The Methacrylate Butadiene Styrene (MBS) market in the United Kingdom is demonstrating steady growth, bolstered by the country’s advanced manufacturing footprint, automotive innovation, and demand for high-performance engineering plastics. As sustainability agendas and lightweight design pressures increase, MBS is carving out a stronger role in UK polymer applications.

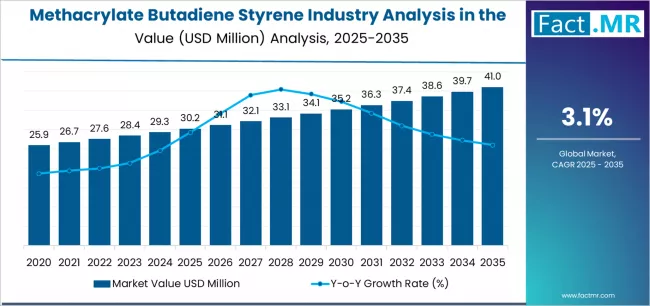

Recent market intelligence suggests that the UK MBS market is set to grow from USD 30.2 million in 2025 to around USD 41.0 million by 2035, implying a compound annual growth rate (CAGR) of about 3.1%.

Key Market Highlights

-

2025 Market Value: ~ USD 30.2 million

-

2035 Forecast Value: ~ USD 41.0 million

-

Projected CAGR (2025–2035): ~ 3.1%

-

Leading Application: Automotive parts (~ 46% of UK demand)

-

Dominant Grade: Extrusion-grade MBS (~ 58% share)

-

Regional Drivers: Strongest demand centers include England, Scotland, Wales, and Northern Ireland—with England leading.

-

Key Suppliers: Major players active in UK or supplying into it: LG Chem, BASF, INEOS Styrolution, Dow, Toray, Chi Mei.

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=11835

Growth Drivers

Automotive Lightweighting & Impact Performance

In the UK, the automotive sector remains a critical user of MBS. As manufacturers strive to reduce vehicle weight (especially for EVs), MBS offers a compelling mix of impact resistance, design flexibility, and processing compatibility. These qualities make MBS an attractive choice for components such as exterior trims, interior parts, and safety-related structures.

Construction & PVC Applications

MBS is widely used as an impact modifier in PVC. Thanks to its ability to enhance transparency and toughness, MBS strengthens PVC profiles used in construction—windows, siding, and other rigid applications.

Sustainability Pressure & Bio-Based Innovation

There is a growing push toward sustainable polymer solutions. Across the global MBS landscape, bio-based alternatives are emerging, and UK players are increasingly considering recycled or low-residual monomer grades. This shift aligns well with UK regulatory scrutiny and circular-economy goals.

Advanced Manufacturing & Local Supply Chains

Specialty polymer compounders and resin suppliers are investing in UK or Europe-aligned manufacturing and compounding capabilities. By localizing compounding operations, companies reduce lead times, improve quality control, and tailor MBS grades to the specific needs of UK’s automotive and industrial sectors.

Demand for High-Performance Grades

New product developments—from high-clarity MBS to grades with improved impact strength—are pushing demand. UK manufacturers looking for both mechanical robustness and optical properties find MBS increasingly attractive.

Challenges & Key Risks

-

Raw Material Volatility: MBS production depends heavily on petrochemical feedstocks like butadiene, styrene, and methyl methacrylate. Price fluctuations in these monomers can significantly affect production costs.

-

Competition from Alternatives: Other impact modifiers—such as chlorinated polyethylene (CPE), acrylic impact modifiers, or other copolymers—can compete with MBS, especially in cost-sensitive or specialized applications.

-

Regulatory & Environmental Pressure: Stricter environmental regulations around production emissions, monomer residuals, and recycling may squeeze margins or require higher investment in sustainable grade development.

-

Maturity of Market: The UK MBS market is relatively stable and mature, limiting opportunities for rapid growth unless novel or differentiated grades are developed.

Competitive Landscape & Strategic Positioning

Major MBS producers are adopting several strategies to remain competitive in the UK market:

-

Grade Innovation: Suppliers are developing high-performance MBS variants tailored to automotive (e.g., crash-relevant components), construction, and specialty industrial needs.

-

Sustainable Resin Development: There is increasing investment in recycled-content MBS and low-residual monomer grades to align with environmental regulations and OEM sustainability goals.

-

Localized Compounding: Building or strengthening compounding facilities in or near the UK enables quicker supply, better quality control, and custom formulations.

-

Partnerships with OEMs: Resin producers are collaborating with automotive manufacturers and tier suppliers to co-develop MBS formulations optimized for EVs, trim, and structural parts.

-

Circular Economy Initiatives: Some companies are working with recyclers and polymer recovery firms to establish closed-loop systems for MBS-containing components.

Strategic Recommendations

-

Accelerate Development of Sustainable MBS: Focus on bio-based or recycled MBS variants that meet both performance and regulatory criteria.

-

Deepen Engagement with Automotive OEMs: Promote custom MBS grades optimized for EVs, safety components, and high-performance trims.

-

Expand Local Compounding Footprint: Establish or expand compounding operations in the UK (or nearby) to reduce lead times and better respond to customer needs.

-

Support Recycling Infrastructure: Partner with recycling companies and policymakers to develop recovery systems for MBS-modified plastics.

-

Invest in R&D for High-Clarity and High-Impact Grades: Cater to evolving markets like premium PVC, electronics housing, and specialty consumer goods.

Outlook

The UK MBS market is on a steady-growth path, driven by longstanding automotive demand, evolving performance requirements, and rising sustainability ambitions. With a projected value of USD 41.0 million by 2035, the market is set to expand at a 3.1% CAGR.

MBS is increasingly valued in the UK for its ability to enable lighter, more durable, and high-performing plastic parts. Companies that invest in sustainable formulations, locally optimized production, and collaborative partnerships with OEMs will be best positioned to lead in the coming decade.

Browse Full Report: https://www.factmr.com/report/united-kingdom-methacrylate-butadiene-styrene-industry-analysis