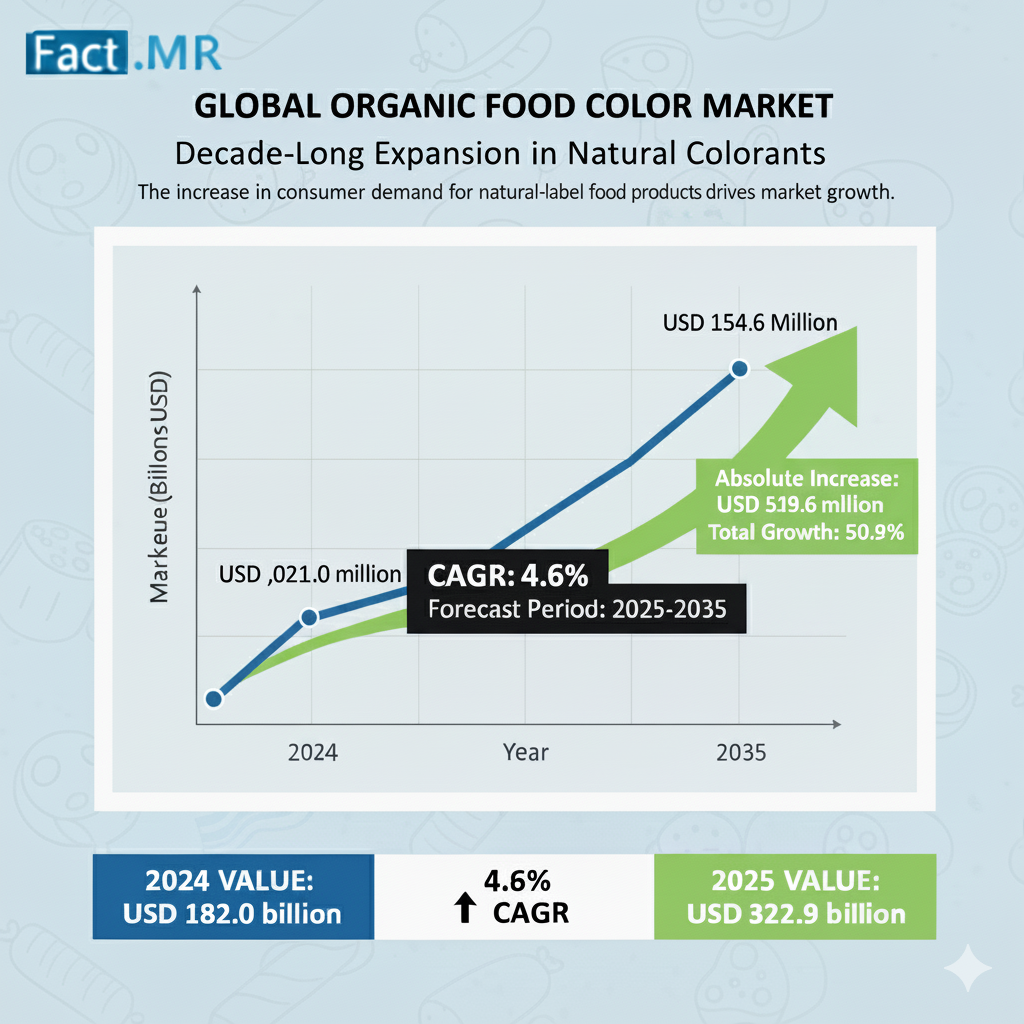

The global organic food color market was worth USD 1,021.0 million in 2024. It is projected to reach USD 1,540.6 million by 2035, reflecting a CAGR of 4.6% over the assessment period 2025 to 2035. This robust growth trajectory underscores the accelerating consumer shift toward chemical-free, clean-label, and sustainable food ingredients a transformation reshaping the global food and beverage industry.

As health-conscious consumers increasingly avoid artificial additives, organic food colors derived from fruits, vegetables, algae, and flowers—are emerging as vital natural alternatives. Their appeal lies not only in visual enhancement but also in their alignment with wellness trends, environmental responsibility, and regulatory compliance.

Natural and Functional A Growing Fusion:

A key growth driver is the increasing adoption of organic food colors in functional foods and nutraceuticals. With consumers demanding natural and health-boosting ingredients, organic pigments are being incorporated into vitamin-enriched drinks, protein bars, and fortified snacks. These colors enhance both product appeal and trust, reflecting consumer desire for transparency and safety.

“Functional foods are no longer just about nutrition—they’re about experience and authenticity,” says a senior analyst. “Organic food colors bridge that gap beautifully by offering vibrant, plant-derived hues that resonate with eco-conscious consumers.”

This trend is reinforced by the growing preference for vegan and plant-based diets, further amplifying demand for natural pigments compatible with clean-label formulations.

Biotechnology Revolutionizing Production:

The organic food color industry is undergoing a technological renaissance through the adoption of biotechnological techniques such as microbial fermentation and enzymatic extraction. These advanced methods enable large-scale, consistent, and sustainable pigment production, reducing dependency on seasonal crops and mitigating cost fluctuations.

This shift also represents a major sustainability milestone. Biotech-driven production consumes less land and water, offering an eco-friendly alternative to traditional farming. As precision fermentation technologies mature, producers can ensure stable pigment supply chains and enhanced purity standards, appealing to both regulators and ethically driven brands.

Regional Dynamics: Global Markets Align with Local Preferences:

The United States, China, and India are at the forefront of organic color adoption, driven by distinct cultural and market forces.

1.United States (CAGR: 6.0%) – Demand in the premium foodservice and hospitality sectors is skyrocketing as restaurants and cafes embrace organic ingredients to meet millennial and Gen Z expectations for “clean food.” Influencers, social media, and health-driven menus are accelerating this transformation.

2.India (CAGR: 5.3%) – A blend of traditional wisdom and modern health awareness is propelling India’s organic color market. Local food manufacturers are replacing synthetic additives in sweets, snacks, and beverages with organic alternatives. The country’s agricultural diversity and Ayurvedic influence provide a strong foundation for domestic production.

3.China (CAGR: 6.2%) – The Chinese government’s investments in food technology R&D are fostering innovations in pigment extraction and stability. Research collaborations between universities and industry are fast-tracking commercialization of new-generation natural colorants, reinforcing China’s position as a global supply hub.

Category Insights: Beverages and Carotenoids Lead the Way:

The beverage sector dominates organic color demand, accounting for 27% of total market share in 2024. Consumers’ preference for natural, functional, and visually appealing drinks—such as juices, teas, plant-based milks, and health beverages—continues to expand this segment.

Meanwhile, carotenoid pigments—responsible for bright yellows and oranges—represent 26% of total pigment sales. Derived from sources like carrots and microalgae, carotenoids deliver both vibrancy and antioxidant benefits, aligning with the holistic health movement. Their multifunctionality ensures continued uptake across bakery, confectionery, and health snack applications.

Competitive Landscape: Innovation and Sustainability Define Leadership:

The competitive environment remains highly dynamic, led by Tier 1 players such as:

– BASF SE – Pioneering sustainable pigment extraction technologies through advanced R&D.

– Archer Daniels Midland Company (ADM) – Expanding its natural ingredients portfolio through strategic collaborations.

– Chr. Hansen Holding A/S – Delivering bio-based color solutions optimized for food stability and transparency.

Tier 2 and 3 companies, including Döhler Group and GNT Group, are carving strong regional footholds by emphasizing quality-driven organic pigments and local sourcing strategies. Strategic acquisitions and joint ventures have also emerged as key tactics to ensure supply chain integration and regional distribution.

Recent notable developments include:

– Symrise AG (2022): Expanded its “Taste, Nutrition & Health” segment with innovative natural color systems designed for clean-label applications.

– Givaudan Active Beauty (2024): Introduced the [N.A.S.]™ Vibrant Collection—five vegan botanical color powders featuring antioxidant and skin-beneficial properties, reinforcing the trend of functional beauty and hybrid innovation.

Sustainability at the Core of Future Growth:

Sustainability continues to anchor the organic food color narrative. Manufacturers are focusing on carbon-neutral processes, waste reduction, and renewable energy sourcing in pigment production. As global food brands strengthen their sustainability pledges, organic food color adoption is expected to expand beyond premium products to mainstream categories, including snacks, RTE foods, and dairy.

Moreover, eco-labeling initiatives and strict certification standards are enhancing consumer confidence and encouraging large-scale brand conversions from synthetic to organic pigments.

Forward Outlook: A Colorful Decade Ahead:

Between 2025 and 2035, the organic food color industry is set to experience a transformational decade marked by:

– Integration of traditional agriculture with biotechnology, ensuring supply resilience.

– Expansion of natural pigment applications in nutraceuticals, beverages, and functional foods.

– Rising regional investments in R&D and sustainable sourcing.

– A clear shift from premium niches to mass-market adoption driven by cost optimization and consumer education.

For manufacturers and investors, the message is clear: the organic food color market is not just a trend — it is a strategic frontier in the clean-label revolution. Companies that invest in innovation, transparency, and sustainable practices will be best positioned to capture growth, inspire trust, and define the next era of natural food solutions.

Browse Full Report-https://www.factmr.com/report/organic-food-color-market