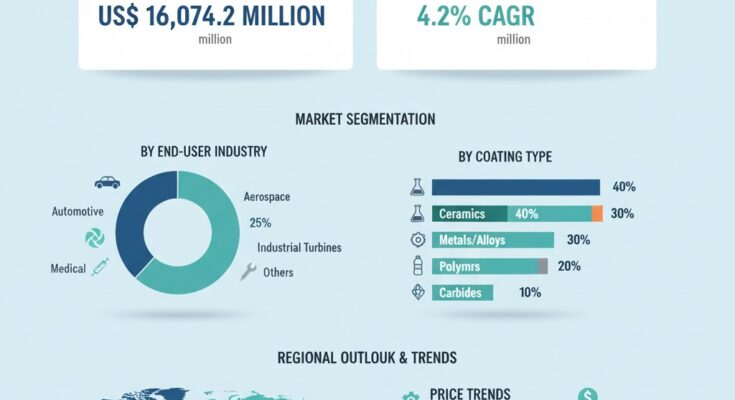

The global thermal spray coating market is gaining strong momentum, driven by increasing demand for wear-resistant, corrosion-protective, and high-performance surface coatings across industrial, automotive, aerospace, and energy sectors. According to a recent report by Fact.MR, the market is valued at US$ 10,223.1 million in 2024 and is projected to reach US$ 16,074.2 million by 2034, expanding at a CAGR of 4.2% during the forecast period.

With growing emphasis on performance enhancement, cost efficiency, and sustainable production, thermal spray coatings are increasingly being recognized as an essential technology for extending equipment life and reducing maintenance costs in harsh operating environments.

Strategic Market Drivers

Growing Demand for High-Performance Coatings

Industries such as aerospace, automotive, power generation, and oil & gas are adopting thermal spray coatings to enhance surface durability, improve resistance against wear, heat, and corrosion, and maintain performance in extreme conditions. These coatings are used on turbine blades, engine components, medical implants, and industrial tools to ensure operational efficiency and longevity.

Advancements in Coating Technologies

Continuous innovations in coating materials and application processes are revolutionizing the thermal spray industry. Developments such as high-velocity oxy-fuel (HVOF) and plasma spray technologies enable precise coating deposition with improved adhesion and microstructure. Integration of automation, robotics, and digital monitoring systems further enhances coating uniformity and process control, ensuring consistent quality in high-volume production.

Industrial Growth and Infrastructure Modernization

The surge in global manufacturing and infrastructure investment is fueling demand for heavy machinery, turbines, and industrial components requiring advanced protection solutions. Emerging economies are investing in energy, transportation, and construction sectors, boosting the need for thermal spray coatings that ensure cost-effective, long-lasting surface performance.

Sustainability and Energy Efficiency Trends

Manufacturers are increasingly prioritizing eco-friendly coating technologies that minimize waste, reduce emissions, and optimize energy consumption. Thermal spray coatings contribute to sustainability goals by extending component lifespans, reducing material replacement rates, and enabling energy-efficient manufacturing practices.

Regional Growth Highlights

North America: Innovation Hub for Aerospace and Defense

The United States remains a dominant player in the thermal spray coatings market, backed by robust aerospace, automotive, and energy industries. Strong R&D investments in turbine efficiency, aviation safety, and renewable energy equipment are accelerating adoption. Canada’s expanding oil and gas sector further contributes to steady regional demand.

Europe: Regulation and Technology-Driven Expansion

Europe’s market growth is supported by stringent quality and performance standards, driving adoption in aerospace, medical, and industrial manufacturing. Germany, France, and the United Kingdom are key markets, focusing on energy-efficient coatings and automation-integrated application processes.

East Asia: Industrial Powerhouse

China, Japan, and South Korea are witnessing rapid growth, driven by large-scale manufacturing, electronics production, and heavy industry modernization. Local players are expanding production capabilities to cater to global demand, while government initiatives supporting renewable energy and EV manufacturing strengthen the market outlook.

Emerging Markets: Latin America and the Middle East

These regions are becoming promising destinations for thermal spray coating applications, particularly in oilfield equipment, mining, and energy infrastructure. Growing industrialization, coupled with public-private investments in sustainable manufacturing, provides fertile ground for future growth.

Market Segmentation Insights

By Process Type

- Flame Spray Coating – Cost-effective and widely used for wear resistance.

- Plasma Spray Coating – Preferred for high-temperature and complex applications.

- HVOF (High-Velocity Oxy-Fuel) – Increasingly adopted for superior bond strength and dense coating properties.

- Cold Spray – Gaining traction in electronics and additive manufacturing due to low-heat deposition.

By Material Type

- Ceramics: Provide heat and corrosion resistance in turbines and engines.

- Metals & Alloys: Offer mechanical strength and conductivity.

- Carbides: Widely used for abrasion and wear resistance in cutting tools.

By End-Use Industry

- Aerospace: Dominates global demand for protective coatings on critical components.

- Automotive: Rapidly adopting coatings for engine blocks, exhausts, and transmission parts.

- Energy & Power: Uses coatings for turbines, boilers, and oilfield machinery.

- Healthcare & Industrial Equipment: Growing application in medical implants and precision instruments.

Challenges and Market Considerations

Despite its robust growth outlook, the thermal spray coating market faces several challenges:

- High Capital Costs: Advanced coating equipment and process control systems involve significant initial investment.

- Skilled Workforce Shortage: Precision in coating applications demands specialized training and expertise.

- Competition from Alternative Technologies: Emerging surface treatment solutions like PVD and CVD coatings offer potential substitutes in certain applications.

- Environmental Regulations: Compliance with emission and material handling standards requires continuous process optimization.

Competitive Landscape

The global market is highly competitive, marked by technological innovation, strategic collaborations, and strong global footprints. Key companies profiled include:

- Praxair Surface Technologies Inc.

- Höganäs AB

- H.C. Starck Inc.

- Castolin Eutectic

- Wall Colmonoy Corp.

- Powder Alloy Corp.

- Saint-Gobain S.A.

- Carpenter Technology Corp.

- Fujimi Incorporated

- Durum Verschleiss-Schutz GmbH

- Montreal Carbide Co. Ltd.

These companies are investing heavily in R&D to develop next-generation coating powders, automated application systems, and environmentally compliant materials. Strategic partnerships with aerospace, energy, and automotive OEMs are also enhancing their market positions.

Recent Development

In 2023, Kennametal Inc. unveiled an enhanced turning grade, KCP25C, featuring its advanced KENGold™ coating technology. The innovation delivers improved wear resistance and higher metal removal rates, specifically designed for steel-turning applications, marking a significant advancement in the company’s metal-cutting solutions portfolio.

Future Outlook: Toward High-Performance and Sustainable Coating Solutions

The next decade will mark a transformative era for the thermal spray coating industry. With industries increasingly focused on operational efficiency, sustainability, and extended component life, thermal spray coatings are set to become integral to modern manufacturing ecosystems.

Manufacturers that integrate digital process control, eco-friendly coating materials, and hybrid deposition techniques will emerge as leaders in the evolving surface engineering landscape. The thermal spray coating market is thus poised for sustained growth—driven by innovation, industrial modernization, and a global shift toward cleaner, smarter production technologies.