, integrated supply chains, capacity expansions, and strategic partnerships. Rising raw material costs and environmental regulations are pushing firms to innovate and differentiate their offerings, further intensifying competition.

Adiponitrile Market Recent Developments

-

Mitsubishi Heavy Industries (2025): Nissay Positive Impact Finance agreement to address climate change and societal challenges.

-

Siemens AG & Boson Energy (2024): MoU to convert non-recyclable waste into renewable energy for EV infrastructure.

-

Ingersoll Rand (2024): Acquisition of ILC Dover to expand presence in life sciences and high-performance materials.

Outlook

With sustained growth in automotive, electronics, textiles, and energy storage applications, the global adiponitrile market is projected to achieve strong, innovation-driven expansion between 2025 and 2035. Companies focusing on sustainable production, high-performance solutions, and application-specific innovations are poised to gain strategic advantages, positioning themselves as leaders in this rapidly evolving chemical sector.

Browse Full Report: