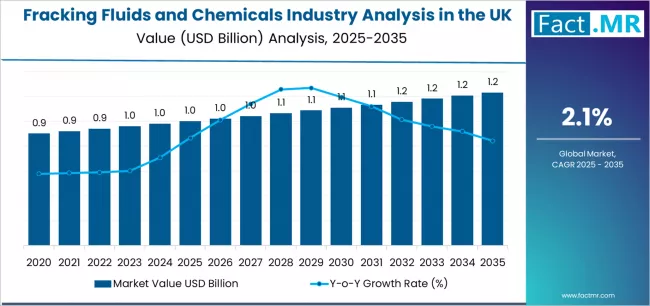

The United Kingdom’s fracking fluids and chemicals industry is set for steady growth over the next decade, fueled by renewed focus on domestic energy sourcing, technology-enabled drilling solutions, and demand for advanced well-stimulation systems. According to the latest industry analysis by Fact.MR, the market is projected to expand from USD 1.00 billion in 2025 to approximately USD 1.23 billion by 2035, registering a CAGR of 2.1%, while recording an absolute growth of USD 0.23 billion during the forecast period.

This growth reflects increasing interest in high-performance fracturing chemistries, customization of fluid formulations for complex geology, and the need for efficient and environmentally compliant stimulation operations in the UK energy landscape.

Strategic Market Drivers

Focus on Domestic Energy Security

Amid global energy volatility, domestic exploration remains an area of national interest to reduce dependency on external fuel supply. Fracking fluids and stimulation chemicals play a critical role in unlocking unconventional reserves by ensuring optimized fracturing performance, reduced formation damage, and improved hydrocarbon flow rates.

Advancements in Green & High-Performance Fluid Systems

Growing R&D momentum around low-toxicity fluid additives, biodegradable friction reducers, advanced surfactants, and water-efficient formulations is supporting the development of next-generation fracturing chemistries. Operators are increasingly opting for innovative fluid formulations that balance performance, sustainability, and regulatory compliance.

Browse Full Report: https://www.factmr.com/report/united-kingdom-fracking-fluids-and-chemicals-industry-analysis

Need for Chemicals Optimized for UK Geology

The UK’s complex shale basins require custom fluid chemistries with strong proppant suspension, thermal stability, corrosion control, and scaling resistance. This has elevated demand for tailor-made crosslinkers, clay stabilizers, demulsifiers, biocides, and iron control agents designed for local subsurface conditions.

Regulatory Emphasis on Environmental Compliance

UK environmental policies and oversight frameworks are pushing demand for non-hazardous chemical additives, wastewater treatment chemicals, and emissions-reducing fluid constituents. This has accelerated interest in closed-loop fluid systems and safer chemical alternatives to align with sustainability goals.

Regional Insights

England: Primary Zone of Unconventional R&D & Pilot Activities

England remains the focal geography for shale resource assessments, test-well operations, and fluid development programs in major shale-potential areas. Fluid design innovation and chemical sourcing activities continue to expand across research-supported unconventional hubs.

Scotland & North Ireland: Geological Evaluation & Environmental-Compliant Fluid Trials

While commercial hydraulic fracturing activity remains limited, these regions are witnessing continuous fluid trials, academic collaboration programs, and environmental impact assessments, supporting future-ready chemical development and cleaner fracturing formulations.

Market Segmentation Insights

By Product Type

- Water-Based Fracking Fluids – Largest segment due to ease of formulation, cost efficiency, and environmental alignment.

- Foam-Based & Gelled Fluids – Growing adoption driven by water-saving trends and enhanced proppant transport capability.

- Oil-Based Fluids – Niche deployment for specific geological conditions requiring higher fluid stability.

By Chemical Type

- Friction Reducers – Dominant supported by demand for improved pumping efficiency.

- Surfactants & Gelling Agents – High demand due to UK shale complexity.

- Biocides, Corrosion Inhibitors & Scale Control Agents – Strong adoption due to subsurface challenges.

- pH Adjusters & Iron Control Chemicals – Steadily rising to improve fluid system stability.

By End Use

- Onshore Drilling – Primary segment

- Research & Fluid Testing Labs – Rapidly expanding due to academic and industrial collaboration

- Water & Waste-Treatment Facilities – Growing demand supported by environmental requirements

Challenges Impacting Market Growth

Policy Uncertainty around Commercial Fracturing

Changing regulatory and political dynamics surrounding shale drilling remain a challenge, temporarily limiting large-scale deployment of fracking chemicals in field operations.

Environmental Sensitivities and Public Concerns

Community resistance and environmental considerations have shifted focus toward chemical safety, water management, and recycling-based fluid chemistries, requiring additional R&D and compliance investments.

Import Dependency for Specialized Fluid Additives

Limited domestic production of specific stimulation chemicals has increased reliance on imported additives, creating supply chain bottlenecks and pricing pressure.

Competitive Landscape

The UK market for fracking fluids and stimulation chemicals is moderately consolidated, with companies driving innovation through clean-chemistry fluid systems, polymer-efficiency improvements, proppant transport enhancers, and wastewater treatment additives.

Key Companies Active in the UK Market

- Baker Hughes

- Halliburton Company

- Schlumberger

- BASF SE

- Dow Inc.

- Innospec

- Croda International

- Solvay

- Clariant

- Chemours

Industry players are increasing investments in:

- Low-carbon stimulation chemicals

- Hybrid and water-efficient fracturing fluids

- Rare-earth and synthetic alternative additives

- Chemical recycling and produced-water treatment tech

- Performance-driven fluid customization for UK shale formations

Recent Developments

- 2024: Deployment of laboratory-tested low-impact fracturing additives aligned with UK environmental compliance goals.

- 2023: Chemical suppliers scale friction reducer portfolios to improve pumping efficiency and reduce water stress.

- 2022: Pilot fluid recycling programs gain momentum, increasing demand for chemical treatment additives for reused fluids.

Future Outlook: Innovation for Efficiency and Sustainability

The next decade will witness gradual but important transformation in UK fracking fluid chemistry, driven by:

- National energy security considerations

- Water-saving fracturing technologies

- Low-toxicity and biodegradable chemical additives

- Closed-loop fluid ecosystems

- Increasing collaboration between chemical suppliers and UK drilling research institutions

As the UK evaluates the role of unconventional energy in its long-term strategy, demand for safe, efficient, and high-performance fracking fluids and chemicals will continue to grow steadily through 2035.