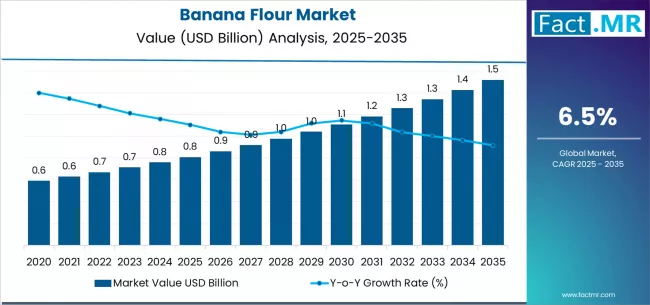

The global banana flour market is poised for strong expansion over the next decade, supported by rising demand for gluten-free alternatives, clean-label ingredients, and functional foods. According to a new analysis by Fact.MR, the market is projected to rise from USD 0.81 billion in 2025 to USD 1.52 billion by 2035, registering a CAGR of 6.5% and an absolute increase of USD 722.9 million. This growth represents an overall market expansion of 1.9x during the assessment period.

Banana flour—recognized for its high resistance starch, natural sweetness, and nutritional density—is increasingly used across bakery, snacks, infant foods, and health supplements. Its clean-label profile and suitability for paleo, vegan, and gluten-free diets are strengthening global adoption.

Strategic Market Drivers

Clean-Label, Gluten-Free Demand Reshapes the Global Food Landscape

As consumers shift toward natural, minimally processed ingredients, banana flour is emerging as a preferred gluten-free alternative to wheat and artificial stabilizers. Rich in potassium, vitamins, and prebiotic fiber, it caters to health-driven consumers seeking functional nutrition. The flour’s low glycemic index and digestive benefits further amplify its appeal among fitness-focused and diabetic populations.

Functional Food & Nutraceutical Expansion Boosts Utilization

Banana flour’s high levels of resistant starch make it a powerful functional ingredient used in protein shakes, energy bars, nutritional powders, and weight-management products. As the functional food industry expands dramatically, manufacturers are incorporating banana flour to enhance texture, nutrition, and gut-health properties.

Browse Full Report: https://www.factmr.com/report/banana-flour-market

Regional Growth Highlights

North America: Fastest Adoption Driven by Wellness Trends

North America remains one of the fastest-growing markets due to rapid acceptance of gluten-free diets and clean-label supplements. The U.S. shows strong uptake in bakery premixes, smoothies, and sports nutrition categories, supported by consumer preference for natural alternatives.

Europe: Clean-Label Compliance & Premium Food Industry Fuel Growth

Europe continues to lead in organic and natural ingredient adoption. Countries such as Germany, the U.K., France, and the Netherlands are witnessing strong demand for banana flour in artisanal baking, baby nutrition, and plant-based product lines.

Asia Pacific: Leading Production Hub with Rising Domestic Consumption

India, the Philippines, and Indonesia dominate global banana flour production. Increasing processed food consumption, urbanization, and the availability of green bananas have made Asia Pacific a critical growth region. Japan, South Korea, and China are adopting banana flour in snacks and clean-label bakery items.

Emerging Markets: Strong Potential from Health-Focused Millennials

Latin America, the Middle East, and Africa are gaining momentum owing to rising disposable incomes, evolving dietary patterns, and the popularity of plant-based, allergen-free foods among young consumers.

Market Segmentation Insights

By Source

- Green Banana Flour – Largest segment due to high resistant starch content.

- Ripe Banana Flour – Used for natural sweetness in bakery & smoothies.

By Application

- Bakery & Confectionery – Strong utilization for gluten-free breads & cakes.

- Infant Nutrition – Rising due to easy digestibility and neutral flavor.

- Snacks & Convenience Foods – Growing use in chips, crackers, and bars.

- Nutraceuticals & Supplements – Fast growth driven by gut-health benefits.

- Pet Food – Adoption rising for natural, grain-free formulations.

By Distribution Channel

- Supermarkets & Hypermarkets – Strong presence across retail shelves.

- Online Retail – Fastest-growing due to rising demand for specialty flours.

- Specialty Health Stores – Preferred by premium and organic consumers.

- Foodservice & Institutional – Growing use in bakery and beverage mixes.

Key Challenges Affecting the Market

- Raw Material Dependency – Banana yield fluctuations impact supply stability.

- Higher Production Costs – Processing and drying significantly raise costs vs. conventional flours.

- Shelf-Life Sensitivity – Moisture exposure can affect texture and freshness.

- Limited Consumer Awareness – Requires strong marketing in emerging markets.

Competitive Landscape

The banana flour market is moderately fragmented with both global and regional manufacturers focusing on organic farming, advanced drying technologies, and clean-label certifications.

Key Companies Profiled:

• Ceres Organics

• Archer Daniels Midland (ADM)

• NuNatural Foods

• Natural Evolution Foods

• Woodland Foods

• KADAC Australia

• International Agriculture Group

• Agrofair

• Paradise Fruits Solutions

• Stawi Foods & Fruits

Companies are expanding production capacity, introducing gluten-free product lines, and investing in environmentally sustainable processing technologies.

Recent Developments

- 2024: Major manufacturers increased investments in spray-drying and freeze-drying technologies to enhance product shelf life and nutritional retention.

- 2023: Launch of organic banana flour ranges across European and North American health stores.

- 2022: Surge in demand for infant-nutrition-grade banana flour driven by clean-label baby food product launches.

Future Outlook: A Decade of Clean-Label Ingredient Innovation

The next decade will witness banana flour becoming a mainstream ingredient in gluten-free bakery items, health supplements, and functional snacks. Accelerated clean-label demand, digestive health awareness, and innovation in plant-based foods will continue to propel market adoption.

Brands that invest in organic sourcing, sustainable farming, advanced processing technology, and functional food R&D will shape the future of the global banana flour industry. With applications expanding across both mainstream and niche consumer groups, the market is expected to continue its strong, resilient growth trajectory through 2035.