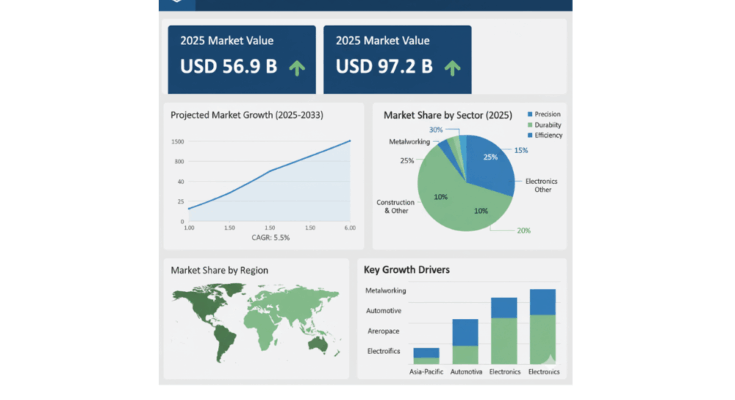

The global abrasives market is set for substantial growth, projected to expand from USD 56.9 billion in 2025 to USD 97.2 billion by 2035, at a compound annual growth rate (CAGR) of 5.5%. The surge is largely driven by increasing demand from electronics, metalworking, automotive, aerospace, and construction industries, where high-performance grinding, cutting, and finishing solutions are critical to meeting the precision, durability, and efficiency requirements of modern manufacturing.

Abrasives Market Performance-Driven Market Growth

As automation, robotics, and precision engineering become central to industrial operations, the demand for abrasives offering consistency, longevity, and cost-effectiveness continues to rise. Manufacturers are increasingly relying on ceramic, diamond, and engineered abrasives to achieve tighter tolerances, improve operational efficiency, and reduce downtime. These trends are particularly evident in the electric vehicle (EV) sector, aerospace component fabrication, and high-tech electronics manufacturing.

Abrasives Market Key Market Drivers

Several factors underpin the robust growth of the abrasives market:

-

Industrial Expansion: The rise of automated manufacturing systems and robotics has increased the need for abrasives capable of handling high-speed, high-precision operations.

-

Electric Vehicles & Lightweight Alloys: Global EV adoption drives demand for abrasives that can efficiently machine aluminum, magnesium, and other lightweight alloys in battery components, powertrains, and chassis systems.

-

Infrastructure Development: Expansion of construction and metalworking projects in Asia, the Middle East, and Africa supports steady abrasives demand.

-

Technological Innovation: Advancements in bonded and coated abrasives, superabrasives, and engineered grains improve precision, reduce energy consumption, and extend tool life.

Abrasives Market Regional Insights

The abrasives market shows distinct regional dynamics:

-

Asia Pacific: Dominates the global market, led by China, Japan, South Korea, and India. China remains a global powerhouse in fused alumina, silicon carbide, and zirconia production, supporting domestic and export demand. Advanced abrasive solutions are increasingly applied in EV manufacturing, electronics, and precision machinery. Japan and South Korea focus on high-precision superabrasives for automotive, electronics, and semiconductor manufacturing. India’s market is accelerating due to infrastructure expansion and industrial modernization under initiatives like “Make in India.”

-

North America: Steady growth is fueled by domestic manufacturing, onshoring of supply chains, semiconductor expansion, and renewable energy projects. U.S. manufacturers are investing in automation-ready and sustainable abrasives to meet high-tech industry requirements.

-

Europe: Growth is driven by sustainability and regulatory compliance, with Germany, France, and Italy leading the adoption of recyclable, high-performance abrasives for automotive, renewable energy, and engineering sectors.

-

Latin America & MEA: Moderate growth is noted, primarily in Brazil, Mexico, and emerging Middle Eastern markets, where construction, metal fabrication, and automotive production are key demand drivers.

Abrasives Market Challenges and Market Restraints

While the abrasives market is expanding, several challenges persist:

-

Raw Material Volatility: Price fluctuations for synthetic diamonds, aluminum oxide, and zirconia impact cost structures, particularly in emerging economies.

-

Environmental and Regulatory Pressure: Regulations on emissions, waste, and energy usage increase production costs, pushing manufacturers to innovate sustainable abrasives.

-

Non-Abrasive Alternatives: Techniques like laser cutting and waterjet machining are gradually replacing traditional abrasives in some high-precision applications.

-

Recycling Limitations: Bonded abrasives face challenges in recyclability, posing a competitive disadvantage for environmentally conscious OEMs.

Abrasives Market Country-Specific Outlook

-

United States: Abrasives demand is rising in electronics, medical devices, aerospace, and EV manufacturing. Advanced bonded and coated abrasives for battery components, powertrains, and lightweight alloys are becoming essential. Federal support for semiconductors, defense, and renewable energy further accelerates market growth.

-

China: Maintains global leadership in both production and consumption of abrasives. Domestic EV makers like BYD, Geely, and NIO drive demand for high-precision abrasives for battery assembly, e-motors, and thermal management components. Electronics giants such as Xiaomi and Huawei fuel demand for coated abrasives in consumer devices.

-

Japan: Precision engineering industries, including automotive and electronics, rely heavily on superabrasives and engineered bonded abrasives. Applications include wafer thinning, micro-lens fabrication, EV component machining, and CNC-based automation systems.

Abrasives Market Segment and Category Insights

-

Product Type: Bonded abrasives dominate due to their precision, durability, and adaptability across industries. Widely used in machinery, automotive, aerospace, and metal fabrication, they support grinding, sharpening, and surface finishing under extreme conditions.

-

End-User Applications: The machinery sector remains a leading consumer of abrasives, utilizing high-strength solutions for surface preparation, deburring, and finishing of heavy equipment and industrial systems.

-

Regional Leadership: Asia Pacific holds the largest market share, driven by China’s industrial base, India’s infrastructure projects, and Japan and South Korea’s high-precision manufacturing.

Abrasives Market Competitive Landscape

The global abrasives market is highly competitive, with Saint-Gobain SA, 3M, DuPont, TYROLIT, and Henkel AG & Co. KGaA leading innovation in performance and material engineering. These companies invest heavily in superabrasives, nonwoven abrasives, and tailored solutions for electronics, automotive, aerospace, and machinery applications. Mid-tier players focus on niche solutions for high-precision automation, sustainability, and digital manufacturing, while mergers, acquisitions, and strategic alliances strengthen regional and global presence.

Abrasives Market Recent Developments

-

Saint-Gobain (2024): Launched Razorstar ceramic grain and Q‑Flute Prime diamond wheels, enhancing grinding efficiency, tool life, and energy savings.

-

3M (2024): Introduced Cubitron™ II 92VC ceramic grinding wheels and advanced diamond dressing rolls, supporting precision manufacturing and customized geometries.

Abrasives Market Outlook

With rising automation, precision engineering, and sustainability initiatives, the abrasives market is positioned for strong growth between 2025 and 2035. Manufacturers adopting high-performance, environmentally friendly, and application-specific abrasive solutions are likely to gain a competitive edge in industries ranging from automotive and aerospace to electronics and metalworking, ensuring the market’s resilience and innovation-driven expansion.