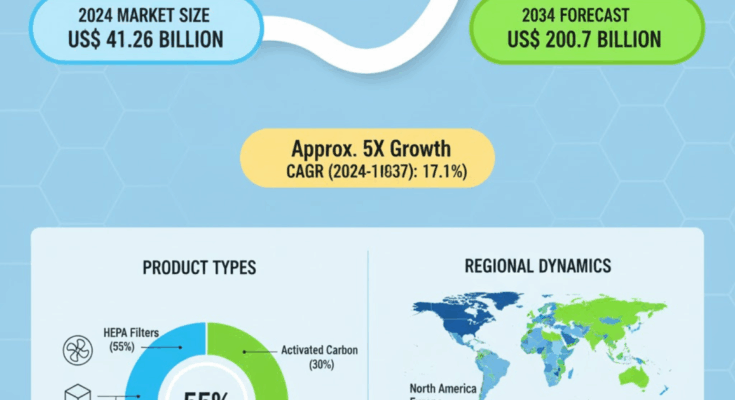

According to a new industry study by Fact.MR, the global air purification market is projected to grow from US$ 41.26 billion in 2024 to US$ 200.7 billion by 2034, reflecting a compound annual growth rate (CAGR) of approximately 17.1% over the forecast period. The strong surge in demand is being driven by increasing concerns over indoor and outdoor air pollution, rising awareness of the link between air quality and health, and a proliferation of regulatory measures aimed at improving air purity in residential, commercial, and industrial settings.

Market Growth Drivers & Key Trends

One of the primary drivers of market growth is growing public awareness of the health risks associated with poor air quality. Conditions such as allergies, asthma, respiratory infections, and more recently, concerns about airborne pathogens have pushed both consumers and institutions to invest more heavily in effective air purification solutions. Urbanization, vehicular emissions, industrial pollution, and volatile organic compounds (VOCs) from building materials are contributing to deteriorating air quality in many cities, fueling demand for advanced air purification technologies.

Technological innovation is another major trend shaping the market. High-Efficiency Particulate Air (HEPA) filtration systems are expected to hold the largest share by 2034 (about 37.9%), due to their ability to capture fine particles, allergens, dust, and pathogens. Other technologies gaining traction include activated carbon filters, ionic purification, and Ultraviolet Germicidal Irradiation (UVGI), as well as hybrid and multi-stage filtration systems that combine several technologies for improved efficiency.

Commercial applications are driving a large portion of market expansion. The commercial sector—including hospitals, educational institutions, offices, malls, and hotels—is expected to represent over US$ 109.98 billion of market value by 2034, as businesses seek to meet stricter indoor air quality (IAQ) regulations, improve occupant health, and enhance customer confidence. Demand from residential users is also rising steadily, spurred by rising disposable incomes, awareness of indoor pollutants, and the appeal of health-centric and smart-technology enabled home devices.

Regions such as East Asia are expected to lead the market, with projected market share near 40.7% by the end of 2034. China, in particular, is forecast to see strong growth (about 18.0% CAGR), driven by government policies aimed at improving air quality, intensified public health efforts, and high levels of pollution in urban centres. North America is also a significant contributor, expected to account for about 23.8% of global market share in 2034, as the United States amplifies regulatory oversight and demand grows for workplace, healthcare, and residential purification systems.

Challenges & Market Constraints

Despite the positive outlook, several restraints could moderate growth. One key issue is the cost of acquisition and maintenance of air purification systems. High-end devices with advanced filtration, UVGI, or hybrid technologies tend to carry higher upfront costs, and replacement filters or UV lamps can add recurring expenses. In markets with lower purchasing power, this remains a barrier to adoption.

Another challenge is ensuring public trust and product performance transparency. With many brands entering the market, consumers face confusion over filtration efficiency, maintenance requirements, noise levels, energy consumption, and certification. Lack of standardized benchmarks across regions can hamper buyer confidence.

Regulatory and infrastructural constraints also impact growth. In many regions, indoor air quality regulations are still developing or not strongly enforced. Lack of awareness in rural or low-income urban sectors, limited power supply reliability, and insufficient after-sales service or supply of replacement parts may slow adoption rates.

Recent Developments & Innovation Highlights

Recent years have witnessed a number of noteworthy developments that are helping push the air purification market forward. Manufacturers are increasingly launching smarter, connected devices—air purifiers with built-in sensors, app-enabled controls, air-quality monitoring, and automation features. These “smart purifiers” are helping consumers monitor air quality in real time and reduce maintenance burdens.

In addition, there is growing adoption of reusable and washable filter technologies, which address sustainability concerns and reduce long-term maintenance costs. Firms are also exploring hybrid purification methods—combining HEPA, activated carbon, UVGI, and ionic purification—to improve removal of particulates, odors, VOCs, and microbial contaminants in a single device.

Governments and urban planning authorities in polluted regions are increasingly mandating IAQ standards for public buildings, schools, hospitals, and commercial spaces. In China, regulatory push and public programmes are boosting installations of air purifiers in institutional settings. In North America, there is a trend for products certified under strict performance or energy efficiency labels, which supports premium segment growth.

Key Players & Competitive Landscape

The market is populated by well-established global players, regional appliance manufacturers, and specialized air-quality solutions companies. Notable companies profiled in the Fact.MR report include Daikin Industries Ltd., American Air & Water Inc., Eureka Forbes Ltd., Honeywell International Inc., Hitech Ultraviolet Pvt. Ltd., IQAir, Panasonic Corporation, Koninklijke Philips N.V., Sharp Corp., and LG Electronics.

These companies are competing on multiple fronts: filtration technology (efficiency, hybrid solutions), energy efficiency, smart features (IoT, sensors, real-time monitoring), design and form factor, noise levels, and long term sustainability (reusable filters, eco-friendly materials). Pricing strategies and regulatory compliance also weigh heavily, with certifications and performance benchmarks (e.g., HEPA standards, UV safety, energy consumption) becoming key differentiators.

Emerging players and startups are focusing on innovations like self-cleaning filters, advanced UV-C systems, and low-power devices for off-grid or low-electricity contexts. Some are also targeting institutional or industrial applications (e.g. hospitals, cleanrooms, labs) where performance parameters are more demanding.

Market Outlook & Strategic Implications

Given the projected growth—from US$ 41.26 billion in 2024 to US$ 200.7 billion by 2034—stakeholders across the air purification value chain should align strategies to capitalize on major opportunities. Manufacturers should invest in R&D around hybrid technologies, energy-efficient purification, sustainability (reusable filters, recyclable materials), and smart connectivity. They should also ensure supply chain resilience for filters and replacement parts.

Distributors and retailers can benefit by expanding into institutional and commercial channels, including schools, hospitals, and offices, where demand is accelerating. Customer education on long-term benefits (health, reduced disease risk, regulatory compliance) can help drive adoption in residential segments.

Regulators and policymakers can support the market by defining clearer indoor air quality standards, offering subsidies or incentives for installations in public buildings, promoting certification standards, and encouraging sustainable design in product manufacturing.

The growing consciousness about indoor air quality, especially after global health scares, is likely to keep this market in focus over the coming decade. As filtration technologies evolve, affordability improves, and regulatory frameworks strengthen, air purification is set to become an essential aspect of built environments globally.

Browse Full Report: https://www.factmr.com/report/air-purification-market