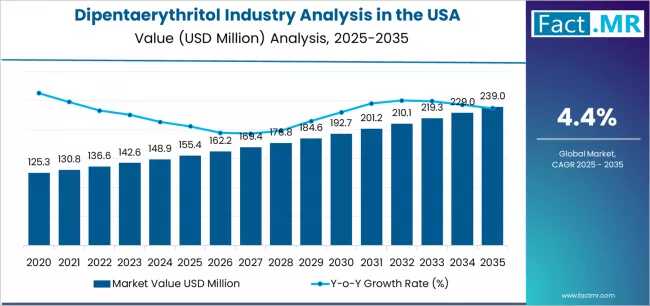

A newly released 10-year industry forecast reveals that the U.S. dipentaerythritol (Di-Penta) market is positioned for steady acceleration, supported by robust consumption from the coatings, synthetic lubricants, and specialty polymer industries. According to the analysis, the market is projected to grow from USD 155.4 million in 2025 to approximately USD 239 million by 2035, achieving a compound annual growth rate (CAGR) of about 4.4%.

Dipentaerythritol—an advanced polyol valued for its multifunctional structure and exceptional thermal and chemical stability—continues to gain traction as manufacturers intensify their focus on long-lasting, low-VOC, and high-performance material systems. With downstream industries expanding their use of advanced crosslinkers, resin modifiers, and high-temperature additives, Di-Penta has emerged as a strategic ingredient for next-generation coatings and engineered materials in the United States.

Key U.S. Market Highlights (2025–2035)

-

Market Size 2025: USD 155.4 million

-

Forecast 2035: Nearly USD 239 million

-

CAGR (2025–2035): Approx. 4.4%

-

Top Product Segment: Industrial-grade dipentaerythritol, estimated at more than half of total consumption

-

Top Application Segment: Alkyd/resin modifiers, representing roughly 44% of application demand

-

Primary End-Use Trends: Long-life coatings, heat-resistant lubricants, and engineered polymer systems

Drivers Fueling the Uptick in Demand

1. Growing Adoption in Advanced Coatings & Alkyd Resin Systems

U.S. coatings manufacturers continue to scale their use of dipentaerythritol for producing high-durability alkyds, polyester polyols, and UV-resistant coatings. Its ability to enhance film hardness, weatherability, adhesion, and chemical resistance has made it a preferred multifunctional crosslinker.

Low-VOC requirements across architectural, marine, and industrial coatings also favor Di-Penta, as the compound improves solids content and resin efficiency—key parameters for compliance and performance.

2. Rising Need for Heat-Stable Synthetic Lubricants

Modern machinery, electric motors, and high-temperature industrial systems increasingly rely on synthetic lubricants and esters that require thermo-oxidative stability. Di-Penta offers an ideal foundation for producing high-performance polyol esters used in:

-

Turbine oils

-

Compressor lubricants

-

High-temperature greases

-

Specialty automotive fluids

This specific demand segment is projected to be one of the highest-growth categories through 2035.

3. Expansion of Electrical & Composite Materials

Dipentaerythritol is gaining visibility in electrical insulation, rigid PVC stabilizers, flame-retardant systems, and composite resins. Its multi-functional backbone improves dimensional stability and extends material life cycles—an increasing priority in energy, EV components, and infrastructure applications.

4. Strengthening Domestic Supply Capabilities

With domestic production capacity in North America supplemented by strategic imports, U.S. manufacturers can access stable and diversified supply channels. Industry players continue to emphasize regional sourcing to protect against global supply chain risks, helping ensure consistent availability for formulators.

Competitive Landscape & Strategic Opportunities

The U.S. market, while moderately consolidated, offers several clear areas for strategic growth:

• Value-Added Derivatives

Producers are increasingly focused on Di-Penta derivatives such as:

-

Dipentaerythritol esters

-

Etherified Di-Penta products

-

Custom-tailored polyols for resin systems

These derivatives enhance performance in niche applications and command premium pricing.

• Specialty Formulation Partnerships

As coating and lubricant companies refine formulations for harsh environments—corrosive, marine, thermal, high-wear—demand for formulation-grade Di-Penta continues to rise. Co-development agreements between chemical suppliers and OEMs create high-value commercial pathways.

• Automation, Infrastructure, and EV Supply Chain Growth

Long-life materials needed for EV battery components, powertrain materials, and high-temperature insulation present new applications for multifunctional polyols.

Challenges & Market Sensitivities

Although market sentiment is strong, several external factors may influence growth over the next decade:

1. Feedstock Volatility

Dipentaerythritol production relies on aldehydes and polyols that are affected by commodity cycles. A significant rise in raw material costs—typically above 20% per year—can compress margins for producers and formulators.

2. Regulatory Dynamics

While dipentaerythritol is considered safe and stable, certain solvent-borne applications face tightening VOC and emissions regulations. Manufacturers are proactively shifting toward high-solids and waterborne systems that leverage the performance benefits of Di-Penta.

3. Competition from Functional Alternatives

Polyol technologies continue to evolve, and alternatives such as pentaerythritol derivatives, trimethylolpropane (TMP), and multi-functional acrylates may compete in specific applications. However, Di-Penta retains a clear advantage in crosslink density and long-term stability.

Analyst Perspective

“Dipentaerythritol is not a commodity growth story—it’s a performance-driven one,” said the lead analyst of the market forecast. “The U.S. market benefits from the increasing sophistication of coatings, advanced polymers, and high-temperature lubricants. These industries need durable chemistries, and Di-Penta delivers exceptional performance per unit cost. That is the primary catalyst supporting its long-term growth.”

Browse Full report : https://www.factmr.com/report/united-states-dipentaerythritol-industry-analysis

Implications for Industry Stakeholders

Manufacturers & Producers

-

Consider small-scale capacity expansions for specialty grades

-

Prioritize development of high-performance esters and derivatives

-

Strengthen technical collaboration with downstream formulators

Formulators & End-Users

-

Leverage Di-Penta’s multi-functional chemistry for low-VOC, high-durability applications

-

Evaluate Di-Penta esters for next-generation thermal and oxidative stability

-

Adopt long-life resin systems that reduce lifecycle maintenance costs

Investors & Strategic Buyers

-

Favor companies engaged in derivative production and vertical integration

-

Target suppliers with exposure to high-margin specialty markets

-

Assess long-term value in performance coatings and specialty lubricants