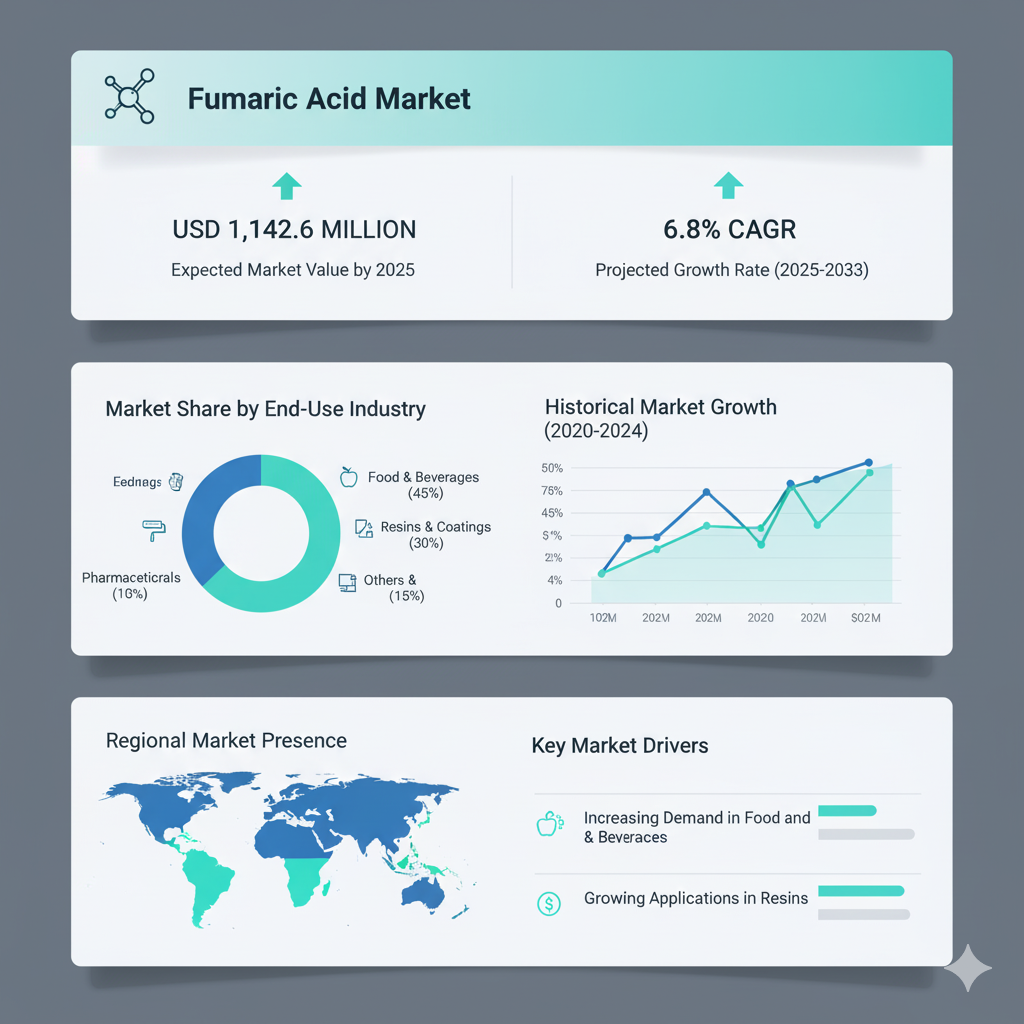

The global fumaric acid market is poised for substantial growth in the coming decade. The market is projected to increase from USD 591.8 million in 2025 to USD 1,142.6 million by 2035, reflecting a robust CAGR of 6.8% during the forecast period. This anticipated growth is underpinned by rising demand across multiple end-use sectors such as pharmaceuticals, food & beverage, and polymer resins, as well as increasing emphasis on more sustainable production methods.

Segmentation Overview: Extraction Type, Application & End-Use

By Extraction Type

The fumaric acid market is segmented by extraction or production method into Fumaria Officinalis, Maleic Anhydride, and Fermentation. Among these, the Fumaria Officinalis route currently leads by revenue share. This is largely due to its acceptance as a more natural source of fumaric acid, which appeals especially to food and pharmaceutical formulators in markets with clean-label preferences, especially in Europe and North America.

However, the fermentation route is emerging as the fastest-growing subsegment. Its appeal lies in its eco-friendliness, scalability, and alignment with green chemistry trends. In regions with stringent regulatory pressures and sustainability goals, fermentation is increasingly preferred for producing fumaric acid with controlled quality and lower carbon footprint.

By Application

Applications of fumaric acid span across food additives, rosin paper, unsaturated polyester resins (UPR), alkyd resins, animal feed, and others. Among these, food additives command the largest revenue share. Fumaric acid serves as a pH regulator, acidity adjuster, flavor enhancer, and preservative in baked goods, confectioneries, beverages, and other processed foods. Its GRAS (Generally Recognized As Safe) status helps maintain wide adoption.

That said, unsaturated polyester resins (UPR) represent the fastest-growing application segment. The expansion of infrastructure, composites, and building materials usage—particularly in developing regions—is fueling demand for UPRs, thus pushing fumaric acid usage in resin systems.

By End-Use Industry

The market is also analyzed by end-use industry: food & beverage, cosmetics, pharmaceutical, and chemical. The food & beverage sector currently leads in revenue share because of consistent demand for additives in processed food, beverages, and packaged goods. Its favorable chemical properties—effective at low concentrations, non-hygroscopic, and stable over shelf life—make fumaric acid a go-to acidulant in formulations.

However, the pharmaceutical segment is the fastest expanding. This is driven by the use of fumaric acid in therapeutic formulations for dermatological and neurological diseases, as well as increasing interest in bio-based excipients. Rising R&D spending and regulatory approvals in this domain are adding momentum.

Regional Dynamics & Market Outlook

Geographically, the market is broken down into regions such as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa. Asia Pacific currently holds the largest share, led by rapid expansion of food & beverage industries, increasing processed food consumption, urbanization, and rising disposable incomes.

North America is a significant contributor, supported by strong pharmaceutical, construction, and food sectors. Europe is projected to register one of the faster growth rates, thanks to stricter environmental norms, rising demand for cleaner and sustainable acidulants, and investments in polymer and resin sectors.

Recent Developments, Key Players & Competitive Analysis

Recent Developments

In recent years, producers have leaned heavily into capacity expansions, process optimization, and strategic consolidation. Bartek Ingredients launched operations at its expanded manufacturing facility in September 2024, doubling malic and fumaric acid output while achieving an estimated 80% reduction in emissions through process intensification.

Thirumalai Chemicals Limited began commercial production at its new 10,000 MT fumaric acid facility in Dahej, Gujarat, in early 2024 as part of its second-phase expansion efforts. Alphagary executed the acquisition of a Mexican fumaric acid business to integrate stabilizer output with its flexible PVC cable operations, vertically integrating its raw materials chain.

In Southeast Asia, contract fermentation players are locking in private-label agreements with local beverage brands, which heightens regional competition and reduces reliance on long-range exporters.

Key Players & Competitive Landscape

The competitive landscape in the fumaric acid market features a mix of global and regional players. Bartek Ingredients now holds one of the largest combined malic and fumaric acid capacities globally, strongly positioned in food-grade production given its scale and energy-efficient processes. Thirumalai Chemicals, with its recent Gujarat expansion, is bolstering its footprint in India, aiming to serve both domestic and export markets more effectively.

Polynt S.P.A is a European chemicals company active in specialty resins and acid systems, leveraging synergies with existing polymer operations. Nippon Shokubai Co. Ltd, a Japanese firm, maintains integrated supply chains and robust R&D capabilities in Asia. Chinese producers such as Tianjin Bohai Chemicals, The Chemical Company, Wego Chemical Group, and Changzhou Yabang Chemical Co. Ltd. primarily compete through cost-efficiency, localization, and flexible capacity.

Request for Discount: https://www.factmr.com/connectus/sample?flag=S&rep_id=526

Buy Now at USD 4500: https://www.factmr.com/checkout/526

Check out More Related Studies Published by Fact.MR Research:

Aliphatic Solvents Market: https://www.factmr.com/report/aliphatic-solvents-market

Biosolids Market: https://www.factmr.com/report/biosolids-market

Polycaprolactone Market: https://www.factmr.com/report/4754/polycaprolactone-market

Bioplastic Textiles Market: https://www.factmr.com/report/bioplastic-textiles-market