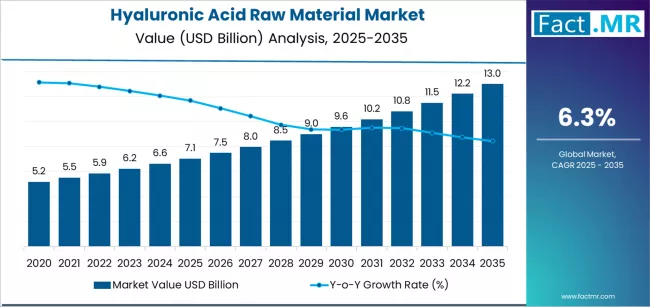

The global hyaluronic acid raw material market is poised for robust growth over the next decade, driven by surging demand in medical aesthetics, dermatology, pharmaceutical formulations, and advanced wound care. According to a new analysis by Fact.MR, the market is projected to rise from USD 7.05 billion in 2025 to approximately USD 13.0 billion by 2035, marking an absolute increase of USD 5.95 billion. This reflects total growth of 84.4% and a healthy CAGR of 6.3% during the forecast period.

The market’s momentum is fueled by the increasing preference for minimally invasive aesthetic treatments, rising incidences of osteoarthritis, growing applications in drug delivery, and ongoing innovations in biotechnology. Pharmaceutical-grade hyaluronic acid (HA) continues to gain traction due to its hydration, biocompatibility, viscoelasticity, and regenerative properties.

Strategic Market Drivers

Aesthetic Dermatology and Anti-Aging Solutions Drive Demand

Global demand for fillers, injectable gels, and topical formulations has surged with the rising interest in age-defying skincare and non-surgical cosmetic procedures. Hyaluronic acid’s ability to retain moisture, smooth wrinkles, restore volume, and support tissue repair makes it the cornerstone ingredient in dermal filler manufacturing. With younger consumers adopting preventive skincare and older populations seeking rejuvenation solutions, the market for high-purity HA raw material continues to accelerate.

Medical Applications Expand with Biotech Innovations

Hyaluronic acid is increasingly used in viscosupplementation for osteoarthritis, ophthalmic surgeries, wound healing products, and drug delivery systems. Emerging biotech processes — including fermentation-based production and bioengineered HA — are enabling higher purity grades, customized molecular weights, and improved batch consistency.

Browse Full Report: https://www.factmr.com/report/hyaluronic-acid-raw-material-market

Rapid Growth Driven by R&D, Clean-Label Formulations & Pharma Adoption

Shift Toward Fermentation-Derived, Non-Animal HA

The global move toward clean-label, vegan, and non-animal-derived raw materials is reshaping production methods. Microbial fermentation technology is now favored for generating safe, consistent, and high-yield HA suitable for pharmaceutical and cosmetic applications.

Rising Use in Premium Skincare and Hydration-Based Formulations

Serums, creams, moisturizers, and sheet masks are increasingly adopting multi-weight hyaluronic acid for deep hydration, barrier repair, and enhanced dermal absorption. Beauty brands are introducing innovative combinations such as HA + peptides, HA + ceramides, and crosslinked HA systems.

Expanding Pharmaceutical Pipelines Boost High-Purity HA Demand

Pharma companies are investing heavily in drug delivery systems leveraging HA for sustained release, improved bioavailability, and targeted delivery advantages. Applications in regenerative medicine – including tissue engineering, cartilage repair, and stem cell therapies – represent emerging high-value segments.

Regional Growth Highlights

North America: Stronghold of Medical Aesthetics and Advanced Dermatology

North America dominates the market owing to the widespread adoption of dermal fillers, growing cosmetic procedure volumes, and advanced HA-based medical applications. The U.S. continues to lead with rapid FDA approvals, R&D expansion, and a well-established aesthetic service ecosystem.

Europe: Biotech Expertise and Clean Manufacturing Fuel Growth

Europe remains a key hub for premium hyaluronic acid production with strong regulatory compliance, advanced fermentation technologies, and rising consumer focus on clean beauty. Countries such as France, Germany, and Italy lead in dermal filler consumption and cosmetic innovation.

East Asia: High-Volume Production and Growing Cosmetic Adoption

China, Japan, and South Korea contribute significantly to market expansion through large-scale HA manufacturing facilities, booming K-beauty trends, and rising demand for non-surgical cosmetic procedures. East Asia is also becoming a global center for biotechnology-driven HA production.

Emerging Markets: Rapid Urbanization and Rising Aesthetic Awareness

India, Southeast Asia, Latin America, and the Middle East show accelerating adoption due to increasing disposable incomes, expanding dermatology clinics, and higher demand for hydration-based skincare. Global brands are strengthening their footprint through collaborations and localized marketing.

Market Segmentation Insights

By Grade

- Pharmaceutical Grade HA – Dominant in injectables, wound care, and ophthalmology.

- Cosmetic Grade HA – Rapid growth driven by skincare and beauty formulations.

- Food Grade HA – Emerging segment for nutraceuticals and joint support supplements.

By Molecular Weight

- Low Molecular Weight (LMW) – Preferred for skincare penetration and anti-aging.

- Medium Molecular Weight (MMW) – Widely used in topical and oral formulations.

- High Molecular Weight (HMW) – Essential for viscosupplementation and medical devices.

By Application

- Dermal Fillers

- Osteoarthritis & Joint Care

- Wound Healing

- Drug Delivery Systems

- Cosmetics & Personal Care

- Ophthalmic Procedures

Challenges Impacting Market Growth

- High Cost of High-Purity HA – Advanced fermentation, purification, and crosslinking increase production expenses.

- Regulatory Stringency for Pharmaceutical Applications – Strict quality and safety requirements extend time-to-market.

- Competition from Synthetic Alternatives – R&D in biomaterials is intensifying rivalry.

- Supply Chain Volatility – Variations in fermentation substrates and raw fermentation materials impact pricing.

Competitive Landscape

The global hyaluronic acid raw material market is moderately consolidated, with companies focusing on biotechnology enhancements, molecular customization, and expanding production capacities.

Key Companies Profiled

- Bloomage Biotechnology

- Contipro

- Shandong Focuschem Biotech

- Kewpie Corporation

- Lubrizol Life Science

- Fidia Farmaceutici

- HTL Biotechnology

- Croma Pharma

- Seikagaku Corporation

- DSM

Manufacturers are increasingly investing in advanced microbial fermentation, crosslinked HA technologies, clean-label formulations, and sustainable production techniques.

Recent Developments

- 2024: Global firms introduced next-generation biofermented HA with improved purity and molecular precision for injectable-grade applications.

- 2023: Rapid expansion of HA-based regenerative medicine solutions including scaffolds, hydrogels, and stem cell-support matrices.

- 2022: Skincare brands launched multi-weight HA complexes and biome-friendly formulations tailored for hydration and barrier protection.

Future Outlook: A Decade of Biotech-Driven Transformation

The coming decade will witness significant advancements in hyaluronic acid science and manufacturing technologies. Growth will be strongly supported by medical aesthetics adoption, regenerative medicine breakthroughs, pharmaceutical innovation, and rising consumer preference for hydration-focused skincare.

Brands and manufacturers that invest in biotechnology, molecular customization, sustainability, and high-purity production will shape the future of the global hyaluronic acid raw material market through 2035.