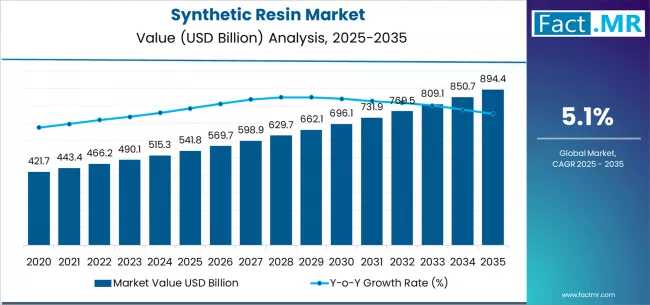

The global synthetic resin market is entering a high-growth decade, projected to expand from an estimated USD 541.8 billion in 2025 to USD 894.4 billion by 2035, advancing at a 5.1% compound annual growth rate (CAGR). The industry is experiencing robust momentum as synthetic resins become increasingly essential in packaging, automotive engineering, construction, and electrical applications.

Driven by rapid industrialization, a global shift toward lightweight materials, and major advancements in sustainable and high-performance polymer technologies, synthetic resins continue to solidify their position as a backbone of modern manufacturing.

Packaging and Automotive Lead Market Growth

The packaging industry remains the single largest consumer of synthetic resins, accounting for over 42% of global demand. Growth in e-commerce, the expansion of FMCG sectors, and a rising push toward protective and functional packaging solutions are accelerating resin usage in flexible films, rigid containers, closures, laminates, and barrier layers.

Automotive manufacturers represent the second-largest user base, contributing about 24% of total resin consumption. Automakers are increasingly substituting metals with advanced resin-based materials that reduce component weight by up to 40–60%, improving fuel efficiency and supporting electric vehicle (EV) performance.

High-performance resin composites are gaining traction in structural and under-the-hood applications, contributing significantly to vehicle lightweighting targets and emissions compliance.

Market Segmentation

By Form: Solid Resins Dominate

Solid-form resins account for roughly 71–72% of the total market. They are integral in the production of molded components, coatings, adhesives, packaging materials, and industrial composites. Their strength, durability, and compatibility with efficient manufacturing processes have contributed to their widespread adoption.

By Product Type: Thermosetting Resins Lead

Thermosetting resins represent approximately 77% of market volume. Industries rely on them for their superior heat resistance, dimensional stability, and structural integrity. Meanwhile, thermoplastic resins continue to gain ground, supported by increasing demand for recyclable and circular-economy-ready materials.

By Region: Asia-Pacific Remains the Powerhouse

The Asia-Pacific region dominates the global landscape with nearly 48% of total synthetic resin consumption. This leadership is fueled by:

-

Expanding manufacturing ecosystems in China, India, Vietnam, and Indonesia

-

Booming packaging and consumer goods sectors

-

Growth in automotive and electronics production

-

Strong government support for industrialization and infrastructure

India stands out as one of the fastest-growing markets, expected to grow at over 6% CAGR through 2035.

Key Drivers Steering the Market Forward

1. Lightweighting and High-Performance Adoption

Industries across automotive, aerospace, construction, and electronics are shifting from traditional metals to high-performance polymer resins. Manufacturers are achieving weight reductions of as much as 60%, enabling measurable improvements in energy efficiency, durability, and performance.

Advanced epoxy, polyurethane, phenolic, and polyester resins are increasingly found in aircraft interiors, wind turbine blades, vehicle chassis components, and high-temperature equipment.

2. Acceleration of Sustainability and Circular-Economy Solutions

Growing environmental commitment has triggered an increased focus on:

-

Recycled-content resin blends

-

Bio-based resins with significantly lower carbon footprints

-

Monomaterial packaging for easier recycling

-

Resins engineered for low-VOC coatings and adhesives

Bio-based resin innovations are positioned to reduce carbon impact by up to 30%, while thermoplastics are benefiting from global investments in recycling infrastructure.

3. Industrial Growth Across Emerging Economies

Countries across Asia, Latin America, and the Middle East are ramping up production capacity in automotive parts, packaging materials, consumer appliances, and infrastructure development. This industrial surge directly increases resin consumption, particularly for PVC, polyethylene, polyurethane, and engineering thermoplastics.

Challenges: Raw Material Volatility and Environmental Pressure

While the outlook is robust, the industry faces several challenges:

-

Fluctuating petrochemical feedstocks, since most resins are derived from petroleum

-

Increasing environmental regulations around plastics, additives, and emissions

-

Capital-intensive manufacturing requirements for advanced or specialty resins

-

Pressure to adopt clean-chemistry processes and sustainable production technologies

As a result, resin producers are prioritizing R&D investments, feedstock diversification, and modernization of manufacturing lines to maintain competitiveness.

Forecast: 2025–2035 Market Outlook

Projections suggest steady growth through 2030 as resin usage strengthens in packaging and transportation. Market value is expected to reach roughly USD 695.2 billion by 2030, supported by innovations in recyclable packaging, EV component manufacturing, and eco-friendly construction materials.

Between 2030 and 2035, accelerated development of:

-

high-temperature engineering resins

-

lightweight structural composites

-

high-barrier food and pharma packaging resins

-

bio-based and recycled-content resin lines

will push the industry toward its forecasted USD 894.4 billion valuation.

Strategic Opportunities for Industry Stakeholders

Manufacturers

Can leverage demand for lightweight, high-barrier packaging solutions by expanding into monomaterials, advanced films, and eco-friendly formulations.

Automotive & EV OEMs

Should continue investing in resin-based structural parts, interiors, and battery system housings — particularly for next-generation EV platforms.

Chemical & Resin Producers

Have high-value opportunities in bio-based polymers, specialty thermosets, and high-performance engineering plastics.

Investors

Will find strong ROI potential in Asia-Pacific markets, where industrial growth and manufacturing expansions are reshaping global supply chains.

Browse Full Report : https://www.factmr.com/report/synthetic-resin-market

Conclusion

The synthetic resin market is not only expanding — it is transforming. With strong momentum across packaging, automotive, construction, and electronics, global market value is set to rise from USD 541.8 billion in 2025 to USD 894.4 billion by 2035. Sustainability initiatives, lightweighting, and rapid industrialization will shape market dynamics over the next decade, creating new opportunities for producers, manufacturers, and investors worldwide.