The solvent dyes segment in the United Kingdom is positioned for steady, data‑backed growth over the next decade, driven by rising demand from coatings, inks, plastics, and industrial applications, even as sustainability and regulatory pressures reshape market dynamics.

UK Solvent Dyes Market: Growth Anchored in Dyes & Pigments Sector

The broader dyes and pigments market in the UK — which includes solvent dyes — generated approximately US$ 2.2 billion in revenue in 2023, and is forecast to reach US$ 2.6 billion by 2030, reflecting a compound annual growth rate (CAGR) of 2.4%.

While not all of this revenue is attributable to solvent dyes alone, the “dyes” sub‑segment is already the largest and fastest-growing component within the UK dyes and pigments market.

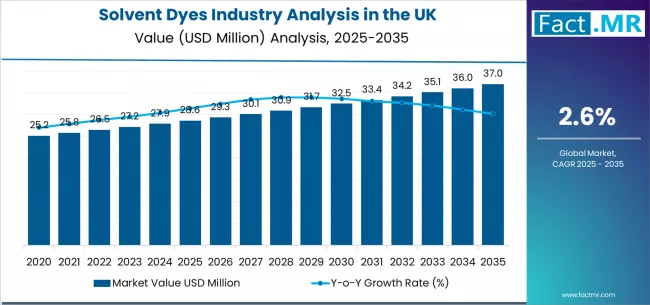

Global analyses of solvent dyes indicate steady growth, with the market projected to rise from USD 1.1 million in 2025 to USD 1.5 million by 2035, growing at a CAGR of 3.2%. The UK is expected to see a more moderate but stable 2.6% CAGR over this period.

Taken together, these data suggest that solvent dyes in the UK are well-positioned to benefit from broader upward trends in dyes & pigments demand and may capture a growing share of total market revenue.

What’s Driving Demand in the UK?

• Coatings, Inks & Plastics — Primary Growth Engines

Globally, coatings, inks, and plastics account for nearly half of solvent dye applications. In the UK, strong demand stems from industrial coatings, printing inks, plastics coloration, automotive coatings, and specialty packaging. Manufacturers increasingly seek high-performance coloration solutions offering stability, consistent color strength, and compatibility with existing solvent-based processes.

• Growth of Specialty, High‑Performance & Sustainable Dye Technologies

There is a rising focus on eco-conscious and low-VOC (volatile organic compound) dye formulations. Approximately 37% of new solvent dye variants in 2023 were designed for eco-conscious applications. The market is seeing a shift toward advanced dye systems that support improved polymer compatibility, enhanced lightfastness, and reduced environmental impact.

Given the UK’s regulatory environment and growing environmental expectations, this trend is likely to resonate strongly with dye producers and end-users, making high-performance solvent dyes a strategic growth area.

• Industrial Modernization, Regulatory Compliance & Premium Applications

Solvent-soluble azo and disperse dyes remain leading types globally, commanding roughly 44% of total solvent dye market share. For UK manufacturers, these systems offer reliable solubility, consistent coloration, and seamless integration into existing production infrastructure — critical given the costs associated with retooling plants for new dye chemistries.

This is particularly relevant for industrial coatings, automotive paint lines, printing inks, polymer coloration, and specialized plastic applications, where performance demands and regulatory compliance are increasingly significant.

Challenges Ahead: Raw Materials, Regulation & Market Pressure

Despite favorable outlooks, several challenges may influence the trajectory of solvent dyes in the UK:

-

Volatile raw-material costs and regulatory pressure: Price fluctuations and tighter regulations on certain chemical intermediates may impact production.

-

Pressure toward eco-friendly alternatives: Rising demand for sustainable solutions such as water-based dyes, bio-based colorants, and low-VOC formulations could affect reliance on traditional solvent dyes.

-

Compatibility across diverse polymers: Ensuring stability, lightfastness, and performance across various polymers remains a technical challenge for manufacturers.

Strategic Outlook and Opportunities

Given the UK’s established chemicals and coatings sector, several opportunities emerge for industry players, investors, and stakeholders:

-

Invest in high-performance solvent dye formulations optimized for coatings, inks, plastics, and industrial manufacturing — with superior solubility, lightfastness, and reliability.

-

Accelerate R&D into sustainable/eco-friendly solvent dyes (bio-based, low-VOC, heavy-metal-free) to meet rising regulatory and customer demands, future-proofing portfolios against stricter environmental standards.

-

Target niche high-performance markets such as automotive coatings, engineering plastics, specialty packaging, and industrial coatings — where premium coloration and performance matter more than cost.

-

Leverage broader UK dyes and pigments market growth: Solvent dyes are well-positioned to capture a growing share as total market revenue rises over the next decade.

Outlook Summary

As of 2023, the UK dyes & pigments market stands at roughly US$ 2.2 billion, and it is forecast to rise to US$ 2.6 billion by 2030. Within this, solvent dyes — benefiting from steady global growth — appear poised for stable gains in the UK, particularly if manufacturers embrace sustainability, regulatory compliance, and high-performance requirements.

While challenges such as raw-material volatility, regulatory pressures, and competition from eco-friendly alternatives remain, these pressures also present opportunities to innovate, differentiate, and capture premium segments of coatings, plastics, automotive, inks, and specialty applications.

For dye manufacturers, coatings companies, and polymer processors in the UK, the coming decade offers a strategic window to capitalize on demand for premium coloration and performance, while adapting to evolving environmental and regulatory standards.

Browse Full Report :https://www.factmr.com/report/united-kingdom-solvent-dyes-industry-analysis