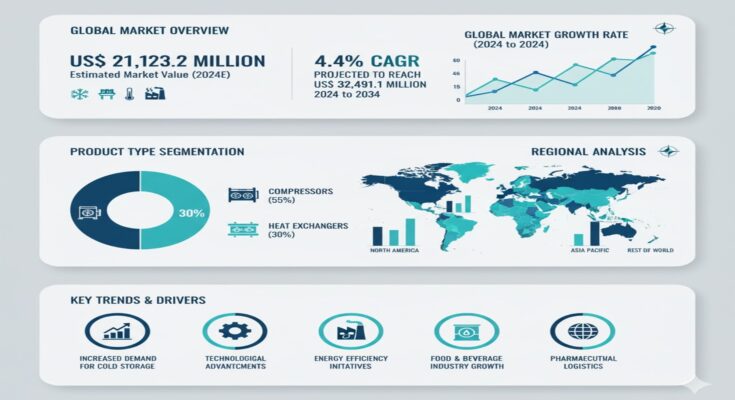

The global industrial refrigeration equipment market is anticipated to be valued at US$ 21,123.2 million in 2024 and is forecast to reach US$ 32,491.1 million by 2034, registering a CAGR of 4.4% during the forecast period. This steady growth is fueled by the increasing adoption of energy-efficient refrigeration systems, rising industrial output, and stringent environmental regulations across food processing, pharmaceuticals, and cold storage sectors.

Strategic Market Drivers

The industrial refrigeration equipment market is witnessing significant growth due to converging technological, regulatory, and operational trends:

Energy Efficiency and Sustainability: Manufacturers are increasingly focused on reducing operational costs and carbon footprints. Advanced refrigeration systems, such as ammonia-based and CO₂-based units, offer high efficiency while complying with environmental standards, making them attractive across industrial sectors.

Rising Industrialization: The growth of the food processing, beverage, pharmaceutical, and cold storage industries drives demand for reliable and large-scale refrigeration solutions. Industrial-scale cooling is critical for maintaining product quality, safety, and compliance with hygiene standards.

Technological Advancements: Innovations in smart monitoring, IoT-enabled controls, and automated systems are enhancing energy management, predictive maintenance, and operational efficiency. These developments are enabling industries to optimize refrigeration performance while minimizing downtime.

Regulatory Compliance: Governments worldwide are implementing stringent regulations regarding refrigerants, energy consumption, and environmental safety. Industrial refrigeration equipment that aligns with these standards is increasingly preferred by end-users seeking long-term compliance and sustainability.

Emerging Applications: Cold chain expansion in emerging markets, including e-commerce logistics, biotech, and healthcare, is creating new growth avenues. Customized industrial refrigeration solutions for specialized storage and transport needs are in high demand.

Regional Growth Highlights

North America: The U.S. dominates due to a mature industrial base and widespread adoption of sustainable cooling solutions. Key end-use industries include food processing, cold storage warehouses, and pharmaceuticals, driving demand for high-efficiency refrigeration systems.

Europe: Europe’s growth is propelled by strict energy efficiency standards and environmental regulations. Countries like Germany, France, and the U.K. are early adopters of advanced refrigeration technologies, particularly ammonia and natural refrigerants.

Asia-Pacific: China, India, and Japan are fast-growing markets due to rapid industrialization, expanding cold chain infrastructure, and rising investments in food and pharmaceutical industries. The region is witnessing strong adoption of eco-friendly, high-capacity refrigeration equipment.

Emerging Markets: Latin America and the Middle East present long-term opportunities driven by modernization of industrial facilities, growth in cold storage networks, and government initiatives promoting sustainable infrastructure.

Market Segmentation Insights

Equipment Type: Ammonia-based refrigeration systems dominate due to high efficiency and suitability for large industrial applications. Meanwhile, CO₂ and hybrid systems are gaining traction, particularly in sustainable and eco-conscious operations.

End-Use Industry: Food & beverage processing remains the largest revenue contributor, followed by pharmaceuticals, chemicals, and cold storage logistics. The increasing need for precise temperature control and compliance with food safety standards drives this segment.

Application: Industrial cold storage accounts for the highest share, while process cooling applications in pharmaceuticals and chemicals are rapidly expanding due to technological upgrades and regulatory compliance requirements.

Challenges and Market Considerations

Despite promising growth, the market faces several challenges:

High Initial Investment: Advanced industrial refrigeration equipment requires significant upfront investment, which can deter adoption, especially in small- and medium-scale operations.

Environmental Concerns: Use of synthetic refrigerants requires careful management to prevent ozone depletion and greenhouse gas emissions. Transitioning to natural refrigerants involves technological and operational challenges.

Maintenance and Reliability: Industrial refrigeration systems demand regular maintenance and skilled personnel for optimal operation, posing operational challenges in regions with limited technical expertise.

Competitive Landscape

The industrial refrigeration equipment market is highly competitive, with leading players including Carrier; Daikin Industries Ltd.; Danfoss Group; Emerson Electric Co.; EVAPCO Inc.; GEA Group AG; Johnson Controls; Ingersoll Rand; LU-VE Group; and Mayekawa Mfg. Co. Ltd. These companies focus on technological innovations, mergers and acquisitions, and strategic partnerships to expand their product portfolios and strengthen market presence.

Recent Developments:

- July 2023: BITZER acquired OJ Electronics A/S to establish a center of excellence for HVAC&R electronic components in Denmark.

- June 2023: Johnson Controls acquired M&M Carnot, enhancing its sustainable industrial refrigeration system portfolio.

Outlook and Market Leadership

The industrial refrigeration equipment market represents a transformative opportunity for manufacturers, end-users, and technology providers. With projected growth to US$ 32,491.1 million by 2034, companies that prioritize sustainability, energy efficiency, and technological innovation are poised to capture significant market share. By aligning with evolving industrial requirements and regulatory standards, leading players can set benchmarks in energy-efficient and reliable industrial refrigeration solutions.