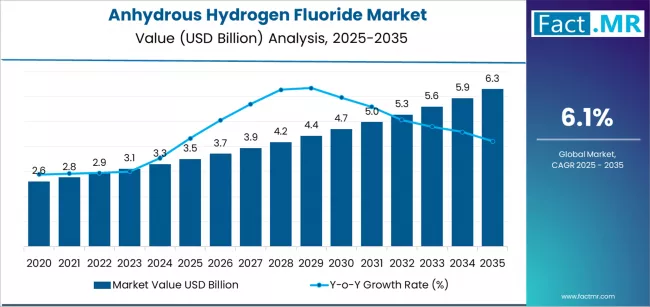

The global anhydrous hydrogen fluoride (AHF) market is set for strong and sustained growth through 2035, supported by rising production of low–global warming potential (GWP) refrigerants, expanding fluoropolymer manufacturing, and accelerating demand across specialty chemical industries. According to a new analysis by Fact.MR, the market is projected to grow from USD 3.5 billion in 2025 to USD 6.3 billion by 2035, creating USD 2.8 billion in new revenue at a robust CAGR of 6.1%.

As global industries transition toward cleaner refrigerant technologies, high-performance fluoropolymers, and advanced manufacturing processes, AHF is emerging as an essential industrial feedstock. Its increasing adoption in semiconductor etching, pharmaceutical intermediates, and high-purity specialty chemicals is further fueling demand.

Strategic Market Drivers

Low-GWP Refrigerant Production Fuels AHF Consumption

Global climate regulations—led by the Kigali Amendment—are rapidly phasing down HFC-based refrigerants. This transition has resulted in robust demand for AHF as a key precursor for producing HFOs and other low-GWP refrigerants, widely used in HVAC, industrial cooling, and automotive air-conditioning systems.

Major refrigerant manufacturers are expanding AHF-based production lines to comply with environmental mandates.

Browse Full Report: https://www.factmr.com/report/anhydrous-hydrogen-fluoride-market

Fluoropolymer Manufacturing Accelerates

Demand for PTFE, PVDF, FEP, and other fluoropolymers is rising sharply across automotive, electronics, energy storage, and chemical processing industries. AHF serves as a vital raw material in fluoropolymer synthesis, and the growing consumption of high-performance materials—especially in lithium-ion batteries, non-stick coatings, and chemical-resistant linings—is strengthening market growth.

Semiconductor & Pharmaceutical Applications Surge

Ultra-high-purity AHF is increasingly used in:

- Semiconductor wafer etching and cleaning

- Optoelectronics manufacturing

- Pharmaceutical intermediate synthesis

With global semiconductor capacity expansion and rising pharmaceutical R&D investments, the need for reliable, high-purity AHF supply is expected to remain strong.

R&D in Specialty Chemicals Enhances AHF Utilization

Manufacturers are exploring new applications of AHF in fluoro-specialties, agrochemicals, and advanced intermediates, opening additional revenue channels. Integration of digital monitoring and corrosion-resistant infrastructure is improving operational safety and efficiency across production facilities.

Regional Growth Highlights

North America: Regulatory Compliance Drives Refrigerant Shift

The U.S. is witnessing rising adoption of low-GWP refrigerants aligned with EPA regulations. Increased investment in semiconductor fabs—including CHIPS Act–led expansions—is boosting demand for high-purity AHF.

Europe: Sustainability & Fluoropolymer Demand Lead Growth

European manufacturers are focusing on eco-friendly refrigerants and advanced fluoropolymer applications across renewable energy technologies. Germany, France, and the U.K. exhibit strong momentum in specialty chemical consumption.

East Asia: The Global Production Powerhouse

China, Japan, and South Korea lead global fluorochemical and semiconductor manufacturing, making East Asia the largest consumer of AHF. High-capacity expansions and strong integration across fluorochemical value chains bolster regional dominance.

Emerging Markets: Rising Industrialization & Chemical Production

India, Southeast Asia, and the Middle East are witnessing rapid growth in HVAC installations, electronics production, and pharmaceutical synthesis—driving higher AHF adoption.

Market Segmentation Insights

By Grade

- Technical Grade AHF – Largest share driven by refrigerant and fluoropolymer production.

- Pharmaceutical & Electronic Grade AHF – Fastest growing due to semiconductor and pharma requirements.

By Application

- Refrigerants – Dominant segment as global industries transition to low-GWP alternatives.

- Fluoropolymers – Increasing consumption in automotive, aerospace, and industrial processing.

- Semiconductor Manufacturing – Highest purity requirements supporting rapid foundry expansions.

- Pharmaceutical Intermediates – Essential for complex fluorinated compounds.

By End Use

- Chemical Industry

- Electronics & Semiconductors

- Pharmaceuticals

- Automotive & Industrial Manufacturing

Challenges Impacting Market Growth

- High Toxicity & Safety Concerns – Demands significant CAPEX in specialized handling systems.

- Stringent Environmental Regulations – Compliance increases operational costs.

- Raw Material Availability – Fluorspar price and supply fluctuations impact production stability.

- Limited Global Producers – Market consolidation poses supply-chain vulnerabilities.

Competitive Landscape

The AHF market is moderately consolidated, with companies focusing on vertical integration, safety innovations, and expanding production capacities to meet global refrigerant and fluoropolymer demand.

Key Companies Profiled

- Honeywell International

- Daikin Industries

- Dongyue Group

- Solvay

- Koura (Orbia)

- Sinochem

- Fluorchemie

- Lanxess

- Navin Fluorine International

- Gujarat Fluorochemicals Ltd. (GFL)

Manufacturers are investing in high-purity production lines, environmentally compliant processes, and strategic partnerships with refrigerant and semiconductor companies.

Recent Developments

- 2024: Major fluorochemical producers expanded AHF capacities to support rising HFO and fluoropolymer output.

- 2023: Semiconductor-grade AHF production saw upgrades to meet stringent purity specifications.

- 2022: Global shift toward eco-friendly refrigerants accelerated investments in integrated fluorochemical value chains.

Future Outlook: A Decade of High-Purity, High-Performance Chemical Growth

The next decade will mark accelerated expansion of the anhydrous hydrogen fluoride market, propelled by sustainability-driven refrigerant transitions, advanced materials demand, and semiconductor manufacturing growth. Companies that invest in safer production technologies, purity enhancements, and value chain integration will shape the future of the fluorochemical landscape.

With its expanding role across refrigerants, polymers, electronics, and pharmaceuticals, the AHF market is poised for strong, resilient, and innovation-led growth through 2035.