The global allulose market is gaining strong momentum as food and beverage manufacturers shift toward clean-label, low-calorie, and sugar-reduced formulations. Allulose—a rare, naturally occurring sweetener—delivers about 70% sweetness of sucrose with only 0.2–0.4 kcal per gram, making it one of the most attractive alternatives to sugar. Its functional performance in bakery, beverages, dairy, confectionery, and sports nutrition continues to expand, supported by rising health-conscious consumer behavior.

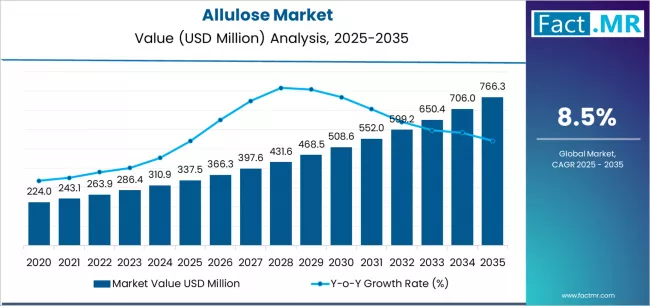

According to recent industry intelligence, the market is projected to grow from USD 420 million in 2025 to nearly USD 1.32 billion by 2035, translating into a robust CAGR of around 12.1% during the forecast period.

Key Market Highlights

2025 Market Size: USD 420 million

2035 Forecast: USD 1.32 billion

Projected CAGR (2025–2035): ~ 12.1%

Top Product Type: Powdered allulose (approx. 52%)

Top Application: Bakery & confectionery (about 36%)

Major Players: Ingredion, Tate & Lyle, Matsutani Chemical, CJ CheilJedang, Samyang

Leading Regions: North America, East Asia, Europe

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=11848

Major Growth Drivers

1. Surge in Sugar Reduction & Clean-Label Demand

The global shift toward low-calorie, diabetic-friendly, and keto-compatible foods is fuelling the adoption of allulose. As consumers reduce refined sugar intake, brands are replacing conventional sweeteners with allulose due to its low glycemic impact and clean-label positioning.

2. Expanding Use in Bakery, Dairy & Beverages

Allulose acts similarly to sugar in browning, texture formation, and moisture retention, making it highly functional across bakery goods, pastries, chocolates, ice-creams, yogurts, and ready-to-drink beverages. This drives large-scale adoption among CPG manufacturers reformulating classic products.

3. Favorable Regulatory Support in Key Markets

Positive regulatory decisions in the U.S. and select international markets—such as its exclusion from “added sugar” labeling and recognition as safe—have significantly boosted commercial interest and product launches.

4. Rise of Keto, Low-Carb & Diabetic Diets

Health trends emphasizing metabolic wellness, weight control, and sugar moderation make allulose a preferred ingredient for keto snacks, sports nutrition, protein bars, and functional beverages. Its negligible caloric contribution enhances its attractiveness.

5. Functional Benefits Beyond Sweetness

Allulose enhances product mouthfeel, improves freeze-point depression in frozen desserts, and supports moisture management in baked goods. Its multi-functional role gives it an edge over many alternative sweeteners.

Challenges & Risks

High Production Costs:

Allulose manufacturing—especially via enzymatic conversion or rare-sugar extraction—remains cost-sensitive, which increases product pricing for downstream users.

Raw Material Limitations:

Dependence on feedstocks like fructose or corn increases supply volatility and cost fluctuations.

Lack of Awareness in Emerging Markets:

While adoption is strong in North America and developed Asia, awareness of allulose remains limited in Latin America, Africa, and parts of Europe.

Competition from Established Sweeteners:

Stevia, monk fruit, and polyols like erythritol maintain strong market presence, requiring allulose suppliers to demonstrate superior functionality and taste advantages.

Competitive Landscape & Strategic Moves

Key companies in the allulose market are intensifying innovation, scaling production, and forming global partnerships:

Ingredient Innovation

Firms are improving purity levels, reducing off-notes, and developing blended solutions that combine allulose with stevia or monk fruit for enhanced sweetness profiles.

Capacity Expansion

Major manufacturers are investing in large-scale enzymatic production facilities to reduce costs and meet rising demand from beverage, confectionery, and sports nutrition brands.

Collaborations with F&B Companies

Ingredient suppliers are co-developing formulations for sugar-free chocolates, bakery products, ready-to-drink beverages, and frozen desserts.

Focus on Regulatory Approvals

Companies are working with regulators to expand geographic approvals, particularly across Europe and Asia.

Strategic Recommendations

1. Optimize Cost Efficiency:

Invest in advanced enzyme technology and fermentation processes to lower production costs and expand scalability.

2. Accelerate Innovation in Blends:

Develop allulose-based blends for high-intensity sweetness and improved flavor profiles, especially for beverages and confectionery.

3. Target Functional Food Categories:

Focus on high-growth segments like protein bars, sports drinks, keto snacks, and diabetic-friendly foods.

4. Strengthen Consumer Education:

Promote allulose’s safety profile, low glycemic impact, and metabolic benefits through brand partnerships and product labeling clarity.

5. Expand Geographic Reach:

Prioritize market entry in Europe, Southeast Asia, and the Middle East through regulatory engagement and local collaborations.

Market Outlook

The allulose market is set for strong expansion through 2035, driven by health-conscious consumers, supportive regulatory frameworks, and rapid product innovation. With an expected market size of USD 1.32 billion by 2035, allulose is positioned to become one of the most influential sweeteners in the global F&B landscape.

Companies investing in advanced production technologies, strategic partnerships, and consumer-oriented product development will be best positioned to lead in this rapidly evolving market.

Browse Full Report: https://www.factmr.com/report/allulose-market