The chemical metering pumps market in the Middle East & Africa (MEA) region is poised for steady growth over the next decade, driven by rising investments in water infrastructure, industrial process automation, and precise chemical dosing solutions across water treatment, oil & gas, and manufacturing sectors. As governments and industries focus on improving wastewater management, industrial compliance, and operational efficiency, chemical metering pumps are increasingly considered essential for accurate and reliable fluid handling.

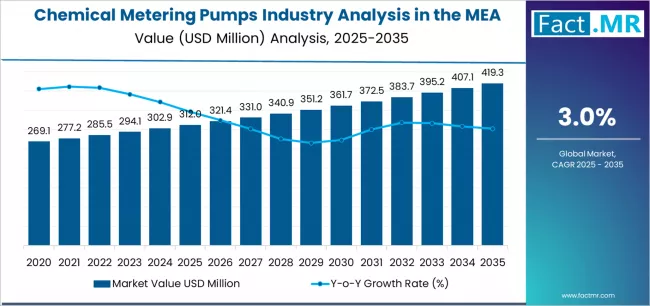

Market projections indicate that the MEA chemical metering pumps market will expand from approximately USD 312 million in 2025 to around USD 418–419 million by 2035, reflecting a compound annual growth rate (CAGR) of about 3.0% over the decade.

Key Market Highlights

-

2025 Market Value: USD 312 million

-

2035 Forecast Value: USD 418–419 million

-

Forecast CAGR (2025–2035): ~ 3.0%

-

Leading Pump Type (2025): Diaphragm metering pumps (~55% share)

-

Top Application Segment (2025): Water treatment (~46% share)

-

Key Demand Countries: Saudi Arabia, United Arab Emirates, South Africa

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=11919

Growth Drivers

Expansion of Water Infrastructure & Regulatory Pressure

The growing demand for safe drinking water, wastewater treatment, and industrial effluent management is a major driver of chemical metering pump adoption. Municipal water utilities and industrial facilities require precise dosing for disinfection, pH adjustment, and chemical treatment. Increasingly stringent environmental regulations and water-quality standards further boost market demand.

Industrialization & Oil & Gas Sector Demand

Beyond water treatment, industrial sectors — including petrochemicals, chemical processing, and oil & gas — rely heavily on chemical metering pumps for accurate injection of process chemicals, corrosion inhibitors, and treatment agents. MEA’s ongoing industrial growth and infrastructure development significantly support pump adoption.

Rising Automation & Smart Process Controls

With Industry 4.0 trends reaching the MEA region, smart metering pumps equipped with digital controls, remote monitoring, and precision dosing features are gaining traction. Automation reduces human error, improves safety, and ensures consistent chemical application, making modern pumps increasingly attractive to industrial operators.

Need for Reliability, Accuracy & Chemical Compatibility

Applications in water treatment, industrial processes, and oilfield operations demand high precision, chemical resistance, and operational reliability. Diaphragm pumps, in particular, dominate the MEA market due to their ability to handle corrosive chemicals and provide consistent dosing.

Challenges & Market Constraints

High Initial Investment Costs

Chemical metering pump systems, especially high-performance or automated variants, require significant capital outlay. For cost-sensitive clients or smaller industrial operators, initial investment can be a barrier.

Technical Expertise & Maintenance Requirements

Effective use of metering pumps demands skilled operators, regular maintenance, and knowledge of chemical handling. Limited technical expertise in certain regions can challenge reliability and operational efficiency.

Competition from Alternative Technologies

Alternative chemical dosing systems may compete in applications where extreme precision is not required. This competition may slow adoption in certain industrial segments.

Market Fragmentation & Regulatory Diversity

MEA comprises multiple countries with varying regulatory standards, industrial practices, and infrastructure maturity. Compliance with local standards, import/export rules, and certification requirements adds complexity for suppliers and manufacturers.

Strategic Outlook & Recommendations

For Pump Manufacturers & Suppliers

-

Focus on diaphragm-type pumps for water treatment and industrial applications.

-

Invest in smart, IoT-enabled pumps with digital controls, remote monitoring, and predictive maintenance.

-

Offer modular and customizable solutions to meet diverse industry needs.

-

Establish regional service and maintenance networks to ensure reliability and reduce downtime.

For Water Utilities & Industrial Operators

-

Adopt chemical metering pumps for accurate dosing, process efficiency, and compliance with water and industrial standards.

-

Evaluate long-term benefits, including reduced chemical waste, consistent water quality, and operational safety.

-

Integrate smart systems to leverage automation, monitoring, and process optimization.

For Policy Makers & Regulators

-

Encourage adoption of modern, efficient chemical dosing standards across water treatment and industrial processes.

-

Support infrastructure development for water treatment, wastewater recycling, and industrial chemical handling.

-

Promote training and certification programs to ensure safe chemical-handling practices and reliable pump operation.

By 2035, the MEA chemical metering pumps market is projected to reach around USD 418–419 million, reflecting steady, resilient growth. Expansion in water treatment infrastructure, industrialization, oil & gas operations, and automation will continue to drive demand.

For manufacturers, suppliers, water utilities, and industrial operators, the next decade offers a strong opportunity: delivering reliable, precise, and technologically advanced chemical metering pumps can help meet regional water, industrial, and environmental requirements while capturing significant market share.

Browse Full Report: https://www.factmr.com/report/middle-east-and-africa-chemical-metering-pumps-industry-analysis