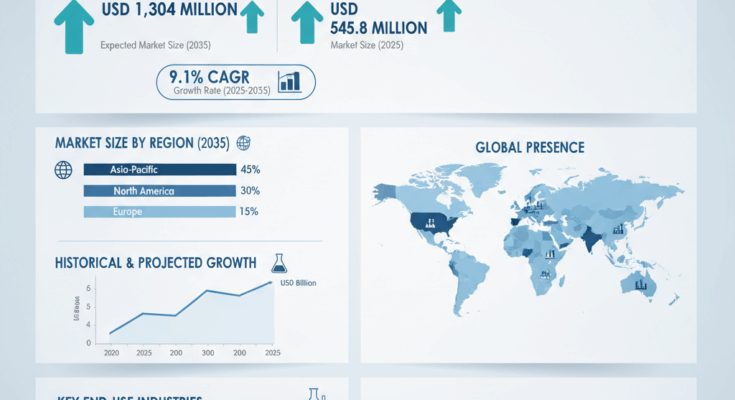

The global lithium fluoride (LiF) market is on track for significant expansion over the coming decade. The market is anticipated to grow from approximately USD 545.8 million in 2025 to USD 1,304 million by 2035, reflecting a compound annual growth rate (CAGR) of about 9.1% during the forecast period.

This rapid growth is driven by rising demand in several industries, especially nuclear energy, advanced battery systems, and high-precision optics, as well as increasing investments in clean energy and semiconductor manufacturing.

Global Lithium Fluoride Market Analysis

By Form

Lithium fluoride is produced and consumed in several physical forms, including powder, granular, pellets, and solution/slurry. Each form serves specific industrial requirements depending on handling, reactivity, and purity needs. Powdered and granular forms dominate the market due to their suitability for chemical synthesis and metallurgical processes, while pellet and slurry forms are increasingly adopted in specialized energy and optical applications.

By Purity Level

The market is segmented into multiple purity grades:

- Industrial/Technical Grade (<99%) – used in general manufacturing and metallurgy.

- High Purity (99%–99.9%) – suitable for chemical synthesis and advanced ceramics.

- Ultra-High Purity (≥99.9%) – critical for electronics, semiconductors, and optical coatings.

- Nuclear Grade (≥99.99%) – used in nuclear reactors and advanced research facilities.

High-purity and ultra-high purity segments are expected to expand rapidly, fueled by the surge in demand for precision materials in electronics, optics, and nuclear energy systems.

By Application

Lithium fluoride serves as a versatile compound used in:

- Breeder reactors and neutron moderator systems

- Fuel coolants and fusion research

- Sintering agents for specialty alloys

- Energy storage and battery manufacturing

- Chemical synthesis and processing

- Optical, glass, and ceramic components

As research into solid-state batteries and molten salt reactors accelerates, the compound’s use in energy storage and nuclear applications is expected to rise sharply.

By End-Use Industry

Key industries driving demand include:

- Energy & Power – for reactor coolants and nuclear applications.

- Metallurgy & Foundry – used as flux and sintering agent.

- Electronics & Semiconductors – for optical coatings and etching.

- Battery & Energy Storage – as an additive in next-generation lithium batteries.

- Glass & Ceramics – for improving transparency and durability.

- Defense & Aerospace – for specialized optics and protective coatings.

By Region

The market is analyzed across:

- North America – with strong growth in advanced materials and nuclear sectors.

- Europe – focusing on clean energy transitions and semiconductor applications.

- Asia-Pacific – led by China, Japan, and South Korea, which dominate production and consumption.

- Latin America, Middle East & Africa – emerging markets with growing industrial bases.

Recent Developments and Competitive Landscape

The lithium fluoride market has undergone several key developments in recent years, shaped by research innovations, new product launches, and strategic partnerships.

Recent studies into cryogenic microwave spectroscopy of high-purity LiF crystals have advanced understanding of impurities and purity standards required for high-tech uses. Manufacturers are investing heavily in process optimization to achieve better consistency and cost efficiency in production.

Key players in the global lithium fluoride market include:

Crystran Ltd, American Elements, MaTeck GmbH, ProChem Inc., Noah Chemicals, Parad Corporation, Foshan Nanhai Double Fluoride Chemical Co., Stanford Advanced Materials, Morita Chemical Industries, Iwatani Corporation, MilliporeSigma (Merck KGaA), and Nacalai Tesque.

Competitor Analysis

The competitive landscape is moderately consolidated, with a mix of large-scale chemical producers and specialized firms focusing on high-purity lithium fluoride. Companies differentiate themselves through:

- Purity enhancement technologies for nuclear and semiconductor markets.

- Vertical integration to secure raw material supply chains.

- Partnerships and joint ventures with battery manufacturers and research institutions.

- Regional expansion strategies to tap into Asia-Pacific’s high-growth markets.

Asia-Pacific players are increasingly competitive, benefiting from lower production costs and government incentives for nuclear and EV industries. Meanwhile, North American and European companies emphasize quality assurance, regulatory compliance, and innovation in ultra-high purity production.

Regional Insights and Market Drivers

China remains the largest producer, supported by integrated supply chains and robust demand from the energy and electronics sectors. Japan and South Korea focus on high-precision applications, while the United States and Europe are investing in capacity expansion and research partnerships to reduce dependency on imports.

Key Growth Drivers:

- Expansion of molten salt and advanced nuclear reactors, using LiF as a stable, neutron-transparent coolant.

- Rising adoption in solid-state and lithium-ion batteries, improving performance and thermal stability.

- Increasing applications in semiconductors, optics, and laser systems, driven by technological advancement.

Challenges:

- High production costs for ultra-pure grades.

- Stringent environmental and safety regulations for fluorine handling.

- Supply chain vulnerabilities due to concentrated production in specific regions.