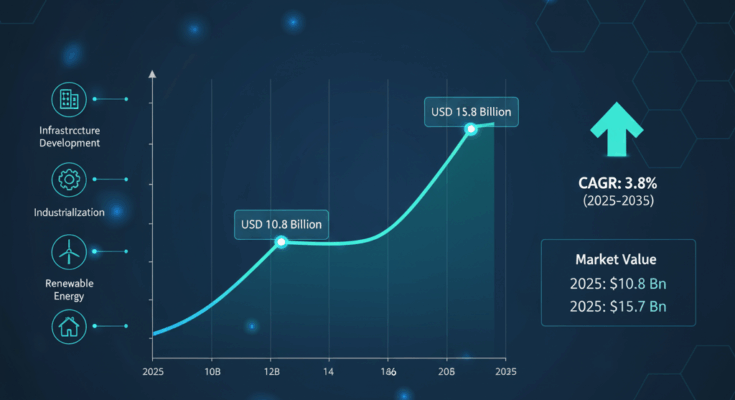

The global compact excavator market is poised for strong growth over the next decade, rising from USD 10.8 billion in 2025 to USD 15.7 billion by 2035, according to the latest market analysis by Fact.MR, a leading market research and consulting firm. This expansion, representing a compound annual growth rate (CAGR) of 3.8%, is underpinned by surging demand for versatile, compact, and energy-efficient construction machinery across residential, commercial, and infrastructure sectors worldwide.

Compact excavators—also known as mini excavators—are increasingly essential in modern construction due to their maneuverability, precision, and suitability for confined workspaces. With growing urbanization, stricter emission regulations, and a global shift toward smarter, more sustainable infrastructure, these machines are becoming a preferred choice for contractors, rental companies, and municipalities.

Technology and Urbanization Fuel Market Growth

The compact excavator market’s growth trajectory is shaped by a combination of technological innovation and accelerating urban infrastructure projects. Manufacturers are integrating advanced hydraulic systems, telematics, and hybrid-electric technologies to enhance performance, reduce emissions, and improve operator comfort.

A prime example is Hitachi Construction Machinery’s 2023 launch of the ZAXIS-7 series—engineered for enhanced operational efficiency in dense urban settings. The ZX75US-7 and ZX85USB-7 models introduced ultra-short-tail swing radii and swing booms, allowing efficient excavation close to walls and barriers—features increasingly demanded in urban construction.

Similarly, Hyundai Construction Equipment’s 2023 introduction of compact hydraulic excavators in North America—models HX35AZ, HX40A, and HX48AZ—demonstrates industry momentum toward smart, emissions-compliant, and multi-functional machinery. These innovations reflect the industry’s pivot toward digitalization and electrification, two megatrends transforming the global construction equipment landscape.

Regulations and Green Innovation Create Opportunity

Global regulatory frameworks are pushing manufacturers to develop eco-friendly and low-emission machines. The U.S. EPA Tier 4 and EU Stage V standards have compelled producers to design cleaner, fuel-efficient models. This shift is opening new opportunities in electric compact excavators, particularly in Europe, China, and urban North American markets where sustainability is now a core purchasing criterion.

Electric compact excavators, while currently a smaller segment, are the fastest-growing product category. Their advantages—low noise, zero emissions, and reduced maintenance—make them ideal for indoor demolition, landscaping, and environmentally sensitive zones. Advances in battery efficiency and charging infrastructure are expected to accelerate adoption over the next decade.

Regional Outlook: Asia Pacific Leads the Global Market

Asia Pacific remains the epicenter of compact excavator demand, driven by large-scale infrastructure expansion and smart city development. China, India, and South Korea dominate regional growth due to government-backed construction initiatives and a thriving manufacturing base.

China, in particular, continues to lead in both production and consumption, supported by mega infrastructure programs such as the Belt and Road Initiative, Shanghai Metro expansions, and major energy projects. Recent product introductions, such as Yuchai Equipment’s U20E electric mini excavator—unveiled at the 135th Canton Fair in 2025—demonstrate the country’s commitment to zero-emission machinery for dense urban applications.

In India, flagship government programs like Bharatmala, Sagarmala, and Smart Cities Mission are fueling demand for compact, efficient construction machinery capable of operating in both urban and semi-urban environments.

Meanwhile, Europe’s compact excavator market is benefitting from increasing urban redevelopment and green building initiatives. Ongoing infrastructure modernization across Germany, France, and the U.K. has spurred the adoption of low-emission and noise-reduced models, particularly in densely populated areas.

North America: Housing and Renewables Accelerate Adoption

In the United States, the market is supported by a renewed housing boom and federal infrastructure investments under the Infrastructure Investment and Jobs Act. Compact excavators are increasingly utilized for residential development, EV infrastructure installation, and renewable energy projects such as solar farms and wind turbine bases.

Manufacturers like John Deere, Bobcat, and Caterpillar are responding with technologically advanced models integrating intelligent hydraulic controls, telematics, and ergonomic designs tailored to contractor needs. As labor shortages continue to challenge the U.S. construction industry, the demand for efficient, multi-attachment compact equipment is projected to remain strong through 2035.

Segment Analysis: Tail Swing and Diesel Lead, Electric on the Rise

By product type, tail-swing compact excavators continue to lead global sales due to their superior lifting capacity, stability, and power efficiency, especially in open-space applications. However, zero-tail swing models—offering safer operation in confined spaces—are growing rapidly, driven by urbanization and stricter operational safety standards.

In terms of motor type, diesel-powered compact excavators still dominate with their proven performance and long-term reliability. Yet, electric models are gaining momentum as cities implement stricter emission zones and public works departments transition to sustainable fleets.

The 4,000 to 10,000 lbs operating weight segment represents the market’s sweet spot, favored for its versatility across construction, agriculture, and utility maintenance. Excavators under 4,000 lbs, however, are growing swiftly in popularity among rental companies and residential contractors seeking agile and cost-effective solutions.

Competitive Landscape: Innovation and Collaboration Drive Leadership

The compact excavator market is witnessing intense competition and strategic collaborations among major players such as Kubota Corporation, Komatsu, Hitachi Construction Machinery, Sany Group, Doosan Bobcat Inc., Volvo CE, Caterpillar, and Yanmar Holdings.

In April 2025, Kubota announced a partnership with Liebherr to supply 9-ton and 11-ton hydraulic wheeled excavators, targeting Europe’s growing demand for mobile compact solutions. Similarly, Volvo CE’s 2025 strategic alliance in Thailand underscores global expansion efforts and localization strategies to capture regional demand.

Leading players are prioritizing R&D investments to develop smart, fuel-efficient, and connected machinery. Features like real-time telematics, predictive maintenance, and hybrid power systems are setting new benchmarks for performance, safety, and sustainability in the construction equipment sector.

Conclusion: Compact Excavators at the Heart of Smart, Sustainable Construction

The compact excavator market’s evolution is closely tied to the world’s push toward sustainable urbanization, efficient energy use, and digital transformation in construction. Manufacturers investing in electrification, modular design, and smart operation technologies are expected to capture significant market share through 2035.

As governments and private developers worldwide ramp up infrastructure spending, compact excavators will remain indispensable to the global construction machinery ecosystem, bridging the gap between performance, sustainability, and versatility.

Browse Full Report : https://www.factmr.com/report/370/compact-excavator-market