The global Lyme disease testing market is entering a powerful growth phase, propelled by increasing incidence of tick-borne infections, heightened public health awareness, and rapid innovation in diagnostic technologies. Increasing investments in infectious disease screening, early detection initiatives, and healthcare infrastructure modernization are expected to fuel the market through 2035.

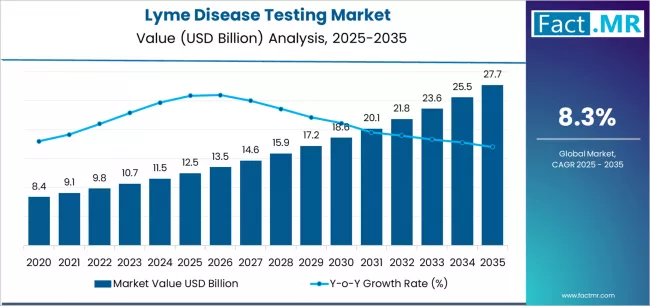

According to recent market intelligence, the Lyme disease testing industry is projected to grow from approximately USD 12.49 billion in 2025 to USD 27.65 billion by 2035, achieving a compound annual growth rate (CAGR) of around 8.3%.

Key Market Highlights

-

2025 Market Size: ~ USD 12.49 billion

-

2035 Forecast Value: ~ USD 27.65 billion

-

Projected CAGR (2025–2035): ~ 8.3%

-

Leading Technology: Conventional serological methods (e.g., ELISA, Western Blot)

-

Dominant Testing Method: Serological tests (~ 53.1% share)

-

Primary Sample Type: Blood (~ 62.4% of tests)

-

Top End-User: Hospitals (~ 58.4%)

-

Key Regions: North America, Europe, Asia Pacific

-

Major Players: DiaSorin S.p.A, bioMérieux, Oxford Immunotec, Bio-Rad, Thermo Fisher Scientific

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=11830

What’s Fueling Growth

Rising Prevalence & Public Health Focus

Lyme disease—caused by the bacterium Borrelia burgdorferi and transmitted by tick bites—is gaining global attention. As tick populations expand and climate change shifts their geographic range, more patients are at risk. These trends are pushing healthcare systems to expand testing capacity, both to treat symptomatic patients and to support broader disease surveillance.

Need for Early & Accurate Diagnosis

Traditional clinical diagnosis of Lyme disease can be challenging—symptoms are often non-specific, and antibody responses may take time to develop. Diagnostic testing, especially serological assays, provides critical confirmation. There is also growing demand for newer platforms that boost specificity and reduce false positives, as misdiagnosis can lead to inappropriate treatment.

Technological Innovation

While conventional serological assays remain dominant, novel diagnostics are gaining ground. Emerging IGRA-based tests (which measure T-cell response) are capturing interest for their potential to improve specificity and reduce cross-reactivity. On another front, molecular methods such as PCR or other nucleic acid tests are being developed to detect the pathogen directly during acute infection, promising earlier detection.

Multiplex & High-Throughput Testing

Demand is also growing for multiplex diagnostics that can screen multiple tick-borne pathogens simultaneously. This is especially critical in regions with co-infections. High-throughput, automated immunoassay platforms are also being adopted by large hospital labs and reference centers to streamline workflows and manage growing testing volumes.

Healthcare Infrastructure & Awareness

Hospitals remain the biggest users of Lyme tests due to their capacity to manage infectious disease diagnostics, integrate them into broader clinical care, and run confirmatory tests. In addition, public health campaigns and physician education are raising awareness, driving more patients to get tested at earlier stages.

Market Segmentation

-

Technology

-

Conventional serological (e.g., ELISA, Western Blot) — largest share

-

IGRA-based testing — emerging

-

-

Testing Method

-

Serological tests (antibody detection)

-

Nucleic acid tests (DNA/RNA detection)

-

Others (antigen tests, etc.)

-

-

Sample Type

-

Blood (dominant)

-

Urine

-

Cerebrospinal fluid (CSF)

-

Others

-

-

End-User

-

Hospitals (largest)

-

Diagnostic laboratories

-

Research institutes

-

Other settings

-

-

Geography

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Challenges & Risks

-

Diagnostic Complexity and Interpretation: Serological testing can yield false positives due to cross-reactivity, and timing of sample collection relative to infection affects sensitivity. Clinicians must interpret results carefully, which places a high burden on lab and medical staff.

-

Regulatory & Reimbursement Barriers: Testing costs and insurance coverage vary widely. In some markets, patients may face out-of-pocket costs, slowing adoption.

-

Emerging Platform Barriers: While IGRA and molecular tests are promising, they require more sophisticated lab infrastructure, trained personnel, and validation against established standards.

-

Competition from Unregulated Tests: There is some concern in the market about unapproved or poorly validated Lyme tests being offered, which could undermine trust in diagnostic platforms.

Competitive Landscape & Strategic Positioning

Leading diagnostic companies are innovating across multiple fronts:

-

Expanding assay portfolios with both conventional and novel Lyme test platforms.

-

Partnering with hospital systems and public health bodies to integrate Lyme diagnostics into broader infectious disease programs.

-

Investing in R&D to validate IGRA and molecular assays with higher accuracy, faster turnaround, and robust clinical performance.

-

Building scalable, automated platforms for large healthcare laboratories.

Key players—such as DiaSorin, bioMérieux, Oxford Immunotec, Bio-Rad, and Thermo Fisher—are competing not just on the basis of test accuracy, but also on service support, regulatory approval, and clinical validation networks.

Strategic Recommendations

-

Promote IGRA & Molecular Adoption: Encourage diagnostic labs and public health agencies to invest in emerging Lyme testing platforms that offer better specificity and early detection.

-

Strengthen Clinical Evidence: Prioritize clinical studies that demonstrate real-world performance, especially in complex cases (e.g., early infection, co-infections, persistent symptoms).

-

Enhance Access Through Hospitals: Deepen partnerships with hospital labs and infectious disease centers to scale up testing capacity and integrate Lyme diagnostics into routine care.

-

Educate Stakeholders: Conduct physician training, patient awareness programs, and guideline development workshops to drive earlier testing and more appropriate use of assays.

-

Focus on Quality & Regulation: Work with regulatory agencies and payers to ensure assays meet high-quality standards, are reimbursable, and gain clinical acceptance.

Browse Full Report: https://www.factmr.com/report/lyme-disease-testing-market

Outlook

By 2035, the Lyme disease testing market is poised to more than double compared to 2025 levels, reflecting both urgent clinical need and advancing diagnostic capabilities. As conventional serological assays continue to serve as the backbone of testing, newer technologies like IGRA and molecular diagnostics are set to significantly shape the competitive landscape.

With heightened tick-borne disease risk, greater public health investment, and deepening diagnostic sophistication, companies that can deliver accurate, high-throughput, and clinically validated tests are likely to lead this transformative growth. The future of Lyme disease testing lies in early detection, integrated testing strategies, and scalable platforms that align with global health priorities.