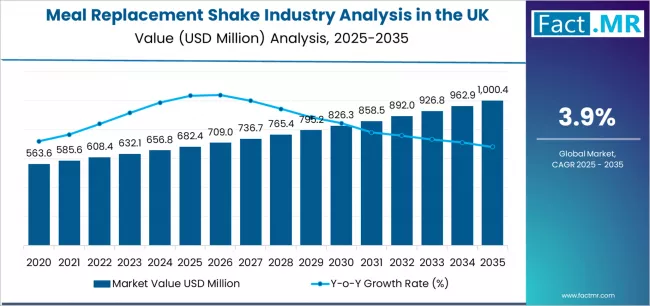

The United Kingdom’s meal replacement shake industry is set to witness strong and sustained growth over the next decade, driven by rising health-conscious consumer behavior, demand for convenient nutrition solutions, and rapid expansion of digital retail ecosystems. According to a new report by Fact.MR, the market is projected to grow from USD 682.4 million in 2025 to approximately USD 977.8 million by 2035, registering a CAGR of 3.9% and an absolute gain of USD 295.4 million during the forecast period.

As consumers increasingly prioritize balanced diets, weight management, and protein-rich nutrition, meal replacement shakes are emerging as a preferred alternative to traditional meals. The ready-to-drink (RTD) segment is expected to dominate, accounting for 52.0% of total UK demand in 2025, reflecting strong adoption due to convenience and portability.

Strategic Market Drivers

Health & Wellness Lifestyle Trends Redefine Consumption

Growing awareness of obesity, diabetes, and lifestyle-related conditions is reshaping dietary preferences across the UK. Meal replacement shakes—positioned as controlled-calorie, macronutrient-balanced alternatives—are gaining popularity among working professionals, fitness enthusiasts, and individuals seeking weight-loss solutions.

Brands are enhancing formulations with high protein, fiber-rich blends, probiotics, vitamins, and plant-based ingredients, aligning with clean and functional nutrition trends.

Clean-Label & Plant-Based Formulations Gain Momentum

The shift toward natural, minimally processed ingredients is leading manufacturers to develop non-GMO, sugar-reduced, vegan, and allergen-friendly formulations.

The rising popularity of plant-based diets across the UK is driving the adoption of shakes made from pea protein, soy, oats, rice protein, and functional botanicals, supporting both performance and weight-management objectives.

Browse Full Report: https://www.factmr.com/report/united-kingdom-meal-replacement-shake-industry-analysis

Digital Commerce & Subscription-Based Models Fuel Accessibility

The UK’s well-established online retail ecosystem—including health platforms, grocery apps, and brand-owned websites—is accelerating product availability and visibility.

Subscription models, personalized nutrition kits, and AI-enabled meal plans are boosting long-term consumer retention and encouraging recurring purchases.

Innovation in Flavors, Textures & Functional Additives Enhances Adoption

Manufacturers are expanding their offerings with gourmet flavors, dairy-free options, and enhanced textures that replicate the mouthfeel of real meals.

Formulation improvements such as slow-release carbs, adaptogens, collagen blends, and immunity-support mixes are strengthening consumer engagement and premium market positioning.

Regional Consumption Trends Across the UK

England: Leading Consumption Hub

England accounts for the largest market share, supported by high adoption among fitness communities, young professionals, and digital shoppers.

Scotland & Wales: Rising Preference for Healthier On-the-Go Nutrition

Urbanization, lifestyle shifts, and strong gym culture are fostering demand in metropolitan areas, with plant-based shakes gaining particular traction.

Northern Ireland: Expanding Market through Retail Modernization

Growing penetration of supermarkets, health stores, and online wellness platforms is improving product accessibility across the region.

Market Segmentation Insights

By Product Type

- Ready-to-Drink (RTD) Shakes – Largest segment driven by convenience and strong brand visibility.

- Powdered Shakes – Growing among fitness communities and consumers seeking customizable blends.

- Protein- and Nutrient-Enriched Variants – Rising demand for functional nutrition and sports recovery.

By Ingredient Base

- Plant-Based Shakes – Fastest growing due to vegan and flexitarian lifestyles.

- Dairy-Based Shakes – Preferred by traditional consumers and high-protein users.

By Distribution Channel

- Supermarkets & Hypermarkets – Strong offline dominance due to product variety.

- Online Retail & Subscriptions – Fastest-growing segment supported by direct-to-consumer models.

- Health & Nutrition Stores – Preferred by premium and fitness-focused consumers.

- Pharmacies & Drugstores – Growing demand for clinically formulated blends.

Key Challenges Affecting Market Growth

- Price Sensitivity Among Mass Consumers – Premium formulations raise affordability concerns.

- Competition from Whole-Food Diet Solutions – Fresh juices, protein bars, and functional snacks increase market rivalry.

- Fluctuations in Raw Material Prices – Impact protein sources like dairy isolates, pea protein, and flavoring agents.

- Regulatory Compliance – Strict labeling requirements for nutritional claims add complexity.

Competitive Landscape

The UK meal replacement shake market is moderately consolidated, with brands focusing on formulation innovation, clean labeling, portion-controlled packaging, and targeted digital campaigns.

Key Companies Profiled:

• Huel

• SlimFast

• Herbalife Nutrition

• Myprotein

• Optimum Nutrition

• Nestlé Health Science

• Fuel10K

• Ensure (Abbott)

• Exante

• Vega

Players are investing in sustainable packaging, sugar-reduction technologies, vegan product lines, and personalized nutrition solutions to strengthen their market presence.

Recent Industry Developments

- 2024: Major brands launched low-sugar, high-protein RTD shakes enriched with probiotics and natural flavorings.

- 2023: Expansion of plant-based formulations using oat, rice, and pea protein across leading UK retail chains.

- 2022: Introduction of gourmet flavors, fiber-enriched blends, and eco-friendly packaging formats.

Future Outlook: A Decade of Nutritionally Smart and Convenient Eating

The next decade will mark significant evolution in the UK’s meal replacement shake landscape, driven by functional reformulation, personalized nutrition, plant-based innovation, and digital-first retail strategies.

Brands that invest in clean-label transparency, convenience-focused formats, and sustainable packaging will shape the future of healthy meal alternatives.

With growing acceptance across mainstream consumers, fitness communities, and busy professionals, the UK meal replacement shake market is positioned for stable, resilient, and innovation-driven growth through 2035.