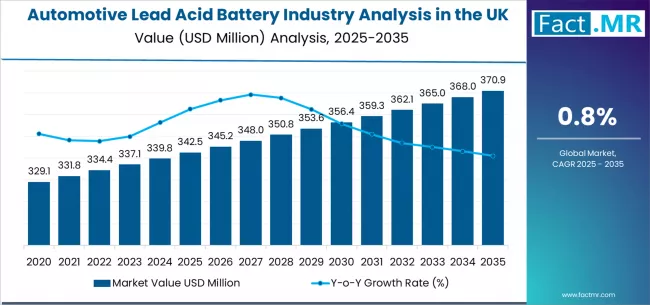

The UK automotive lead acid battery market is set for measured yet positive growth over the next decade, backed by continued reliance on 12V power systems across internal combustion engine (ICE) vehicles, mild-hybrid architectures, and aftermarket replacement needs. According to Fact.MR’s latest industry analysis, demand is projected to rise from USD 342.5 million in 2025 to USD 372.8 million by 2035, reflecting an absolute increase of USD 30.3 million. Total market demand is forecast to expand by 8.8%, registering a CAGR of 0.8% from 2025 to 2035, indicating strong market stability despite evolving powertrain trends.

Automotive lead acid batteries remain a foundational technology in the UK vehicle ecosystem, valued for reliability, safety, recyclability, and cost-effectiveness—especially in starter, lighting, and ignition (SLI) applications.

Key Market Drivers

Sustained Dominance in ICE & Mild-Hybrid Vehicles

Lead acid batteries continue to be the primary SLI energy source in passenger cars, commercial fleets, and two-wheelers throughout the UK. Even with the country’s electric vehicle push, a large installed base of ICE and mild-hybrid vehicles ensures recurring OEM fitments and high aftermarket volume. Mild-hybrids, which use lead acid batteries alongside lithium-ion packs for auxiliary power, are further extending relevance.

Browse Full Report: https://www.factmr.com/report/united-kingdom-automotive-lead-acid-battery-industry-analysis

Strong Aftermarket Replacement Demand

Battery replacement cycles remain a consistent growth anchor. The UK market benefits from:

- High fleet density of passenger and light commercial vehicles

- Regular battery replacement needs (typically every 3–5 years)

- Growth in vehicle parc size, supporting robust independent workshop and service network sales

This ensures stable revenue flow for distributors, recyclers, and service providers.

Circular Economy Advantage & High Recyclability

The UK has one of the world’s most efficient lead acid battery recycling value chains, with lead recovery rates exceeding 95% in Europe. This gives the technology a significant sustainability advantage and aligns with national environmental priorities, helping manufacturers and suppliers maintain high adoption.

Harsh Weather & Driving Patterns Influence Demand

Seasonal temperature variation, long average driving routes, and high accessory load usage contribute to battery wear, reinforcing year-round replacement demand spikes, especially during winter months.

Market Segmentation Snapshot

By Battery Type

- Flooded Lead Acid Batteries – Most widely deployed in conventional vehicles

- AGM (Absorbent Glass Mat) – Rising use in start-stop and premium models

- EFB (Enhanced Flooded Battery) – Growing in mild-hybrid and start-stop passenger cars

By Vehicle Type

- Passenger Cars – Largest consumer of SLI batteries

- Light Commercial Vehicles (LCVs) – High replacement rate due to intensive usage

- Heavy Commercial Vehicles (HCVs) – Multi-battery systems support higher market value share

By Sales Channel

- OEM Supply

- Aftermarket Distributors

- Vehicle Service & Independent Workshops

- E-commerce & Retail Chains

UK Regional & Industry Strengths

- England & Scotland lead consumption due to high vehicle ownership and commercial fleet activity.

- The UK continues to prioritize battery recyclability, safe manufacturing, and closed-loop supply initiatives.

- Manufacturers are expanding AGM and EFB production capacity to match long-term start-stop penetration.

Market Challenges

Gradual EV Transition Pressure

While lead acid batteries will remain essential, full battery-electric vehicle (BEV) penetration may restrict high-growth acceleration, keeping CAGR modest through 2035.

Competition from Advanced Chemistries

Auxiliary lithium-ion substitution risk persists in premium and fully electric models, though lead acid remains unmatched on cost and safety in 12V SLI systems.

Raw Material Pricing Fluctuations

Lead cost variability can impact margins, though the well-developed UK recycling network helps offset supply chain risk via reclaimed lead feedstock.

Competitive Landscape

The UK automotive lead acid battery market has a balanced mix of global suppliers, recyclers, and strong distribution networks, with strategic focus on long-life, start-stop-optimized models and recycled lead utilization.

Key Industry Participants Include:

- Exide Technologies

- GS Yuasa Corporation

- Clarios (formerly Johnson Controls Power Solutions)

- Clarios UK Recycling Partners

- Local and pan-UK aftermarket distributors & workshop networks

Suppliers are investing in:

- AGM/EFB enhancements for start-stop endurance

- Recycled lead integration to stabilize production costs

- Extended-life product warranties

- Retail and workshop channel expansion

Recent Industry Trends

- Start-stop vehicle demand growth sustaining AGM and EFB adoption

- Rising partnerships in battery collection and lead recycling

- Retailers adding private-label lead acid batteries to capture aftermarket buyers

Future Outlook

Through 2035, automotive lead acid batteries will continue to serve as a stable and essential segment of the UK automotive power system, with demand strengthened by:

- Large ICE & mild-hybrid vehicle parc

- Predictable aftermarket replacement cycles

- Strong recycling and circular supply chains

- Cost-efficient and reliable 12V battery performance

As the market coexists with electrification, lead acid batteries will retain solid adoption in OEM 12V systems, premium start-stop vehicles, and high-volume aftermarket channels, ensuring long-term industry viability.