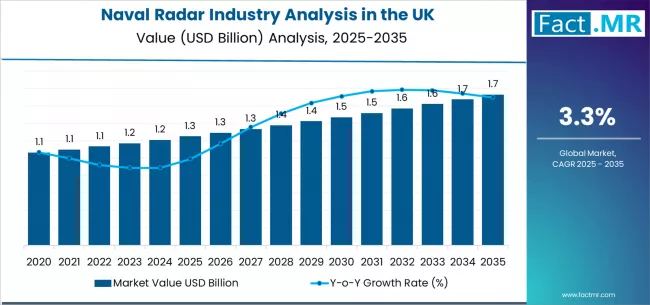

The UK’s naval radar industry is on the cusp of a significant expansion over the coming decade. New analysis indicates that market value will rise from approximately USD 1.25 billion in 2025 to about USD 1.73 billion by 2035 — a total increase of USD 0.48 billion (≈ 38.4% growth), representing a compound annual growth rate (CAGR) of ~3.3%.

This growth underscores a broader shift: the UK is deepening its commitment to upgrading maritime defense capabilities, integrating advanced radar technologies, and strengthening naval surveillance and threat detection standards.

Market Dynamics & Segment Trends

📡 Technology & Band Type Leadership

-

The S/X-band remains the dominant frequency band in 2025, accounting for nearly 47.8% of total radar deployments in the UK. The S/X-band’s mix of long-range detection capability and high-resolution target tracking continues to match operational requirements for surveillance, navigation, and multi-role naval missions.

-

On the technology front, Active Electronically Scanned Array (AESA) radars lead the pack — representing ~52.6% share of demand in 2025. The agility, multi-function performance, and electronic warfare resilience of AESA systems make them increasingly preferred over legacy mechanically scanned arrays or passive systems.

These technological and spectral preferences reflect a long-term strategy: delivering multi-role capability, scalability, and future-proof integration for modern warships and maritime security platforms.

📈 Growth Phases: 2025–2030 vs 2030–2035

-

From 2025 to 2030, the market is forecast to grow from USD 1.25 B to ≈ USD 1.46 B, contributing roughly 44% of the total projected growth. This phase will be largely driven by initial fleet upgrades — including retrofits of existing platforms with modern radar suites — and new vessel builds under naval modernisation programs.

-

Between 2030–2035, growth gains accelerate, with the market rising from USD 1.46 B to ≈ USD 1.73 B, delivering the remaining 56% of the decade’s expansion. During this period, demand is expected to surge for premium radar integrations — especially AESA-based systems and next-generation surveillance solutions — reflecting a wave of fleet renewal, advanced vessel commissioning, and expanded maritime security operations.

What’s Driving the Surge?

• Naval Modernisation & Fleet Renewal

The UK is actively modernising its naval fleet, replacing or upgrading legacy radar systems across frigates, destroyers, patrol vessels, and support ships. As navies worldwide face evolving challenges — from asymmetric threats to maritime surveillance and regional instability — radar upgrades are becoming central to maintaining operational edge.

• Growing Demand for Multi-role & Electronic-Warfare-Ready Radar Systems

Modern naval operations require radars that not only detect surface and air threats, but also offer electronic-warfare resistance, multi-target tracking, and integration with broader combat and sensor systems. AESA radars — with their speed, flexibility, and precision — are meeting these demands, leading to rising adoption rates.

• Heightened Maritime Security & Surveillance Standards

Increasing geopolitical volatility, maritime border security concerns, and the need for continuous maritime domain awareness are prompting navies to invest in robust radar systems. The drive is towards comprehensive surveillance, early-warning capabilities, tracking, and target detection, across patrols, fleet escort missions, and coastal defence operations.

• Regulatory & Strategic Impacts of Defence Autonomy

Post-Brexit shifts and the evolving landscape of European defence cooperation have encouraged the UK to strengthen self-reliance in defence systems. This strategic push favors domestic procurement, local system integration, and long-term upgrades — driving demand for radar manufacture, supply, and maintenance within the UK naval sector.

Challenges & Considerations

Despite the positive outlook, some factors could temper the pace of growth:

-

High Cost and Integration Complexity: Advanced radar systems — especially AESA-based — involve substantial R&D, procurement, and integration costs. Retrofitting older vessels or integrating with legacy systems can pose technical and budgetary challenges.

-

Procurement Cycles & Defence Budget Fluctuations: Naval radar acquisition is often linked to broader defence budgets, which may vary year to year depending on political priorities and economic factors. Any downturn or reallocation could impact timelines and volume of radar orders.

-

Supply Chain & Technology Export Controls: Radar systems involve sensitive technologies. Export controls, supply-chain bottlenecks, and regulatory compliance can influence delivery schedules, component sourcing, and maintenance support — particularly where international collaborations or export-ready designs are concerned.

Opportunities & Strategic Implications

Given the robust forecast and shifting strategic environment, the coming decade offers several clear opportunities for stakeholders across the defence ecosystem:

-

Manufacturers & Defence Contractors — There is a strong opportunity to invest in AESA development, modular radar architectures, and upgrade kits for retrofit projects. Suppliers who can offer scalable, upgrade-friendly radar solutions stand to gain.

-

Naval Forces & Procurement Agencies — Staggered fleet upgrades and phased integrations can optimize budget allocations — starting with high-priority vessels and gradually extending across the fleet.

-

After-market & Maintenance Services — As radar deployments expand, demand for lifecycle support, maintenance, periodic upgrades, and spares will grow — creating a stable recurring-revenue segment.

-

Collaborative Defence Programmes & Exports — The UK’s strong naval infrastructure and evolving radar capability can position it as a supplier of system upgrades or turn-key radar solutions to allied or partner navies.

-

R&D and Innovation Hubs — There’s room for innovation in radar processing, electronic-warfare resilience, software-defined radar, and integration with data-fusion systems. Early-movers in research may shape the next generation of naval surveillance technology.

Browse Full Report : https://www.factmr.com/report/united-kingdom-naval-radar-industry-analysis

Conclusion

The UK naval radar industry is on a steady but strategic growth path between 2025 and 2035. With demand rising from USD 1.25 billion to approximately USD 1.73 billion, the market reflects both the immediate imperative of fleet modernization and the long-term shift toward increasingly sophisticated maritime surveillance.

Advancements such as AESA technology, growing S/X-band radar deployment, and increasing naval security requirements signal a transformation in how the UK — and potentially other allied navies — will approach radar infrastructure. For defense contractors, shipbuilders, and radar suppliers, this decade offers notable opportunities to contribute, innovate, and consolidate positioning.

As geopolitical tensions, maritime security demands, and technological evolution accelerate, naval radar systems are likely to remain at the heart of future maritime defense strategy. The next ten years will be crucial: shaping not only the naval radar market, but also the broader maritime security posture of the UK and its allies.