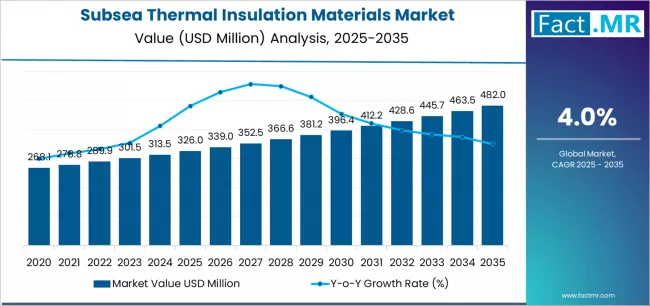

The global subsea thermal insulation materials market is poised for steady growth over the next decade, fueled by rising offshore oil & gas developments, increasing deepwater and ultra-deepwater drilling activities, and mounting demand for flow assurance solutions in harsh marine environments. According to the latest study by Fact.MR, the market is projected to expand from USD 326.0 million in 2025 to approximately USD 482.0 million by 2035, marking an absolute increase of USD 156.0 million over the forecast period.

This represents a total market growth of 47.9%, with adoption set to rise at a compound annual growth rate (CAGR) of 4.0% from 2025 to 2035 as energy operators prioritize pipeline integrity, temperature stability, and long-term subsea performance.

The accelerating push toward extended offshore infrastructure, coupled with technological innovations in insulation materials, is reshaping global market demand for subsea thermal protection systems.

Browse Full Report: https://www.factmr.com/report/subsea-thermal-insulation-materials-market

Strategic Market Drivers

Deepwater & Ultra-Deepwater Projects Propel Demand

Growing energy consumption and declining onshore reserves are shifting exploration toward deep and ultra-deep offshore assets. Subsea thermal insulation materials play a vital role in sustaining target temperatures for pipelines, risers, jumpers, and subsea production systems, ensuring optimized hydrocarbon flow and preventing blockages caused by hydrates or wax deposition.

As offshore energy operators scale long-distance subsea tiebacks and high-temperature, high-pressure (HTHP) installations, demand for reliable insulation materials is rising across the globe.

Flow Assurance & Asset Protection Prioritized

Critical subsea applications require advanced insulation capabilities such as:

- Heat retention for crude and gas transfer lines

- Hydrate and wax formation prevention

- Corrosion resistance and mechanical protection

- Performance stability under extreme ocean pressures

These properties are positioning high-performance insulation solutions at the core of offshore production reliability strategies.

Offshore Renewable and Hybrid Energy Systems Gain Momentum

Beyond oil & gas, new opportunities are emerging with offshore wind, floating solar, subsea power cables, and hybrid energy networks, all requiring temperature-stable insulation solutions for improved durability and performance. This diversification is expanding the adoption potential of advanced insulation materials in next-gen marine energy infrastructure.

Advancements in Syntactic Foams & Polymeric Insulation

Continuous R&D in insulation technologies—including improved syntactic foams, elastomers, advanced polymers, and nano-enhanced insulation composites—has increased service lifespan, reduced material weight, and enhanced thermal efficiency.

Regional Market Highlights

North America: Strong Offshore Oil & Gas and Technological Innovation

The Gulf of Mexico continues to be a major adoption hub, supported by active deepwater exploration and increasing investments in insulation materials for long-distance subsea pipelines. The region is also witnessing increased experimentation with thermally efficient subsea foams and composite insulation structures.

Europe: North Sea Maturity and Renewable Offshore Integration

Europe maintains steady demand due to pipeline rehabilitation in the North Sea and expansion of offshore wind and hybrid energy networks. Countries including the U.K., Norway, and the Netherlands are integrating advanced insulation materials to improve system efficiency and withstand cold-water operational challenges.

Asia Pacific: Rising Exploration and Offshore Production Investments

Countries such as China, Malaysia, Indonesia, India, and Australia are expanding offshore production footprints, driving insulation material demand for subsea process equipment, umbilicals, and hydrocarbon pipelines. The rapid growth of offshore energy infrastructure in Southeast Asia is creating lucrative insulation adoption avenues.

Middle East & Africa: Growing Offshore Mega-Projects

Increasing offshore developments in Saudi Arabia, Qatar, UAE, and West Africa, coupled with investments in HTHP subsea pipelines, are supporting long-term growth demand for durable, corrosion-resistant insulation materials.

Market Segmentation Insights

By Material Type

- Polymeric Insulation – Widely preferred for corrosion resistance and stability

- Syntactic Foams – Strong adoption for deepwater buoyancy and insulation

- Elastomers & Advanced Composites – Growing usage in flexible subsea systems

- Aerogels – Emerging but high-value potential for ultra-thermal performance

By Application

- Pipelines & Flowlines – Largest segment for flow assurance needs

- Risers & Umbilicals – High demand due to HTHP offshore systems

- Subsea Process Equipment – Increasing thermal control adoption

- Offshore Renewables & Power Systems – Rapidly emerging segment

Key Market Challenges

Material Cost and Project Budget Pressures

Premium subsea insulation materials incur higher costs for extreme-condition readiness, affecting adoption in budget-sensitive offshore projects.

Harsh Operational Environment

Extreme ocean depths, pressures, salinity, and fluctuating thermal conditions demand continued material innovation to maintain long-term reliability.

Competitive Landscape

The market includes a balanced mix of global insulation manufacturers and offshore engineering material specialists focusing on:

- HTHP ready insulation composites

- Lightweight thermal syntactic foam systems

- Corrosion-resistant subsea polymers

- Sustainable and recyclable insulation alternatives

Notable Companies Operating in the Market

- Trelleborg AB

- BASF SE

- 3M Company

- Huntsman Corporation

- Dow Inc.

- Cabot Corporation

- Shawcor Ltd.

- Oceaneering International

- TechnipFMC PLC

Recent Industry Trends

- 2024: Increased integration of syntactic foams for combined insulation and buoyancy accuracy.

- 2023: Offshore pipeline projects adopt polymer-elastomer hybrid insulation solutions for improved thermal damping.

- 2022: Emerging insulation composite trials support rare-earth-free thermal formulations.

Future Outlook Through 2035

The subsea thermal insulation materials market is set to evolve with strong emphasis on:

- Expanded deep and ultra-deep offshore hydrocarbon systems

- Offshore renewables and hybrid energy networks

- Lightweight, HTHP-ready insulation materials

- SMEs entering specialized subsea insulation composites

- Growing demand for sustainable and rare-earth-free alternatives

With flow assurance, offshore infrastructure lifespan, and marine energy diversification taking center stage, the global subsea insulation ecosystem is positioned for long-term growth into 2035.