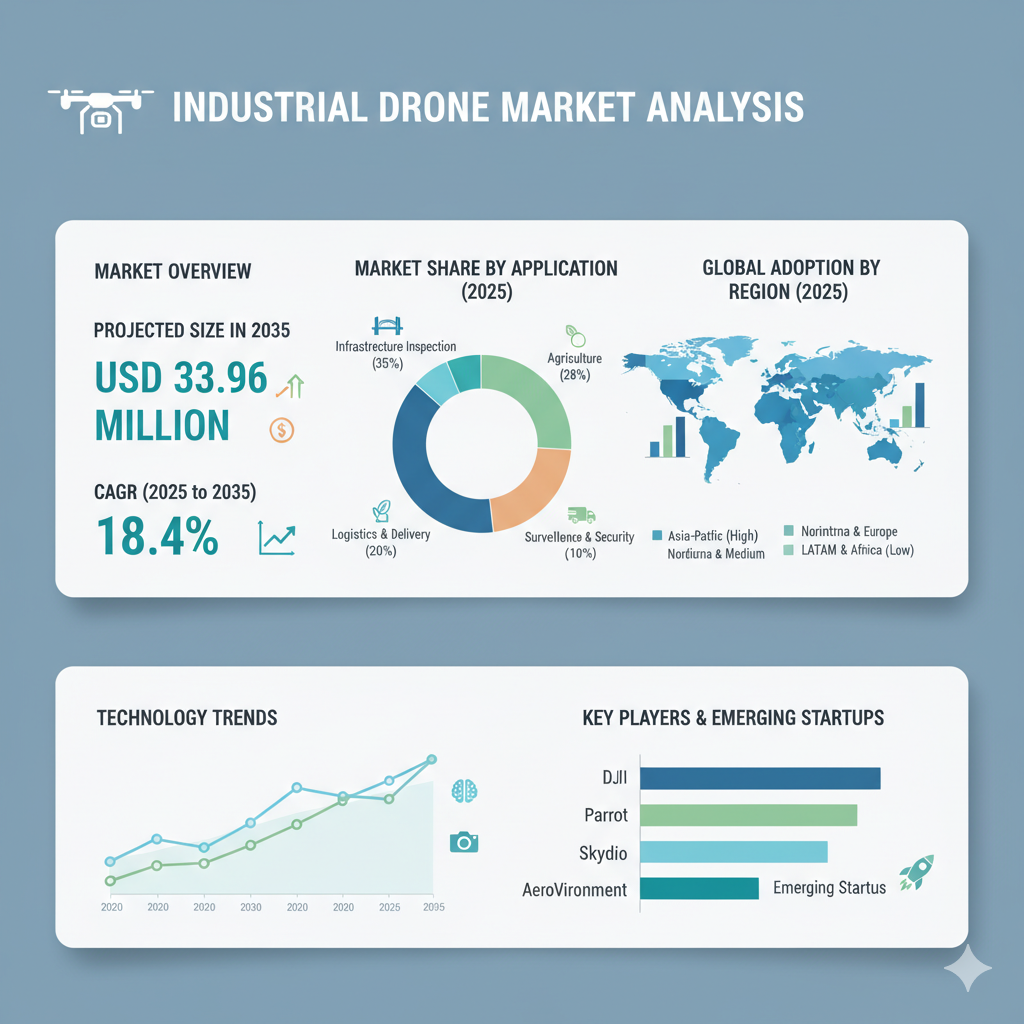

The industrial drone market is entering a high-growth phase. The market is valued at USD 6.27 million in 2025 and is projected to expand at a compound annual growth rate (CAGR) of 18.4%, reaching USD 33.96 million by 2035. This projection underscores the increasing adoption of unmanned aerial systems in industrial settings, driven by the need for automation, safety, operational efficiency, and data-driven decision-making.

Market Segmentation: Types, Payload, Channels, End-Uses & Region

By Drone Type

The market is divided into industrial, rotary, and hybrid drones. Industrial drones are general-purpose models tailored for inspection and monitoring applications. Rotary-wing drones are preferred for precision and hovering operations, while hybrid drones combine the endurance of fixed-wing models with the flexibility of rotary designs. This mix allows manufacturers to cater to a wide range of industrial requirements.

By Payload

Industrial drones are categorized by payload capacity into less than 5 kg, 5–10 kg, 10–15 kg, and above 15 kg. Payload capability determines the kind of sensors, cameras, or equipment a drone can carry. The 5–10 kg category is emerging as the sweet spot, offering an optimal balance between cost and functionality, and making it suitable for a broad range of applications, including inspection, surveying, and moderate delivery operations.

By Sales Channel

Sales channels include online, offline, and other specialized networks. Offline sales continue to dominate the market, as many industrial clients prefer in-person demonstrations, equipment validation, and after-sales support. However, online sales are gaining traction as more buyers explore digital procurement channels, especially for standardized drone models and accessories.

By End-Use Industry

The industrial drone market serves a diverse range of sectors, including agriculture and forestry, delivery and logistics, media and entertainment, construction and mining, oil and gas, security and law enforcement, and recreational activities. In agriculture, drones are revolutionizing precision farming, crop health monitoring, and soil analysis. The construction and mining sectors use drones for site surveying, volumetric measurement, and structural inspection. Meanwhile, oil and gas industries employ drones for pipeline monitoring and flare stack inspection, while security forces rely on them for surveillance and emergency response.

By Region

Geographically, the market is segmented into North America, Latin America, Europe, East Asia, South Asia & Oceania, and the Middle East & Africa. Adoption patterns vary widely depending on regulatory frameworks, infrastructure, industrial density, and government support. North America and Europe are expected to maintain technological leadership, while Asia-Pacific shows the fastest growth due to expanding industrialization and favorable policy reforms.

Recent Market Developments & Competitor Dynamics

The industrial drone market is undergoing rapid innovation. Rotary-wing and hybrid platforms have seen growing demand because of their ability to operate in tight or hazardous environments. These models are increasingly favored for infrastructure inspection, mapping, and confined-space monitoring. The 5–10 kg payload segment continues to expand as industries seek drones that balance affordability with capability.

Offline sales remain a key revenue channel, driven by the need for hands-on assessment and training. Nonetheless, digital sales platforms are slowly reshaping the purchasing process, particularly for repeat customers and standardized models.

Sector-wise, agriculture, construction, and security applications are witnessing the strongest growth. Drones enable precision agriculture, real-time crop health analysis, and pest control, while construction companies use them for terrain mapping and progress monitoring. In the security and law enforcement sector, drones play a vital role in surveillance and crowd monitoring, contributing to operational efficiency and safety.

Regulatory frameworks are gradually evolving to accommodate the expansion of commercial drone operations, including beyond-visual-line-of-sight (BVLOS) flights and airspace integration. However, regional inconsistencies and certification delays continue to pose challenges. Meanwhile, supply chain issues involving batteries, sensors, and semiconductors have prompted manufacturers to explore local production and alternative sourcing strategies.

Key Players & Competitive Landscape

The industrial drone ecosystem is dominated by a few major players while leaving room for specialized firms catering to niche applications. DJI continues to lead the global market with its integrated hardware and software ecosystem, wide distribution, and extensive R&D capabilities. Skydio, based in the United States, has built its competitive edge around autonomous navigation and AI-driven analytics, gaining traction in infrastructure and public safety. Parrot SA, a European leader, emphasizes cybersecurity and compliance, particularly within defense and energy applications.

EHang, known for its autonomous aerial vehicle innovations, is exploring opportunities to transfer its technologies to industrial drone applications. Boeing’s subsidiary Insitu continues to leverage aerospace-grade reliability for long-endurance and defense-oriented drones, while Flyability has carved out a niche in indoor and confined-space inspections. Other emerging competitors, such as AeroVironment, Terra Drone, Percepto, and Microdrones, are focusing on analytics integration and industrial automation to enhance value propositions.

Competitive dynamics in the sector are defined by investments in autonomy, artificial intelligence, and real-time data processing. Companies are also expanding through mergers, acquisitions, and partnerships to strengthen global reach and service networks. As regulatory compliance and technical certification become more stringent, firms capable of navigating these frameworks are gaining a clear competitive edge.